Bitcoin’s Biggest Technical Risks in 2026: Protocol Mutability vs. Quantum Threats

Summary

Introduction: two different kinds of existential worry

Michael Saylor recently framed a clear, stark thesis: the single biggest technical risk to Bitcoin isn't some external attacker but protocol mutability — the gradual, policy-driven risk that the rules that define BTC can be changed in ways that undermine its scarcity or immutability. You can read his position here for the quote and context: Greatest risk to Bitcoin identified by Strategy’s Saylor.

At the same time, a competing narrative has gained headlines: quantum computers will eventually break ECDSA/Schnorr signatures and render Bitcoin addresses insecure. That story has its own engineering and timing questions. Coverage that highlights both the hype and the developer response — including the Quantum Bitcoin Summit and surging dev activity — is useful: see reporting on developer work and the summit at Bitcoin News.

Both concerns are legitimate, but they differ in kind: mutability is a governance and policy risk that can be immediate; quantum is a technological threat whose timing is uncertain but could be catastrophic if unaddressed. This article unpacks each risk, contrasts them, and offers concrete recommendations for developers, custodians and long-term BTC holders.

What Michael Saylor means by protocol mutability

Protocol mutability, in Saylor’s framing, is the risk that consensus rules — the code that enforces scarcity, supply schedule and who can spend which coins — can be altered in ways that change Bitcoin’s long-run properties. In practice this covers a spectrum:

- Soft forks and hard forks: intended upgrades like Taproot (soft fork) add features; contentious hard forks can split the network. How changes are activated matters.

- Policy-level changes: adjustments to subsidy rules, block size or issuance logic would be deeply material.

- Feature creep: adding new opcodes or scripting capabilities increases complexity and attack surface.

These are not abstract legal concerns. History shows the difficulty of changing consensus safely: the 2017 SegWit activation debate, BIP9 vs UASF tensions, and earlier contentious forks all demonstrate how social coordination, miner incentives and client diversity interact. The policy trade-off is clear: more capability (privacy, efficiency, smartness) versus the requirement that rules remain stable, predictable and auditable for decades.

Engineering trade-offs around adding features

When engineers push for new capabilities — Schnorr signatures, Taproot, new sighash types, or covenants — they are making a bet. Benefits include lower fees, better privacy and richer contract expressivity. Costs include a larger codebase, more complex validation rules, and a higher bar for formal verification. Practical engineering trade-offs to weigh:

- Backwards compatibility: prefer soft forks and additive changes that don't force old nodes offline.

- Simplicity vs expressiveness: each new opcode or semantics can create subtle invariants that are hard to prove safe for all edge cases.

- Upgrade paths: how is activation coordinated? BIP8/BIP9 history suggests governance mechanics can become political.

A conservative, well-documented upgrade path reduces the chance that a well-intentioned feature becomes a systemic liability. That is essentially Saylor’s warning — not that every change is bad, but that the process and incentives around change must be treated as central security properties.

The quantum-computing threat: theory, timelines and the developer response

Quantum computing threatens public-key cryptography by enabling algorithms (e.g., Shor’s) that could, in theory, recover private keys from public keys. For Bitcoin that means two practical attack vectors:

- If an attacker can derive private keys from on-chain public keys or signatures, they can steal funds.

- If a large quantum computer appears suddenly, any address with a reused public key or exposed pubkey in a spent output could be at risk during a short window between key exposure and potential migration.

But the devil is in the details. Bitcoin rarely publishes raw public keys on-chain (P2PKH vs P2PKH with reuse, Taproot reveals a public key only when a key is spent under certain conditions), and many outputs don't expose keys until spending. Moreover, building a quantum computer capable of running Shor’s at the scale needed to break secp256k1 remains an open engineering challenge.

Developers are not ignoring the problem. Coverage highlighting surrogate signals—developer activity and community summits—shows active, organized mitigation work. The reporting on the Quantum Bitcoin Summit and maintainers’ activity suggests a proactive community developing strategies rather than sitting idle: see reporting that notes the surge in dev attention and coordinated discussion at the summit here: Is quantum computing stalling Bitcoin?.

Mitigation strategies being explored

Several technical avenues are being explored in the Bitcoin developer ecosystem:

- Post-quantum (PQ) signatures: research into lattice-based or hash-based schemes that resist Shor-style attacks.

- Hybrid signatures: combine existing ECDSA/Schnorr with PQ sigs so security requires both; this buys time and backward compatibility.

- Wallet practices: reduce address reuse, prefer scripts that avoid publishing pubkeys until necessary, and accelerate key rotation for at-risk custodial setups.

- Soft-fork vs userland migration: some changes might be achievable with wallet-level migration (preferred) rather than consensus rule changes; others could require forward-compatible consensus work.

All these paths require significant design, review and standardization work — but the existence of coordinated conferences and active dev discussion is a strong positive signal. The timeline to a viable, production-ready PQ transition is measured in years, not weeks, and depends on both quantum hardware progress and cryptographic standardization.

