Why Tooling and Rollups Are Steering Capital Toward Mid‑Cap Infrastructure Tokens

Summary

Thesis: Tooling + Rollups = Selective Capital Rotation

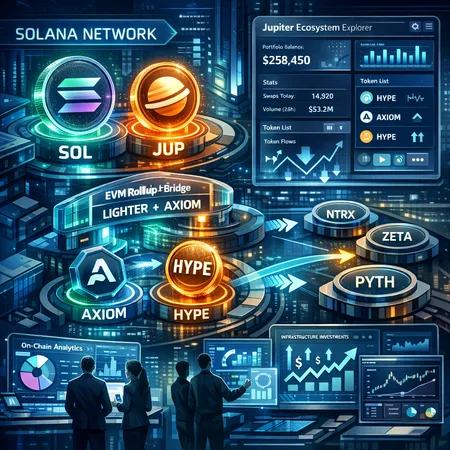

Across crypto cycles, capital chases clarity. When developer tooling, observable on‑chain metrics, and composable infrastructure improve, risk premia shrink—at least for a subset of mid‑cap infrastructure tokens. Recent moves such as Jupiter launching a Solana ecosystem explorer and Lighter partnering with Axiom to build an EVM rollup stage a plausible narrative: better data and easier developer onboarding convert speculative interest into real economic activity and, eventually, token utility.

For many traders, Solana remains the primary market bellwether for high‑throughput application infrastructure. But the same thesis applies to rollup ecosystems where EVM compatibility meets new scaling models. The question investors and engineers face is not whether tooling matters—that's obvious—but which projects crossover from narrative value into sustainable, revenue‑generating infrastructure.

Jupiter’s Explorer: Why Visibility Changes Capital Flow

Jupiter’s announcement of a Solana ecosystem explorer is more than a product update; it reshapes information asymmetry for an entire layer. An explorer that integrates project data, liquidity routing, and activity metrics reduces research friction for builders, market makers, and allocators. The official launch coverage explains the goal: make project integration and data discovery easier for the Solana ecosystem (see the launch announcement for details).

Greater transparency affects three investor behaviors simultaneously: (1) it shortens the due‑diligence cycle because on‑chain signals become easier to parse; (2) it increases market maker confidence, which tightens spreads and raises effective liquidity; and (3) it helps protocol teams measure product–market fit faster. Those effects feed back into price discovery for an infrastructure token like JUP, where visible routing volume, DEX depth and rebased fee accruals are now easier to monitor.

JUP Performance and On‑Chain Signals

JUP’s recent outperformance occurred in a market that overall is cautious, and analysis of the price action points to a mixture of narrative, on‑chain velocity, and concentrated flows. Analysts note that JUP and other mid‑cap tokens such as Hyperliquid’s HYPE have outpaced many peers in recent sessions, largely because traders are pricing in improved utility and revenue capture potential. A detailed price analysis helps explain why these tokens outperform in a cautious market.

On‑chain metrics worth watching for JUP include: routing volume (daily and trailing 30‑day), swap counts routed through the aggregator, token holder concentration, and the fraction of fees captured vs. passed to liquidity providers. When those metrics move together—rising routed volume, stable or growing fee capture, and a diversification of token holders—the move looks more like structural adoption than a headline‑driven pump.

Lighter + Axiom: EVM Rollups and the Commercialization Path

EVM compatibility remains a powerful magnet for developer migration. Lighter’s partnership with Axiom to launch an EVM rollup platform is instructive because it combines two current priorities: a modular security model and developer ergonomics. Coverage of that partnership highlights how teams are leveraging proven data‑availability and prover infrastructure to shorten time‑to‑market for rollups.

Why this matters for token investors: rollup platforms become infrastructure when they solve two problems simultaneously—scalability and developer friction. An EVM rollup that’s easy to deploy against and integrates with standard tooling (wallets, block explorers, andacles, etc.) captures builders and yield opportunities faster. Lighter’s Axiom collaboration is a concrete example of a mid‑cap infrastructure project leaning into composability and security partnership to accelerate real network effects.

Why Tooling and Data Visibility Attract Real Capital Despite Macro Headwinds

Macro conditions may reduce the number of new entrants and speculative margin trading, but they sharpen capital allocation. Institutional and sophisticated retail allocators demand tangible signals: adoption, sustainable fees, and defensible developer moats. Improved tooling effectively turns previously latent adoption signals into reliable on‑chain metrics.

Consider three investor mindsets: the speculator, the allocator, and the operator. Improved tooling converts speculative interest into allocator interest by making it easier to audit activity and by enabling operators (market makers, dev teams) to build around the protocol with lower integration costs. That structural reduction in friction can support a higher valuation multiple for tokens with demonstrable utility.

