Bitcoin's Battle at the $103K Resistance: Market Trends and Strategies in Mid-2025

As Bitcoin confronts the significant resistance level of $103,000 in mid-2025, investors and traders find themselves at a crossroads. Breaking above this price point could signal a new bull run, while a rejection might lead to consolidation or a correction.

Current Market Trends:

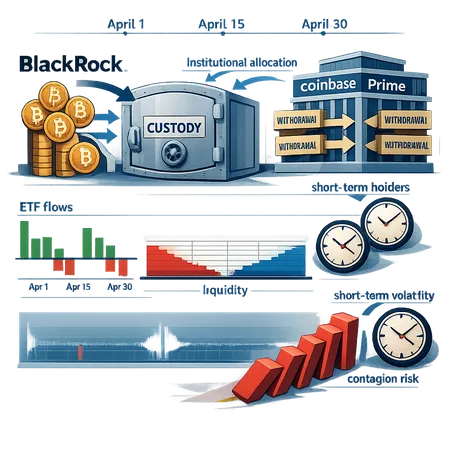

- Bitcoin's price movements have been increasingly volatile, influenced by macroeconomic factors and growing institutional interest.

- Technical analysis shows the $103K level as a critical resistance, with volume and momentum indicators suggesting a potential breakout.

Investment Strategies:

- For cautious investors, waiting for a confirmed breakout above $103K before entering might reduce risk.

- Aggressive traders could capitalize on the volatility with carefully managed positions.

- Long-term holders should consider dollar-cost averaging to mitigate timing risks.

How Bitlet.app Can Help: Bitlet.app offers an innovative Crypto Installment service, enabling buyers to purchase Bitcoin now by paying monthly instead of a lump sum. This approach lowers the entry barrier and allows users to benefit from potential price appreciation around critical resistance levels like $103K without committing all capital upfront.

In conclusion, the $103K resistance is a pivotal moment for Bitcoin in 2025. By understanding market dynamics and leveraging platforms like Bitlet.app, investors can position themselves strategically for the next phase of the crypto market.