How to Launch Tokens with Uniswap Continuous Clearing Auctions on Base: A Technical Guide

Summary

Why teams should consider Uniswap CCA on Base

Token launches have traditionally used manual liquidity provisioning, one‑time Dutch or fixed auctions, or off‑chain fundraising that leaves price discovery fragmented and vulnerable to pop-and-dump behavior. Uniswap Continuous Clearing Auctions (CCA) changes that by running ongoing clearing logic that automatically adds liquidity as supply meets demand, creating a smoother price discovery process and an automatic liquidity floor. The CCA rollout on Base is especially relevant: lower gas and faster finality make frequent on‑chain clears economical for teams and community participants alike, while Base’s growing developer ecosystem provides user density for initial demand. For more context on the Base narrative and why teams are shipping new launch models there, see coverage of Base adoption and novel app patterns like "vibe coding" in the ecosystem.

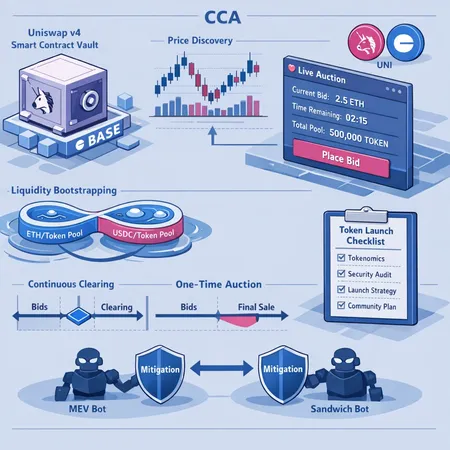

How CCA works end-to-end

Core auction mechanics

At a high level, a CCA is a continuous mechanism that receives buy and sell intents and resolves trades through repeated clearing events. Instead of a single sealed or Dutch auction, CCA performs periodic clears (or continuous matching cycles) where a clearing price is computed and matched against standing orders. Key elements:

- Order entry: participants submit signed buy/sell orders (or provide liquidity intents) on‑chain. Orders can be limit or market style, depending on the implementation.

- Clearing epochs: the auction runs at configurable cadence (e.g., every block, every N blocks, or based on on‑chain triggers) and computes a clearing price that maximizes matched volume given constraints.

- Liquidity provisioning: a portion of auction proceeds or an explicit allocation becomes on‑chain liquidity automatically—no separate LP manual deposit required.

- Price update: after each clear, the new price becomes the reference for the next clearing epoch; unmatched limit orders can persist.

This continuous approach smooths supply-demand imbalances and removes the large single‑block volatility common to one-shot reveals.

Continuous clearing vs one-time auctions

One-time auctions (sealed bids, Dutch auctions) concentrate price discovery into a single event. That concentrates MEV and front‑running risk into a narrow window and can lead to sharp price jumps at the close. Continuous clearing spreads price discovery over time, which:

- Reduces single‑event volatility and the incentive for aggressive frontrunning at a single block;

- Encourages organic orderbook formation and gives broader participation windows; and

- Enables progressive liquidity bootstrapping so the market absorbs supply gradually.

However, continuous clearing does not eliminate MEV—it changes its shape. Instead of a single high‑value block, there are repeated, potentially smaller, opportunities for extractable value. Proper parameterization and MEV countermeasures are essential.

Pricing logic and parameters teams must set

Pricing in a CCA is driven by a clearing function that often solves for a price that equates aggregate buy and sell volume subject to caps and reserve constraints. Typical parameters launch teams set include:

- Reserve/floor price: the minimum price below which sells are not executed.

- Cadence (clear frequency): how often the auction clears (blocks, seconds, or event triggered).

- Maximum per‑epoch matched volume or slippage caps: bounds that prevent outsized price moves in any single clear.

- Liquidity allocation: percentage of tokens earmarked for automatic liquidity and portion for treasury/sales.

- Participant limits: per‑wallet or whitelist caps to limit concentration.

Concrete defaults are situational, but a common starting point: reserve price = soft floor at expected seed valuation; cadence = every 10–100 blocks for L2; per‑epoch volume limit = 1–5% of auctionable supply.

