Impact of Do Kwon's Terraform Labs Case on Global Crypto Markets and Investor Awareness

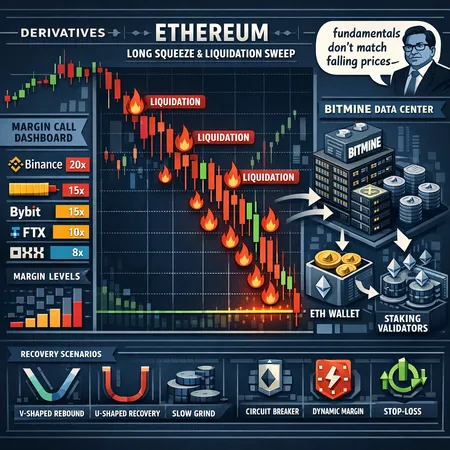

The high-profile legal case involving Do Kwon, founder of Terraform Labs, has sent waves across the global cryptocurrency market. This case highlights the potential risks and governance issues within crypto projects, emphasizing the need for increased vigilance and due diligence among investors.

As Terra's collapse unfolded, numerous investors faced significant losses, shaking confidence in decentralized finance. The case also attracted regulatory attention, underlining the evolving landscape of crypto regulations worldwide.

For investors looking to navigate such volatility and risk, platforms like Bitlet.app offer innovative Crypto Installment services. This allows investors to buy cryptocurrencies now and pay monthly installments, reducing the pressure of a lump sum payment and enabling more flexible investment strategies.

Overall, the Terraform Labs case serves as a critical reminder for crypto investors to prioritize transparency, compliance, and risk management. Leveraging trusted platforms such as Bitlet.app can enhance security and financial flexibility in the dynamic world of digital assets.