How BONK’s Fee Overhaul Pushes Meme‑Coin Tokenomics Toward Institutional Treasuries

Summary

Why BONK’s change matters: a short framing

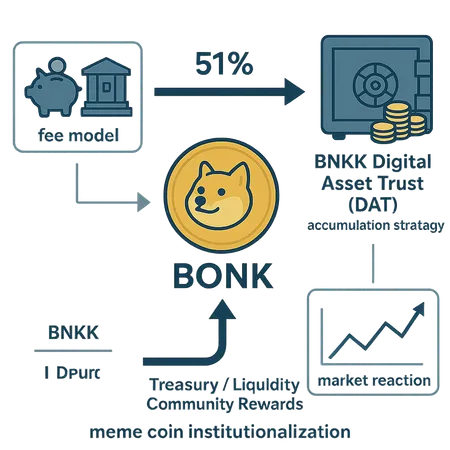

Meme tokens have historically relied on hype cycles, concentrated token releases, and community marketing rather than recurring protocol revenue. BONK’s recent fee distribution overhaul — which routes a majority share of platform fees into BNKK’s Digital Asset Trust (DAT) — is one of the clearest examples yet of a meme project adopting an institutional treasury structure. That shift matters not just for price mechanics, but for how the market perceives governance, longevity and risk.

Bitlet.app users and DAO treasurers should read this as more than a meme‑coin experiment: it’s a test of whether high‑volatility projects can borrow institutional tooling to create sustainable treasuries without killing community momentum.

The specifics of BONK’s fee distribution overhaul

In the announcement, BONK’s team restructured platform fee flows so that 51% of fees are routed directly into BNKK’s Digital Asset Trust (DAT). The stated aim is to accelerate long‑term accumulation in BNKK’s DAT and thereby support a persistent purchase program that reduces effective circulating supply over time. The update was framed as an intentional, long‑run accumulation strategy rather than a one‑off token buyback.

This is not merely semantics: routing more than half of protocol revenue to a trust creates a dependable sink for tokens minted or sold into the market by platform operations. Coinspeaker reported that the DAT mechanism was used to complete a sizable BONK purchase, a move that market commentators immediately linked to a potential price rally and renewed confidence in the accumulation plan (major BONK purchase via DAT announced). The original announcement explaining the fee distribution changes and the rationale for directing fees into BNKK’s DAT can be read at the project release (BONK fee overhaul announcement).

How routing 51% of fees into a DAT changes supply dynamics

The mechanics are straightforward but the effects compound:

Persistent accumulation reduces token velocity. A constant portion of fees taken in native tokens (or used to buy native tokens) and sequestered in a DAT lowers the share of tokens freely circulating. Lower velocity often translates to lower realized sell pressure, all else equal.

Creates a structural bid pressure. If the DAT accumulates by buying on open markets, it creates steady demand that can provide price support and compress drawdowns during risk‑off periods.

Converts ephemeral revenue into locked or professionally managed reserves. Rather than distributing fees immediately to stakeholders who might spend or dump them, the protocol captures fiscal value and places it into a custody vehicle intended for long‑term benefit.

Alters free float perception. Professional investors and market makers will model circulating supply differently once a predictable percentage is being removed from active flows.

A simple hypothetical illustrates the point: if a platform generates $200k in monthly fees and the token price is such that the DAT’s 51% allocation buys $102k of tokens each month, that program will meaningfully accumulate tokens over time. Over a year it becomes a measurable reduction in the market’s available supply — even if those tokens remain technically liquid inside the trust — and market participants will price that scarcity into forward expectations.

But accumulation is not the same as burn. Tokens in a DAT may be liquidated later, loaned, or used for strategic operations. That optionality is valuable for protocol managers but introduces conditional risk for holders.

How a DAT compares to traditional DAO treasuries

DAOs have used a spectrum of treasury models: multisig wallets holding diverse assets, on‑chain vesting contracts, and automated buyback contracts. A DAT sits somewhere between on‑chain treasuries and institutional custody:

Legal wrapper and custodial clarity. A DAT often provides a legal, regulated structure for asset custody that can be more palatable to institutional investors and service providers than anonymous multisigs.

Professional asset management. Trusts can enable formal investment mandates, external auditors, or delegated managers — contrasts with DAOs where treasury decisions are frequently ad hoc or purely on‑chain votes.

Different transparency and recourse tradeoffs. On‑chain treasuries are fully transparent; trusts may provide periodic reporting and legal protections but rely on off‑chain disclosures and governance agreements.

In practice, the DAT approach blends the discipline of a treasury mandate with the legal credibility of a custodial vehicle. That combination can reduce counterparty doubts and attract large holders who otherwise avoid purely experimental projects.

