Altcoin Resilience and Rotation Strategies as Bitcoin Plunges — Tactical Q4 Playbook

Summary

Why altcoin rotation matters when Bitcoin plunges

A sharp BTC drawdown forces portfolio managers to choose: hunker down in cash/Bitcoin or rebalance into risk assets that still have upside. Historically, some altcoins decouple from BTC during local bottoms — not always, but often enough to merit a rules‑based approach. Recent market behavior supports that thesis: analysts observed a rising ALT/BTC ratio and multiple alt sectors holding up even as Bitcoin slid.

For many traders, Bitcoin remains the primary market bellwether, but rotation into selective alts can preserve—or even grow—risk‑adjusted returns during macro‑driven BTC weakness.

Evidence: altcoins holding up in November and ALT/BTC ratio trends

Two contemporaneous reports make the point. Blockonomi documented that altcoins showed “rare strength” and that the ALT/BTC ratio was climbing as Bitcoin approached a local bottom, a sign that traders were redeploying risk into non‑BTC pockets rather than fleeing the market entirely (Blockonomi analysis). Coinpedia’s November coverage similarly notes that while BTC fell ~24% in November, many altcoins held stronger, illustrating selective outperformance in that drawdown (Coinpedia coverage).

This is not a blanket endorsement of all alts. Instead, the signal is about rotation: a higher ALT/BTC ratio suggests capital is moving from BTC into alts with idiosyncratic stories or yield properties.

Categories that show resilience — and why

Infrastructure and middleware (e.g., LINK, SOL)

Infrastructure tokens often draw defense from real utility: oracle demand for Chainlink (LINK), and high throughput/developer activity for Solana (SOL). Infrastructure protocols can outlast narrative selloffs because they sit closer to developer demand and enterprise use cases. Grayscale even highlighted Chainlink as an important bridge between crypto and traditional finance, underscoring the token’s narrative durability (Grayscale commentary).

Yield‑oriented and tokenized yield protocols (example: PENDLE)

Protocols that convert future yield streams into tradeable tokens create a clearer, often on‑chain, payoff structure. Pendle tokenizes yield, letting users separate principal and yield claims; that kind of cash‑flow clarity can attract allocators when spot price action is chaotic. For a primer and tokenomic analysis of Pendle, see the Pendle prediction and protocol overview (Pendle primer).

Tokenomics with upcoming catalysts (e.g., SUI)

Tokens with explicit forthcoming tokenomic changes, unlock cliffs, or protocol upgrades can attract capital even in a BTC drawdown. SUI, for example, benefits from active developer growth and narratives around Layer‑1 scalability and transaction economics — features investors can re‑rate independent of BTC moves.

Why these categories resist a pure BTC correlation

- Utility anchors demand: oracles, settlement layers, and yield primitives have user flows and revenue levers.

- Re‑rateable narratives: product launches, mainnet upgrades, or token burns create idiosyncratic upside.

- Yield and cash‑flow optics: tokenized yield gives investors quasi‑fixed‑income like exposure inside crypto.

Case studies: PENDLE, SUI, LINK, and SOL during the November drawdown

PENDLE: Structurally designed to split principal and yield, PENDLE attracts allocators wanting yield exposure without direct spot volatility. That structural value helped PENDLE remain on traders’ radars as an anchor for yield‑focused rotation; depth in yield‑token strategies made it a natural candidate during ALT/BTC flows (Pendle primer).

LINK: Viewed as middleware between TradFi and crypto, LINK benefits from enterprise narratives and recurring demand for oracle services — a defensive narrative that can sustain buying even when BTC is weak (Grayscale commentary).

SOL & SUI: Both are Layer‑1 narratives tied to developer activity and throughput. During November’s drawdown many mid‑cap L1s and L2s experienced rotation inflows from traders chasing product adoption stories rather than pure risk‑on momentum (Coinpedia report).

These examples show why a manager should think in categories and catalysts, not just in “alts” as a single bucket.

