USDT ADGM: What Abu Dhabi’s AFRt Status Means for Multi‑Chain Liquidity and Regional On‑Ramps

Summary

Executive summary

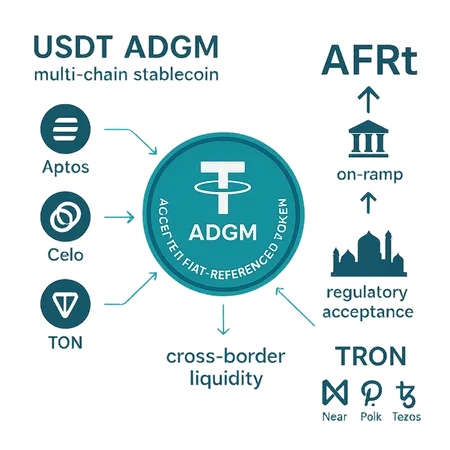

Abu Dhabi Global Market’s (ADGM) recent designation of Tether’s USDT as an Accepted Fiat‑Referenced Token (AFRt) across a list of chains (Aptos, Celo, Cosmos, Kaia, Near, Polkadot, Tezos, TON, TRON) is a pragmatic, policy‑forward step that has near‑term market consequences. For fintech strategists and exchange product leads, the headline is simple: a regulated pathway for USDT to serve as a regional on‑ramp and settlement medium across multiple chains — with implications for liquidity provisioning, ETP listings, and cross‑border settlement architecture. This brief breaks down what AFRt permits, how multi‑chain stablecoin liquidity is likely to shift, the exchange/ETP impact, and the regulatory risks to plan around.

What ADGM’s AFRt status actually permits

ADGM’s AFRt designation is not a blanket endorsement of Tether — it’s a narrowly scoped permissioning that lets regulated entities in ADGM treat USDT as an accepted fiat‑referenced instrument when transacting or offering services on the specified chains. Practically that enables:

Regulated on‑ramps and custody: banks, custodians and licensed exchanges operating under ADGM frameworks can custody and accept USDT on the approved chains as a recognized fiat‑referenced instrument. This simplifies KYC/AML and custody conversations for regional providers. See ADGM coverage for details on the designation and scope. Tether’s USDT gains AFRt status in ADGM.

Clearing and settlement use cases: USDT can be used in contractual settlement flows and payment rails where ADGM law applies, reducing legal ambiguity for swap settlement and merchant payouts denominated in USDT.

Market plumbing on approved chains: the list (Aptos, Celo, Cosmos, Kaia, Near, Polkadot, Tezos, TON, TRON) gives firms a menu of multi‑chain rails on which USDT is effectively sanctioned for institutional activity. That matters for liquidity routing and cross‑chain swaps.

These permissions don’t automatically change global regulation, but they de‑risk certain commercial activities inside ADGM’s jurisdiction.

How AFRt recognition alters multi‑chain and cross‑border liquidity

With AFRt, USDT becomes a more operationally preferred settlement layer for flows into and out of the region. Expect three structural shifts:

Concentration of regional liquidity on AFRt chains. Market makers and exchanges will prioritize quoting depth for USDT pairs on the approved chains, creating deeper liquidity pools and lower slippage for institutional-sized flows.

Cleaner cross‑border rails. Institutional counterparties can route settlements through ADGM‑based custodians and exchanges, reducing reliance on informal OTC corridors. This increases the fungibility of on‑chain liquidity with fiat rails.

Accelerated multi‑chain AMM and bridging activity. Developers and liquidity providers will favor bridges and routers that minimize friction between AFRt‑approved chains, increasing TVL in cross‑chain pools denominated in USDT.

Institutional appetite for channeling funds into crypto ETPs and ETFs — as seen in adjacent markets where ETP inflows have been sizeable — suggests these liquidity shifts are not merely speculative; they’re operational. For example, significant ETF/ETP inflows in related markets underline how institutional demand can institutionalize liquidity on certain rails Solana ETP inflows example.

Implications for exchanges, custodians and ETP listings in the Middle East

Exchanges and product leads should update roadmap priorities around three axes:

On‑ramp productization: Build or accelerate ADGM‑compliant fiat<>USDT rails on AFRt chains. This includes custody integrations, compliance automation, and merchant payout workflows.

Liquidity management: Rebalance inventory and market‑making strategies to ensure tight spreads and deep orderbooks for USDT pairs on the approved chains. That may require re‑allocating capital from other stablecoins or chains.

ETP/ETFs and product filings: Asset managers looking at Middle East ETP/ETF products will now find a clearer compliance pathway for USDT‑denominated products. Institutional inflows into ETP structures elsewhere indicate that when regulatory clarity exists, product adoption can be rapid ETP inflows context.

Operationally, exchanges should consider staging: pilot custody and settlement for lower‑risk chains (e.g., TRON, TON) while implementing stronger monitoring and reserve attestations for higher volume rails.

Risks and competitive regulatory precedent

ADGM’s move creates both opportunity and asymmetry. Key risks to model:

Competitive advantage for USDT: Regulatory acceptance in ADGM may tilt flows to Tether, disadvantaging rival stablecoins and raising concentration risk. That creates systemic exposure if USDT faces reserve or redemption stress.

Regulatory arbitrage and fragmentation: Other jurisdictions may react with stricter rules or, conversely, fast‑track their own approvals for other stablecoins, producing fragmented liquidity and compliance complexity.

Legal/operational complexity across chains: Each approved chain has different finality, bridge risk, and custody constraints (Aptos vs. Cosmos vs. TRON), requiring bespoke operational controls.

Market perception and counterparty concentration: Institutional counterparties may prefer the perceived safety of AFRt rails; this can amplify liquidity squeezes during stress.

From a strategic perspective, these risks argue for diversified stablecoin coverage and multi‑custodian strategies rather than single‑provider reliance.

Practical recommendations for fintech strategists and exchange product leads

Here are tactical actions to take in the next 90–180 days:

Assess AFRt chain priority: Rank the approved chains (Aptos, Celo, Cosmos, TON, TRON, etc.) by regional demand, settlement speed, and institutional tooling.

Implement ADGM‑compliant custody flows: Integrate custodians that can operate under ADGM rules and support the AFRt chains. Add automated attestations and reserve monitoring for USDT holdings.

Design liquidity corridors: Create dedicated liquidity corridors between fiat rails and AFRt chains using a mix of AMM pools and orderbook venues. This reduces slippage for large cross‑border transactions.

Continue stablecoin diversification: Maintain optionality for rival stablecoins in product roadmaps to hedge regulatory and counterparty concentration risks.

Engage regulators and local partners: Proactively discuss settlement use cases and custody standards with ADGM authorities and local banks to shape operational interpretations.

These moves will let firms capture near‑term flows while maintaining optionality. Tools like Bitlet.app can help engineers model installment and settlement flows across chains when evaluating custody and flow designs.

Conclusion

ADGM’s AFRt designation for USDT is a practical, market‑moving step that reduces legal friction for multi‑chain stablecoin settlement in the Middle East. It creates a near‑term advantage for USDT liquidity on approved chains and clarifies on‑ramp design for exchanges and ETP issuers — but it also concentrates risk and sets a precedent that other jurisdictions and stablecoin issuers will react to. Strategists should exploit the window to build compliant rails and liquidity corridors while keeping diversification and regulatory engagement central to their plans.