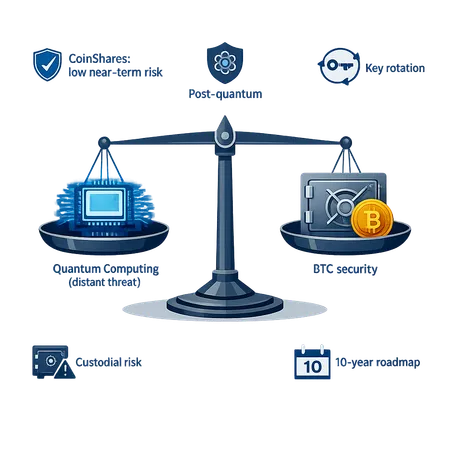

Mutability vs quantum: a comparative risk assessment

Both risks have a high-impact potential; but they differ on immediacy, controllability and technical scope.

- Likelihood today: protocol mutability-related failures (e.g., contentious forks or poorly tested features) are more plausible in the near term due to human and political factors. Quantum cryptographic breakage is plausibly decades away, though uncertainty remains.

- Impact if realized: both are severe — mutability could undermine the currency’s scarcity or governance, quantum breaks foundational cryptography.

- Controllability: mutability is controllable through process and governance; quantum requires sustained R&D and coordinated migration strategies.

This suggests a simple, prioritized posture: treat mutability governance as an immediate security requirement, and quantum as a long-term technical program requiring funding, standards work and staged deployments.

Practical recommendations: governance, engineering and custodial priorities

Below are concrete actions for different actors in the ecosystem.

For Bitcoin core developers and protocol stewards

- Codify a conservative upgrade discipline: rigorous peer review, formal verification where possible, and clear, non-coercive activation paths.

- Prefer additive, opt-in features and prioritize maintainability. Avoid changing monetary policy semantics unless consensus is near-unanimous and the case is existential.

- Establish clearer, documented escalation paths for contentious activations (lessons learned from BIP9/BIP8 and UASF).

- Fund and coordinate post-quantum cryptography research, including interoperability and hybrid schemes.

For wallet developers and custodians (including institutional services)

- Start rolling out wallet-level mitigations: discourage address reuse, implement key rotation strategies, and design for hybrid signatures once standards mature.

- Custodians should diversify signing technology: multisig across different key types/vendors reduces single-point quantum risk and mitigates supplier risk.

- Maintain a migration playbook and test it via rehearsals: cold-wallet recovery, coordinated mass key rotation and cross-signing among custodial partners.

- Monitor releases from Bitcoin core closely and follow best-practice guidance — custodians like Bitlet.app should incorporate these playbooks into their institutional procedures.

For node operators and infrastructure providers

- Run validated client implementations and upgrade nodes only after extensive testing in staging networks.

- Preserve client diversity; avoid centralization of validation on a single codebase or provider.

- Monitor mempools and chain state for suspicious mass-spend patterns that could indicate emerging threats.

Implications for long-term holders (HODLers)

If you hold BTC for decades, focus less on short-term headlines and more on hard crypto hygiene and custody planning:

- Avoid address reuse; prefer fresh addresses for large transfers and prefer script types that minimize pubkey exposure.

- Use multisig custody with keyholders across different jurisdictions and technologies.

- Insist your custodian publish migration plans for future key-rotation and PQ adoption; demand transparency around key lifecycle management.

- Keep a small portion of funds in self-custody with well-tested recovery rituals; whole-coinstorage with a single vendor is a single point of failure.

Closing assessment: what deserves attention now

Protocol mutability — specifically, how Bitcoin changes — is a governance and engineering surface we can and must harden now. That means better activation processes, conservative feature design, and a culture that treats changes as permanent commitments. Michael Saylor’s admonition is a useful corrective: the community should not conflate useful evolution with reckless rule changes.

Quantum computing is a serious technical threat that demands a structured, funded R&D program. But it is not an immediate reason to change consensus rules hastily. The right response is layered: wallet hygiene and multisig today; hybrid signature standards and gradual migration later; and a globally coordinated, well-tested rollout once standards and implementations are proven.

Both tracks require sustained attention. Developers should prioritize robust governance and secure-by-default upgrades while also funding the long-term cryptographic research that will protect BTC in a post-quantum world. Institutional custodians and node operators should translate those priorities into operational plans: no single fix will save Bitcoin, but disciplined governance plus forward-looking cryptographic strategy will.

For the technical reader and dev watcher, the takeaway is clear: watch the governance details as closely as the math. And for institutional custodians evaluating long-term protocol risk, demand migration plans, insist on diverse multisig, and fund the research that will keep BTC resilient for decades.

Sources

- Michael Saylor on protocol mutability: Greatest risk to Bitcoin identified by Strategy’s Saylor

- Reporting on dev activity and the Quantum Bitcoin Summit: Is quantum computing stalling Bitcoin?

For readers wanting to track further: for many traders and watchers, Bitcoin remains the primary market bellwether and technical yardstick — keeping pace with both governance debates and cryptographic research is a necessary part of long-term risk assessment.