The Ethereum Paradox: Heavy Selling vs. Large-Holder Accumulation — What Comes Next?

Summary

The paradox in plain terms

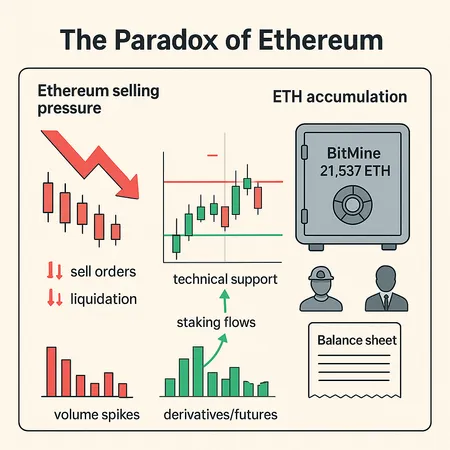

Ethereum is trading like a market under pressure: heavy selling, volatile intraday ranges, and a sense that liquidity is thin when downside momentum accelerates. Yet, beneath that surface narrative large holders are quietly adding inventory. The contrast matters: selling pressure reflects current supply-demand friction and immediate liquidity needs, while ETH accumulation by entities such as BitMine points to longer-term balance-sheet positioning that can change available float over months.

Two recent datapoints crystallize the paradox. First, reporting shows heavy selling pressure and rising ETH trading volume as November closed, a near‑term tone setter for price action (TheNewsCrypto). Second, BitMine — a large institutional actor — reportedly added 21,537 ETH while price was struggling, a sizable accumulation event that deserves explanation and context (Invezz).

Understanding how those two dynamics interact is essential for investors and macro crypto analysts deciding whether to accumulate, hedge, or sit on the sidelines.

What the charts and on‑chain data are telling us

Technical analysis still matters for timing and risk control even when on‑chain flows are active. Recent TA highlights key levels: Blockonomi’s analysis places immediate support around $2,720 and resistance near $2,890 — levels that will shape short-term trader behavior and stop/liquidation placement (Blockonomi).

Volume spikes during sell-offs tell a story: increased traded volume with price falling often indicates forced selling or capitulation rather than calm deleveraging. That aligns with reports of heavier-than-normal sell volume in November. Rising volume and falling price is an environment where leveraged positions get squeezed, funding rates spike, and derivatives flows can temporarily dominate spot dynamics.

At the same time, watch on‑chain indicators for offsetting signs: exchange outflows, staking inflows, and large address accumulations. Sustained exchange outflows and increased staking flows reduce available spot liquidity — they don’t change immediate order book demand, but they lower future supply, which can support higher prices once short-term selling abates.

Why BitMine’s 21,537 ETH matters (and what it might mean)

A 21,537 ETH purchase is not trivial. At current ranges, that transaction represents a multi‑million dollar allocation and signals one or more of the following motives:

- Treasury diversification: miners and mining pools often rebalance into liquid blue‑chip assets to smooth revenue volatility and hold a productive, decentralized reserve.

- Staking intent: acquiring ETH can be a precursor to staking or liquid staking to generate yield, shifting an asset from sellable inventory to yield-bearing, semi-locked capital.

- Opportunistic accumulation: institutional actors can accumulate when they assess risk-reward as favorable, expecting price normalization or longer-term appreciation.

Balance-sheet implications are straightforward: large purchases increase a firm’s ETH exposure and reduce market float if the ETH is staked or taken off exchanges. If BitMine puts a material portion into staking, that reduces available sellable inventory and increases yield sensitivity — they may be less inclined to sell at marginally lower prices, changing the marginal supply curve.

But accumulation isn’t automatically bullish. Institutions can buy to rebalance, but they can also buy inventory to sell later at higher prices or to hedge against other exposures. The timing and use of accumulated ETH (staking vs. short-term inventory) will determine whether this accumulation meaningfully tightens supply.

How accumulation interacts with short-term liquidations and derivatives

Derivatives markets are where short-term price structure is often decided. Here are the important interactions to track:

Leverage and liquidations: heavy selling lifts realized volatility and can trigger long liquidations, which cascade into deeper drops. Accumulation by large holders may be too slow to arrest a liquidation cascade once it begins.

Funding rates and positioning: persistent negative sentiment drives negative funding for perpetual futures, incentivizing short sellers. If institutions are accumulating spot ETH while perpetual funding is negative, the two flows temporarily pull in opposite directions — one reduces spot float, the other increases synthetic short pressure.

Coordination risk: if large holders are accumulating while other large actors are hedging with futures, the net effect on price is ambiguous until a liquidity imbalance breaks — either through short-covering rallies or forced spot selling.

A realistic pattern: accumulation reduces longer‑term available supply gradually, while derivatives amplify short-term moves. That means you can see large buyers on-chain but still endure sharp price weakness if derivative deleveraging dominates in the short term.

