Understanding the ProShares Bitcoin & Ether Market Cap Weight ETF (BETH) and Its Role in Crypto Investment

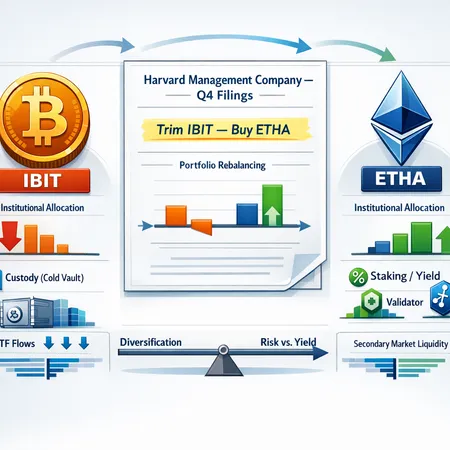

The ProShares Bitcoin & Ether Market Cap Weight ETF, ticker symbol BETH, offers investors an innovative way to access the two biggest cryptocurrencies—Bitcoin and Ethereum—in a single, balanced fund. By weighting the ETF holdings according to the market capitalization of these digital assets, BETH provides diversified exposure that reflects the relative prominence of Bitcoin and Ether in the crypto market.

BETH's dual-asset structure can appeal to investors seeking to harness the growth potential of both Bitcoin and Ethereum without managing separate investments. As Ethereum continues to expand its ecosystem with DeFi, NFTs, and smart contracts, combined with Bitcoin's status as digital gold, this ETF aims to capture a comprehensive snapshot of the crypto market.

For those interested in entering or expanding their crypto portfolios, innovative platforms like Bitlet.app offer additional flexibility. Bitlet.app's Crypto Installment service allows investors to buy cryptocurrencies today and pay monthly, removing the barrier of paying the full amount upfront. Such services make investing in ETFs like BETH or even buying individual cryptocurrencies more accessible and manageable.

In summary, ProShares BETH serves as a practical vehicle for gaining balanced crypto exposure, while platforms like Bitlet.app further enhance the investment journey by providing ease and flexibility in how you invest.

Explore more about BETH and how Bitlet.app can support your crypto investment goals today!