Integration with Uniswap v4 and Base

How Uniswap v4 enables CCA

Uniswap v4 introduces architectural improvements—such as hooks and more composable pool logic—that make implementing continuous clearing primitives more gas‑efficient and modular. CCA implementations typically sit on top of or integrate with Uniswap v4 pools to use its concentrated liquidity and advanced routing while adding an auction layer that drives initial pool price and liquidity creation.

Practically, a CCA contract can programmatically mint a Uniswap v4 pool position or call pool hooks during clear events to deposit the auction's liquidity allocation into the pool at the computed clearing price. This gives token teams an automatic liquidity bootstrapping path which results in a live Uniswap pool populated by auction proceeds.

For readers who track core developments, Uniswap’s announcement and technical overview for CCAs deployed on Base describes the design choices and how continuous auctions automate token launches on‑chain.

Base L2 considerations

Launching on Base changes the economics of continuous auctions:

- Lower gas makes frequent clears practical: a cadence that would be too expensive on mainnet becomes affordable on Base.

- Faster finality reduces the effective latency window attackers can exploit, but Base’s sequencer model also centralizes transaction ordering to some extent—teams should weigh trust and compliance implications.

- Base’s developer adoption and user base (including new app narratives) increase the pool of potential participants, improving price discovery quality and liquidity depth.

For ecosystem context and why many new token launch narratives are choosing Base, see reporting on Base’s growing app ecosystem and novel asset experiments.

Tokenomic structures suited for CCA launches

CCA works best when tokenomic design intentionally coordinates supply, vesting and liquidity. Below are three practical templates launch teams can adapt.

1) Launch + Liquidity Reserve (Balanced)

- Auction allocation: 25–40% of total supply.

- Liquidity reserve: 50–70% of auction proceeds are converted to automatic pool liquidity (seed LP), the rest to treasury/operations.

- Team & advisors: vested over 12–36 months with cliffs and linear release to reduce sell pressure.

- Participant caps: per‑wallet soft cap during initial epochs to avoid concentration.

Why it fits: This structure balances decentralization and treasury runway while ensuring a substantial automatic liquidity peg.

2) Community‑first bootstrap (Wide distribution)

- Auction allocation: 40–60%.

- Liquidity allocation: 30–50% to pool; 20% reserved for incentives (staking rewards, liquidity mining).

- Vesting: minimal for community allocations; longer for team tokens.

- Whitelisting: optional phased opens to give fair access.

Why it fits: Prioritizes broad token distribution and community control; use CCA cadence to allow multiple participation windows.

3) Capital‑raising hybrid (Fundraise + Liquidity)

- Auction allocation: 20–30% sold to strategic and public participants.

- Liquidity allocation: 60–80% of proceeds intentionally locked into the pool for a prolonged period.

- Vesting: strategic allocations with multi‑quarter cliffs but strict vesting schedules.

- Caps: higher per‑wallet limits for strategic, lower for public tranche.

Why it fits: Encourages early strategic support while preserving on‑chain liquidity and reducing immediate sell pressure.

Practical numeric example: if total supply = 100M tokens and auction allocation = 30M, with 60% of proceeds to LP, then 18M worth of value will bootstrap the pool. Set per‑epoch limits so no single epoch can dump >2% of supply into liquidity without price relief.

Potential risks and MEV mitigation

Common risks

- Sandwiching and front‑running: repeated clears can still be targeted by bots that detect large volume or predictable cadence.

- Excessive concentration: large buyers dominating early epochs can pull price away from organic discovery.

- Price manipulation via off‑chain coordination: coordinated large buys/sells timed to epochs.

- Sequencer/order centralization (L2): Base’s sequencer reduces gas and latency but introduces a single ordering point that teams must consider for censorship or ordering concerns.

MEV and mitigation techniques

No single measure eliminates MEV. Combine several defenses:

- Frequent, smaller clears: reduce per‑epoch extractable value by limiting matched size per clear.

