Bitdeer Invests in TSMC: An Innovative Move for Cryptocurrency Mining

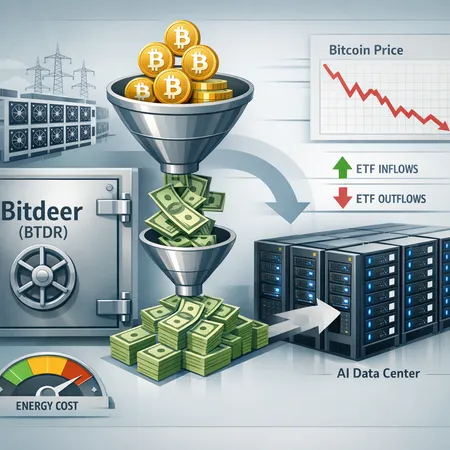

Bitdeer Technologies has made headlines with its strategic investment in Taiwan Semiconductor Manufacturing Company (TSMC), a move that could redefine the landscape of cryptocurrency mining. This collaboration is expected to enhance the efficiency and performance of mining operations worldwide. By leveraging TSMC's cutting-edge semiconductor technology, Bitdeer aims to improve the processing capabilities of its mining rigs, thus reducing energy consumption and increasing profitability for miners.

As the cryptocurrency market continues to grow, the demand for advanced technology becomes crucial. Bitdeer's partnership with TSMC signals its commitment to staying at the forefront of the industry, ensuring that miners have access to the best tools available. This investment not only benefits Bitdeer but also the broader mining community, as improved technology can lead to more sustainable practices and lower operational costs.

For those looking to explore the world of cryptocurrency mining, platforms like Bitlet.app offer innovative solutions such as Crypto Installment service, allowing users to acquire crypto assets now and pay in monthly installments. This flexibility can make it easier for miners to invest in high-quality technology like that which Bitdeer is developing with TSMC.

Overall, Bitdeer's investment in TSMC illustrates a forward-thinking approach that could pave the way for future advancements in cryptocurrency mining technology.