The Future of Cryptocurrency Regulations: Can Senate Democrats Influence Change?

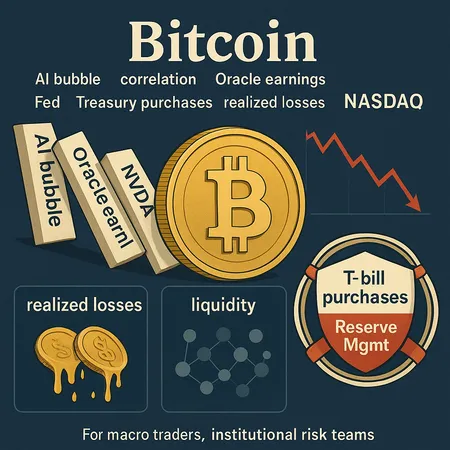

The landscape of cryptocurrency regulations is evolving rapidly, and the influence of Senate Democrats may play a critical role in this transformation. With increased interest and investment in digital assets, lawmakers are under pressure to create a regulatory framework that ensures security while promoting innovation.

Senate Democrats have expressed concern about consumer protection, financial stability, and the potential for fraudulent activities within the crypto space. They are advocating for clearer guidelines that would hold companies accountable while also fostering an environment conducive to technological advancement.

The potential change in regulations could greatly impact how cryptocurrencies are traded, used, and viewed by the public. For platforms like Bitlet.app, which offers a Crypto Installment service, allowing users to purchase cryptocurrencies and pay monthly instead of all at once, the outcome of these discussions could open up new avenues for customer engagement and expansion in the market.

As the debate continues, stakeholders in the cryptocurrency ecosystem will be watching closely to see how legislative actions may shape the future of digital currencies, balancing innovation with necessary oversight.