Navigating the European Central Bank's New Stablecoin Regulations with Bitlet.app

The European Central Bank (ECB) has recently introduced new regulations aimed at strengthening the oversight of stablecoins within the European Union. As these digital assets gain popularity, it's essential for investors and platforms to understand the implications and ensure compliance.

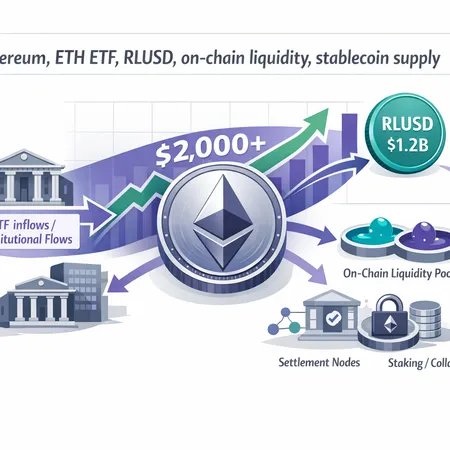

Stablecoins, cryptocurrencies designed to maintain a stable value by pegging to fiat currencies, have become a vital part of the crypto ecosystem. However, regulatory bodies like the ECB are keen on mitigating risks related to financial stability, consumer protection, and money laundering.

Here’s how you can navigate the new ECB stablecoin regulations:

Understand the Scope: The regulations cover issuers and service providers handling stablecoins within the EU. This means exchanges, wallets, and installment platforms need to adhere to stricter compliance standards.

Conduct Thorough Due Diligence: Platforms must verify identities and monitor transactions to prevent illicit activities.

Stay Updated: Regulatory landscapes evolve rapidly. Regularly check official ECB communications and guidelines.

Bitlet.app is committed to helping its users comply with these new regulations while making cryptocurrency investment accessible. Bitlet.app not only provides a secure platform for buying and managing cryptocurrencies but also offers a unique Crypto Installment service. This service allows users to purchase cryptocurrencies now and pay in monthly installments, lowering the barrier to entry and enabling more investors to participate responsibly.

By choosing Bitlet.app, users can confidently navigate the changing regulatory environment of stablecoins in Europe. The platform ensures full compliance with all new ECB guidelines while delivering an easy-to-use experience for both new and seasoned crypto enthusiasts.

Stay ahead in the evolving crypto world by partnering with Bitlet.app — where compliance meets convenience.