Two Years of Spot Bitcoin ETFs: How ETF Flows Rewired Price Discovery and Institutional Demand

Summary

Overview: why two years matters

Two years is long enough to move beyond honeymoon headlines, and short enough that structural effects are still unfolding. Since spot Bitcoin ETFs launched, institutional access to BTC through regulated tradfi wrappers went from theoretical to routine. That shift has not only increased assets parked in BTC-denominated products but also altered how price discovery, liquidity and arbitrage work across spot venues, futures, and on‑chain markets.

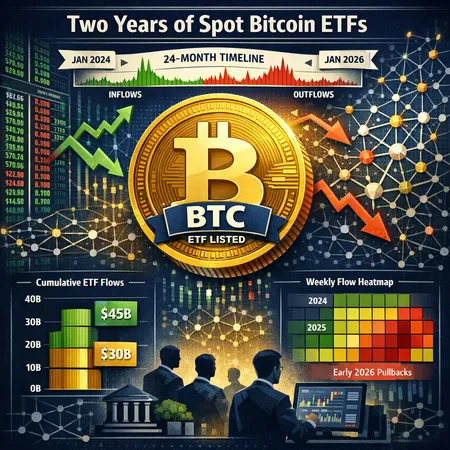

Cryptoslate’s two‑year retrospective shows roughly $56.6 billion in ETF assets under management — a scale that matters for book depth and narrative formation (Cryptoslate report). In this piece we trace the timeline, compare adoption with gold ETFs, explain the causes behind early‑2026 pullbacks, and offer scenario-based takeaways for allocators.

Timeline: the first two years in context

The first 12 months were dominated by adoption headlines and steady inflows as large allocators and wealth managers added BTC exposure via familiar ETF wrappers. The second year brought more complexity: product diversification, increased ETF share creation/redemption activity, and the beginning signs of rotation between asset classes.

Key timeline markers:

- Launch and rapid onboarding: first months characterized by healthy, often consistent daily inflows as funds on‑ramps and custodial chains scaled.

- Institutional normalization: asset managers, pensions and cross‑asset desks began modeling Bitcoin allocations as part of macro strategies rather than niche bets.

- Product proliferation: different issuers and fee structures, along with growing secondary liquidity and tighter NAV tracking.

By the two‑year point, the ecosystem matured enough that ETF flows themselves became one of the primary market signals for traders and allocators — not just price, but whether spot demand is institutional, sticky, and likely to persist.

ETF adoption vs. gold: a quantitative comparison

One of the most-cited narratives is how quickly Bitcoin ETFs matched — and in some metrics outpaced — early gold ETF adoption. Analyses early in the lifecycle found Bitcoin ETF uptake was roughly 600% faster than gold ETFs at a comparable early stage, driven by both retail momentum and concentrated institutional allocations (Bitcoin.com analysis).

Why does this comparison matter? Gold ETFs historically broadened institutional access to a non‑yielding store of value; Bitcoin’s faster adoption signals both stronger allocative interest from portfolios wanting macro beta and a willingness from tradfi distribution channels to sell crypto exposure at scale. But a faster early adoption curve does not guarantee the same long‑term flow profile — gold was adopted into multi‑decade allocation frameworks; Bitcoin is still being fit into contemporary portfolios and macro narratives.

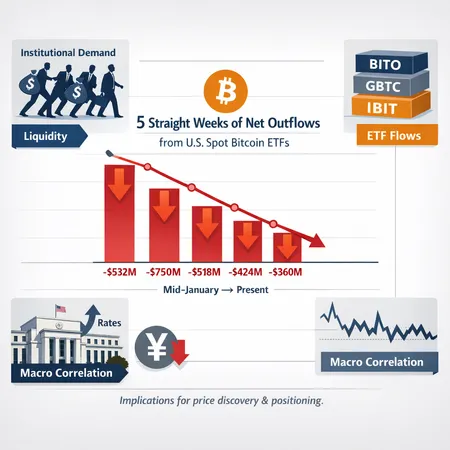

The pullback in early 2026: what the weekly flows tell us

After a mostly positive adoption arc, the start of 2026 saw a noticeable pullback in weekly spot inflows. Reporting in early 2026 highlights that ETF investors pared back allocations to Bitcoin and Ether while rotating into select altcoin funds and other strategies (CryptoNews report). Ambcrypto noted that spot Bitcoin inflows hit a six‑week low, prompting questions about price momentum and near‑term liquidity (AmbCrypto analysis).

Drivers behind the pullback include:

- Rotation and risk‑parity adjustments: allocators taking profits or shifting marginal capital into cyclical or higher‑beta alt opportunities.

- Macroeconomic crosswinds: rising yields or a stronger USD can reduce the appeal of risk assets, including BTC ETFs.

- Concentration and mean reversion: early buyers who front‑loaded allocations sometimes rebalance, which can generate episodic outflows.

- Tactical profit-taking and liquidity needs within large allocators, rather than a structural repudiation of the ETF vehicle.

It’s important to distinguish between episodic outflows and structural deleveraging. A multi‑week slowdown in flows is an early warning signal for momentum traders and liquidity providers, but not by itself definitive evidence that the ETF model has failed.

How ETF liquidity reshapes price discovery, volatility and on‑chain behavior

The impact of spot Bitcoin ETFs extends beyond headline AUM numbers. The instruments change where and how liquidity sits in the market.

Creation/redemption and arbitrage: the plumbing that matters

ETF mechanics — authorized participants, creation/redemption baskets and custodial transfers — provide a clear arbitrage channel between NAV and secondary market price. When ETFs are large, arbitragors can lean on deep OTC and custodial liquidity to keep ETF prices aligned with spot. This process tends to tighten spreads and can damp intraday volatility on regulated venues, because price dislocations are absorbed by institutional counterparties rather than thin exchange order books.