In practical terms, product updates like Jupiter’s explorer and rollup partnerships like Lighter/Axiom are the ingredients that transform vague promises into measurable KPIs: daily active contracts, routed swap volume, smart contract deployment growth, and third‑party integrations. Those KPIs translate into revenue pathways (fees, commission, staking yields) that matter to long‑term capital.

How to Tell a Durable Infrastructure Story from a Transitory Pump — An Investor Checklist

Below is a pragmatic checklist for investors and engineers trying to separate short‑term speculation from sustainable infrastructure adoption. Treat it as a scoring rubric: projects that meet the majority of these criteria deserve deeper allocation research.

Developer Activity and Deployment Trajectory

- Consistent GitHub/org activity and meaningful merges (not just docs updates).

- Increasing number of unique contracts and verified contracts deployed.

- Signals of third‑party integrations (wallets, indexers, oracles).

Observable On‑Chain Demand

- Persistent growth in routed volume and transaction counts, not single‑day spikes.

- Growing number of unique active users and distinct counterparties.

- Fee accruals that scale with usage rather than inflationary token emissions.

Liquidity Quality and Market Structure

- Depth and bid‑ask stability across multiple venues and market makers.

- Low dependence on concentrated whale wallets for price support.

- Presence of protocol or treasury liquidity that is transparent and vesting‑driven.

Tokenomics and Incentive Alignment

- Clear utility capture (fees, staking rights, governance with on‑chain impact).

- Reasonable emission schedule and inflation control mechanisms.

- Lockups/vesting that align founders and community over multiple years.

Composability and Ecosystem Effects

- Native compatibility with developer tooling (EVM compatibility, SDKs, aggregators).

- Evidence of integrations with major DeFi primitives: AMMs, lending, liquid staking.

- Third‑party services (analytics, relayers, indexers) building on the protocol.

Security, Audits, and Modular Risk Posture

- Reputable audits and a public bug bounty program.

- Architectural clarity on how proofs, finality, and data availability are handled.

- Clear mitigation plans for bridging and cross‑chain risks.

Growth Signals from Real Users and Partners

- Named partnerships or integrations (not just “we’re talking with X”).

- Measurable on‑chain outcomes from those partnerships (TVL, payments flow).

- Developer grants, hackathon traction, and active developer support channels.

Red Flags to Watch

- Social‑media‑led pumps with no corresponding on‑chain metric change.

- Token distributions that are highly concentrated or have rapid unlock cliffs.

- Fee models that require perpetual subsidies to show volume.

If a mid‑cap infrastructure token clears multiple items above—especially in developer activity, composability, and real fee accruals—it’s more likely receiving durable capital rather than a transitory speculative bid.

Case Applications: JUP, HYPE and Early Signals

Using this checklist, JUP’s recent moves score well on visibility and on‑chain demand because the new explorer reduces information friction and makes routing metrics more transparent. Independent analysis of why JUP and HYPE outperformed suggests a combination of improved utility narrative and actual volume capture—two necessary ingredients for a sustainable run. Meanwhile, Hyperliquid’s HYPE benefited from concentrated product adoption signals in its niche; it’s a reminder that outperformance can come from narrow but real product‑market fits.

For rollup plays like those emerging from Lighter+AXIOM, evaluate the checklist through a developer‑first lens: how easy is it to port an existing Solidity stack, how mature is the prover/data availability layer, and what latency/fee profile can users expect? Those are the variables that translate developer interest into real economic throughput.

Practical Due Diligence Workflow for Investors and Engineers

- Start with product telemetry: grab routing volume, swap counts, and contract deployment trends from explorers and the protocol’s API.

- Cross‑verify with off‑chain signals: GitHub commits, package downloads, and Discord developer channel activity.

- Assess token distribution on‑chain: top 50 holders, vesting schedules, and treasury proportions.

- Talk to integrators: ask market makers and infra providers whether they have live integrations or plans to support the protocol.

- Stress‑test assumptions under macro compression: model fee accrual under flat or declining user growth.

This workflow helps convert qualitative impressions into quantitative conviction.

Closing: Why Now Matters

We are at an inflection where raw narrative is no longer sufficient. Tooling investments—explorers, SDKs, and modular rollups—are raising the bar for what deserves durable allocation. Pilots like Jupiter’s ecosystem explorer and Lighter’s Axiom collaboration are practical demonstrations of how better tooling reduces friction and creates measurable KPIs. That’s how selective capital rotation will play out: not a broad flight to all mid‑caps, but concentrated flows into infrastructure tokens that show real adoption, developer traction, and defensible utility.

For investors and engineers evaluating these bets, the checklist above is a starting point. As infrastructure matures, platforms with transparent data and composable primitives will attract more credible liquidity. Bitlet.app and other service providers will find these improvements reduce onboarding friction, ultimately making capital allocation decisions easier and more evidence‑based.