Likely market reactions and short‑term dynamics

When a meme coin announces a durable revenue allocation to accumulation, markets react along several predictable vectors:

Immediate speculative rally. News that permanently shunts fees into accumulation formats is commonly followed by buying as traders price in future scarcity; the Coinspeaker piece on BONK linked the DAT purchase to a likely rally (report of rally expectations).

Front‑running and higher volatility. Market participants may accelerate buying ahead of known accumulation windows; automated strategies will attempt to arbitrage timing differences, which can raise intraday volatility.

Longer‑term price support but concentrated tail risk. Over months, a steady accumulation program can support higher baseline prices. But if the DAT holds a large fraction of supply and later sells (or is forced to liquidate for legal/regulatory reasons), the downside can be amplified.

Enhanced institutional interest — conditional on governance clarity. Sophisticated investors look for consistent revenue streams, legal custody, and transparent mandates. A DAT ticks those boxes more than an ad‑hoc treasury, but only if reporting and governance are credible.

Risks and governance considerations

Institutionalizing meme‑coin treasuries introduces frictions and risks that must be managed deliberately:

Centralization of control. Concentrating economic power in a DAT or a single custodian can undermine decentralization narratives and create attack targets.

Regulatory scrutiny. Legal wrappers can invite oversight; protocols must carefully structure mandates to avoid being treated as investment products or securities in some jurisdictions.

Transparency and trust. Periodic reporting, third‑party audits, clear selling rules and lockups are essential. Without them, the accumulation can appear like a stealth treasury or a time bomb.

Market liquidity mismatch. If a large portion of the float becomes illiquid inside a trust, on‑chain liquidity pools may experience higher slippage, increasing costs for legitimate traders and reducing usable market depth.

What BONK’s move signals for other meme projects

BONK’s experiment offers several practical lessons for token designers, DAO treasurers, and sophisticated retail investors evaluating sustainability in high‑volatility projects:

Design fee models with a clear accumulation mandate. A formulaic routing of fees to an accumulation vehicle (whether on‑chain buybacks, burns, or a DAT) creates predictability — and market participants value predictability.

Use legal and custodial structures to attract capital. A DAT or trust can bridge the gap to institutional capital that otherwise avoids anonymous, purely on‑chain treasuries.

Publish a selling and usage policy. Accumulation without constraints raises suspicion. Clear rules — e.g., vesting schedules, delegated investment mandates, emergency liquidity clauses — preserve optionality while demonstrating restraint.

Balance decentralization and professional management. Many communities will accept professional hands if governance still has meaningful checkpoints. Hybrid models (on‑chain treasury + DAT for a portion) can be a pragmatic compromise.

Maintain token utility. Accumulation sustains price only if the token retains or grows real utility (staking, governance, platform fees). A treasury alone cannot replace a compelling product roadmap.

For teams building new projects, think of the treasury as a product feature: design it to serve holders, attract sensible capital, and survive regulatory scrutiny. For DAO treasurers, the question is operational: does a DAT increase optionality and legal safety without trading away community control?

Practical checklist for implementing a DAT‑style accumulation program

- Define fee allocation precisely and on‑chain where possible. Include triggers for adjustments.

- Specify the DAT’s mandate in writing: accumulation method (market buys vs. direct transfers), holding rules, allowed asset uses.

- Require regular audits and public reporting of the trust’s holdings and activity.

- Build governance guardrails: multi‑party approvals for major moves, emergency mechanisms, and community oversight.

- Model liquidity impacts: simulate how accumulation affects pool depth, slippage, and market maker behavior.

Conclusion — meme coin institutionalization is not a fad

BONK’s fee overhaul and the BNKK DAT accumulation strategy are an important early signal: meme‑coin tokenomics are maturing. Projects that adopt disciplined, legally credible treasuries stand a better chance of attracting long‑term capital and surviving multiple market cycles. That doesn’t eliminate volatility or remove the need for product market fit — but it does create a different risk profile, one more familiar to traditional treasury managers.

For token designers and DAO treasurers, the takeaway is pragmatic: marry the transparency of on‑chain mechanics with the credibility of real‑world custody and clear governance. For sophisticated retail investors, the move suggests a new lens for evaluation: not just hype or social metrics, but the fiscal architecture that will determine long‑term survivability.

For wider context on how the announcement was framed and market reaction to the initial DAT purchase, see the project release and reporting linked in the Sources below.

Sources

- BONK fee overhaul announcement and BNKK DAT rationale: https://coinpedia.org/news/bonk-overhauls-fee-system-to-strengthen-bnkks-dat-accumulation-strategy/

- Reporting on BONK purchase routed via the DAT and market expectations: https://www.coinspeaker.com/major-bonk-purchase-via-dat-announced-rally-inbound/

(Also referenced internal context such as DeFi trends and how macro narratives like Bitcoin scarcity conversations influence institutional thinking.)