On‑chain consequences

Large ETF custody means more BTC moving into institutional silos and fewer coins circulating in retail trading wallets. That has multiple effects:

- Exchange spot inventories can fall as newly minted ETF shares are backed by custody holdings, reducing sell pressure from retail order books.

- On‑chain transfer volumes may decline for trade purposes while increasing for custodial settlement and cold‑storage rebalancing.

- With more BTC parked off‑exchange, short liquidity (and thus the ease of supplying two‑way markets) can tighten, which influences futures basis and options skew.

Volatility: damped in some dimensions, amplified in others

The presence of large, slow‑moving ETF demand tends to smooth realized volatility on regulated venues; however, when flows reverse, the liquidity that absorbed those inflows can evaporate quickly, creating sharp repricings. In other words: ETFs can reduce microstructure noise but increase the risk of concentrated repricing if a large cohort of ETF buyers or sellers moves at once.

Cross‑market linkages

Price discovery now spans custodial ETF markets, spot exchanges, and derivatives. Futures basis, funding rates and options skew reflect not just retail order books but also institutional ETF activity and the cost of sourcing physical BTC for ETF creation. For traders, reading ETF flows alongside futures basis gives a clearer picture of whether buying pressure is structurally oriented (custody demand) or liquidity‑driven and transitory.

For readers who follow on‑chain narratives, note how reduced primary market coin circulation intersects with DeFi liquidity: less supply on exchanges can feed tighter on‑chain borrowing markets and influence loan funding costs.

Practical indicators to watch

Portfolio managers and advanced retail investors should track a short list of high‑signal metrics:

- Weekly net ETF flows and AUM changes (the most direct measure of tradfi demand).

- ETF premium/discount to NAV and creation/redemption activity (shows arbitrage stress).

- Exchange spot balances and net inflows/outflows on custodial venues.

- Futures basis and perpetual swap funding rates (indicates leverage appetite and directional conviction).

- Options implied volatility and skew (for tail‑risk pricing).

Monitoring these together offers a real‑time picture of whether ETF demand is additive or simply reallocative.

Scenarios and portfolio takeaways

Below are three plausible scenarios and how allocators might respond.

Bull case — sustained structural inflows

Catalyst: renewed macro acceptance of BTC as digital macro beta or an institutional re‑rating. Flows resume and expand beyond current AUM, creating persistent net demand.

Implication: tighter spot liquidity, compressed basis in futures, and higher realized price levels. Allocators can justify marginally higher strategic weights to BTC ETFs as a tradfi instrument, keeping an eye on liquidity and custody concentration risks.

Base/neutral case — flows stabilize, episodic rotation

Catalyst: secular interest remains, but flows settle into a stable cadence with occasional outflow episodes tied to macro or risk‑on rotations.

Implication: BTC becomes a tradfi macro asset with episodic volatility. Use ETF allocations as portfolio ballast for macro beta exposure while sizing positions to tolerate several weeks of negative flows.

Bear case — sustained outflows and deleveraging

Catalyst: macro shock, regulatory setbacks, or prolonged risk‑off that forces large allocators to de‑risk.

Implication: ETF outflows accelerate, custodial sell pressure returns to exchanges, and liquidity providers widen spreads. Managers should consider defensive actions: reduce allocation, hedge via futures or options, or stagger reentry using dollar‑cost averaging.

Tactical threads for allocators

- If you want tradfi simplicity and compliance-friendly exposure, ETFs are a pragmatic vehicle — but they concentrate custody risk and can hide on‑chain liquidity dynamics.

- Combine ETF exposure with a smaller direct‑hold allocation if active staking, lending or on‑chain strategies are part of your playbook; otherwise ETFs provide the cleanest macro beta.

- For macro tactical trades, read ETF flows alongside futures basis and exchange balances. A divergence — e.g., inflows into ETFs while futures show rising longs and tight basis — signals genuine demand. The reverse divergence can be an early warning of ETF outflows.

Platforms such as Bitlet.app have made it easier for some allocators to model cross‑product exposure; use them to test how ETF allocations would have behaved across stress scenarios rather than assuming steady inflows.

Conclusion

Two years of spot Bitcoin ETFs have already reshaped market plumbing. ETFs brought tradfi scale, faster adoption than historical gold analogues, and new price‑discovery dynamics that sit at the intersection of custodial markets, spot exchanges and derivatives. The early‑2026 pullback is a reminder that flows can and will change — and that ETF liquidity can both mute volatility and concentrate repricing risk.

For portfolio managers and advanced retail allocators, the path forward is pragmatic: watch ETF flows, futures basis, and on‑exchange balances; size positions to tolerate episodic outflows; and use ETFs for tradfi‑style macro beta while preserving optionality through selective direct holdings or hedges. The narrative around BTC is maturing — ETFs are the conduit, but market signals will continue to tell the story.

Sources

- Two‑year retrospective on Bitcoin ETFs and their market impact: https://cryptoslate.com/two-years-of-bitcoin-etfs-56-6b-later-wall-street-owns-the-bid/

- Bitcoin ETF adoption vs gold analysis: https://news.bitcoin.com/bitcoin-etfs-outpace-gold-adoption-by-600-two-years-into-tradfi/

- Report on ETF investor pullback in early 2026: https://cryptonews.com/news/etf-investors-pull-back-from-bitcoin-and-ether-as-altcoin-funds-buck-trend/

- Data on spot inflows hitting a six‑week low: https://ambcrypto.com/bitcoin-spot-inflows-hit-6-week-low-but-is-there-good-news-next/