- Randomized cadence windows: vary epoch timing slightly to make ordering less predictable to bots.

- Per‑wallet caps & KYC/whitelisting phases: limit concentration, especially for early epochs.

- Commit‑reveal for large intents: hiding the exact size/price intention reduces frontrunning knowledge (costly in UX but effective for large strategic allocations).

- Using private transaction relays or threshold signing: submit sensitive orders through private channels to reduce mempool exposure.

- Liquidity locking and time‑based vesting: reduce immediate sell pressure that creates MEV opportunities.

When designing mitigation, remember tradeoffs: commit‑reveal harms UX and broad participation, while private relays increase complexity and possibly centralization. A layered approach—small clears + randomized timing + per‑wallet caps—is pragmatic for most launches.

Operational checklist for a compliant, on‑chain token auction

Below is a stepwise checklist token launch teams can follow when using Uniswap CCA on Base.

Define goals and constraints

- Decide if the priority is fair distribution, fundraising, or liquidity depth.

- Set supply split: auction allocation, treasury, team, ecosystem.

Design tokenomics

- Set vesting schedules, cliffs, and transfer restrictions for insiders.

- Determine liquidity allocation percentage and lockup duration.

Choose auction parameters

- Reserve/floor price, cadence, per‑epoch volume caps, participant limits.

- Decide whether to use open participation or phased whitelisting.

Integrate with Uniswap v4 primitives

- Implement the CCA contract to interact with Uniswap v4 pool hooks for automatic LP provisioning.

- Configure pool parameters (tick spacing, fee tier, initial price anchor).

Smart contract engineering and audit

- Author auction contracts with clear ownership, admin controls, and emergency pause.

- Get at least one professional security audit and run fuzzing and unit tests.

MEV analysis and mitigation

- Run simulated adversarial testing to measure sandwich and extraction risk under likely cadence and volumes.

- Implement randomized cadence, per‑wallet caps, or private submission paths as needed.

Compliance and legal review

- Document token sale mechanics and consult legal counsel regarding jurisdictional securities rules and KYC obligations.

- If conducting a public sale with tiers, prepare whitepaper / terms and necessary disclosures.

Test on chain (staging)

- Deploy on a Base testnet or sandboxes that mirror Base sequencing behavior.

- Run end‑to‑end tests: order submission, clearing, LP minting, withdrawals, and emergency pause.

Communication and UX

- Publish clear launch parameters, expected cadence, and participant limits.

- Provide monitoring dashboards and educational content for participants.

Execute and monitor

- Roll out the auction with real‑time monitoring for abnormal activity.

- Be prepared to pause and adjust parameters if attacks or unexpected instabilities surface.

- Post‑launch governance and treasury operations

- Lock/vest liquidity per the roadmap and publish proofs of lock where appropriate.

- Use a portion of treasury to incentivize early LP providers or staking if needed.

Teams can use infrastructure such as relays, front‑end libraries that integrate with Uniswap v4, and tooling on Base to streamline several of these steps. Platforms like Bitlet.app and other builders in the space provide complementary tooling for secondary distribution and wallet flows.

Final notes and practical tips

- Start conservatively: lower per‑epoch match sizes and increase cadence as depth builds. This prevents large early swings and helps organic price formation.

- Publish all parameters and smart contract code ahead of time: transparency reduces suspicion and attracts rational liquidity providers.

- Treat MEV as a design constraint, not an afterthought. Regularly simulate adversarial behavior and be ready to change cadence or caps quickly.

- Consider a hybrid go‑to‑market: run an initial moderated whitelist tranche to establish base demand, then open to public continuous clearing.

For teams already familiar with Uniswap tooling, CCA on Base represents a practical way to replace off‑chain manual LP schemes with an on‑chain, auditable, and continuous price discovery mechanism. For more on the CCA technical rollout, see the Uniswap Base announcement and the ecosystem writeups on Base adoption.

Sources

- Uniswap CCA announcement and technical overview: Uniswap Continuous Clearing Auctions on Base

- Context on Base ecosystem adoption and new app narratives: Vibe coding and Base adoption