Practical 3–6 month scenarios (probabilities and triggers)

Below are three practical scenarios to help investors frame decisions. These are not predictions but conditional pathways tied to observable triggers.

Scenario A — Base case (45%): Rangebound with downward bias, slow accumulation

- Price range: $2,300–$3,100 over 3–6 months.

- Drivers: Continued retail/hedge selling, periodic liquidations, but steady institutional accumulation (like BitMine) and steady staking flows keep a hard floor from deeper capitulation.

- Triggers to move out of this range: sustained exchange outflows + consistent positive open interest shifts; or an exogenous macro shock that compresses risk appetite further.

Scenario B — Bearish (30%): Derivative-driven capitulation followed by cleaning out of weak hands

- Price range: $1,800–$2,600.

- Drivers: A cascade of long liquidations or macro risk shock; negative funding and concentrated short positions push price down until forced buyers emerge. Large-holder accumulation continues but sits on sidelines until volatility subsides.

- Recovery signal to watch: volume-driven reversal with funding normalization and renewed exchange outflows.

Scenario C — Bullish (25%): Quiet accumulation + catalytic demand lifts price materially

- Price range: $3,100–$4,200.

- Drivers: Meaningful, sustained exchange outflows plus substantial staking flows and renewed on‑chain activity (DeFi TVL upticks, NFT or application-driven demand). Reduced supply meets improved demand and shorts are squeezed.

- Catalysts: Institutional buy programs (more BitMine‑style buys), meaningful staking adoption or a macro risk‑off reversal.

These probabilities are intentionally conservative; the market can surprise. Use them as a planning framework rather than a hard forecast.

Risk management playbook for holders and analysts

Deciding whether to accumulate, hedge, or wait depends on your horizon and risk tolerance. Here are practical tactics:

Graduated accumulation: use dollar-cost averaging in tranches. If you’re waiting for confirmation, ladder buys at support bands such as ~$2,720 and heavier at secondary support if broken. Keep position sizing small enough to avoid panic selling during drawdowns.

Hedging: buy puts or set a collar if you own sizable spot exposure and want limited downside while keeping upside. For cost-conscious hedges, sell covered calls against a portion of your holdings (but be mindful this caps upside).

Use of futures: short-term tactical hedges can be done with short futures, but monitor funding and margin; costly funding and potential forced liquidations can make futures hedges risky in volatile markets.

Staking considerations: staking reduces liquid float but locks capital. If you might need liquidity within the next 3–6 months, avoid locking too much into non‑withdrawable stakes; consider liquid staking tokens as a compromise, though they carry their own counterparty/peg risks.

Watch derivatives and on‑chain risk signals: keep an eye on funding rates, open interest, exchange flows, and large transfers. These signals often precede price action more reliably than headlines.

Protective sizing and mental stop rules: define position sizes where you won’t be forced into liquidation. If a drawdown would trigger emotional selling, scale back position size.

Decision checklist for investors and macro analysts

Before adding to ETH or initiating hedges, ask:

- Are exchange outflows accelerating and sustained? (yes = stronger accumulation signal)

- Is staking flow increasing materially? (yes = longer-term supply reduction)

- Are funding rates extreme and open interest spiking? (yes = derivatives risk is acute)

- Are large wallets accumulating on-chain (like BitMine’s reported buy) or merely recycling balances? (one‑time buys are different from systematic accumulation)

- What is my time horizon and liquidity need for the next 3–6 months?

If you answer “yes” to the first two and have a multi‑month horizon, staged accumulation makes sense. If funding rates and OI are extreme, prioritize hedges or smaller buys to avoid being caught in a derivative squeeze.

Final takeaways

The apparent paradox isn’t a contradiction so much as a timing mismatch. Heavy selling pressure and rising volume reflect immediate liquidity dynamics and derivative market structure; institutional accumulation like BitMine’s 21,537 ETH points to longer‑term balance‑sheet positioning that can reduce available supply over time. Those two forces can coexist for weeks or months.

For ETH investors and macro analysts: treat accumulation as a bullish structural signal but respect short‑term technicals and derivatives risk. Use technical support/resistance (notably ~$2,720 support and ~$2,890 resistance) as execution anchors, manage sizing to avoid forced liquidations, and consider cost‑effective hedges if you can’t stomach sharp drawdowns. Watch on‑chain signals and staking flows closely — they are the most direct evidence that accumulation is shifting market structure.

Bitlet.app can be useful for investors who prefer systematic accumulation through instalments rather than timing single large buys — but always match strategy to your liquidity needs and risk tolerance.

Sources

- Ethereum ETH battles heavy selling pressure as November draws to a close — The News Crypto

- BitMine adds 21,537 ETH as Ethereum price continues to struggle — Invezz

- Ethereum: Key support at $2,720 and resistance at $2,890 — Blockonomi

For context on broader market narratives, consider cross‑checking on‑chain metrics and derivatives dashboards, and follow developments in Ethereum and DeFi activity as leading demand signals.