Tactical portfolio rules for Q4 volatility

Below are concrete, intermediate‑level rules for portfolio managers and experienced allocators who want a disciplined playbook.

1) Allocation bands (baseline)

- Core BTC allocation: 30–50% of crypto risk budget (not total net worth). This keeps exposure to the market bellwether.

- Tactical alt allocation: 30–50% of crypto risk budget divided across categories: Infrastructure (10–20%), Yield/tokenization (5–15%), Tokenomic catalysts (5–15%).

- Cash/stablecoins: 10–20% reserved for opportunistic buys or volatility management.

Tailor bands to risk appetite; more conservative managers tilt toward the lower end of tactical alt allocation.

2) Rebalancing triggers and discipline

- Volatility rebalancing: Rebalance when a holding moves ±12–20% intraperiod relative to its baseline weight. Bigger moves justify trimming/adding in scale.

- ALT/BTC ratio signal: If the 7‑day ALT/BTC ratio rises >8% while BTC is down >10%, bias new buys toward high‑quality alts (infrastructure and yield) for the short term.

- Time‑box adds: If you plan a DCA add after a BTC drawdown, split it into 3 tranches across 10–21 days to avoid buying all at local extremes.

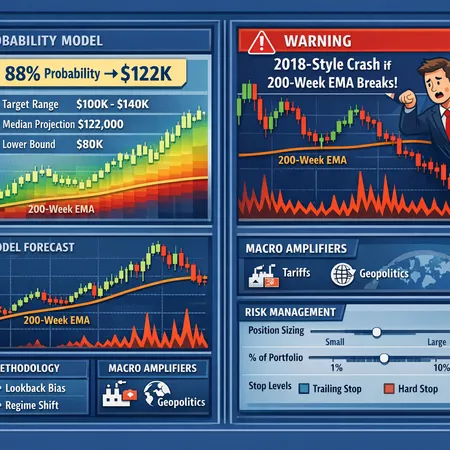

3) Position sizing & stops

- Max position size per alt: 3–6% of total portfolio for mid/high risk alts (e.g., PENDLE, SUI) and 6–12% for large infrastructure tokens (LINK, SOL) depending on conviction.

- Hard stop guidelines: Use mental stops based on thesis invalidation (for example, a fundamental dev exodus or clear on‑chain revenue collapse), not purely price-based stops. For retail managers who require mechanical rules, a 30–45% drawdown stop per position (not immediate liquidation) can prevent ruin while allowing the thesis some breathing room.

4) Diversification rules

- Limit single‑category exposure to 30–40% of your alt sleeve. Diversify across infrastructure, yield, and tokenomic catalysts.

- Correlation checks: If two positions have a historical 30‑day correlation >0.8, reduce combined exposure to avoid single‑factor risk.

5) Risk management and execution tools

- Trade in layers: execute rebalances in 2–4 tranches to average execution and reduce slippage in illiquid markets.

- Use stablecoin reserves on exchanges and on‑chain to capture rapid opportunities.

- Track on‑chain metrics (active addresses, fees, TVL) as early indicators of narrative decay or strength.

Bitlet.app and other platforms can be part of an execution stack for installment buys and P2P liquidity, but execution should align with your rebalancing cadence and custody preferences.

Scenario playbooks: what to do if BTC recovers vs continues lower

Scenario A — BTC recovers (mean reversion rally)

- Immediate objective: protect alpha while riding the rally.

- Actions:

- Trim high‑beta alts (those that outperformed massively) by 20–40% into strength. Lock gains and rotate into stable, utility‑driven assets (LINK, SOL) or into BTC to rebalance core exposure.

- If BTC recovers >20% from local lows and ALT/BTC ratio falls, switch to a momentum bias: increase BTC allocation or rotate into names that historically follow BTC rallies.

- Maintain small cash buffer (5–10%) to capture post‑rally adjustments.

Rationale: During recoveries, BTC often reasserts dominance and some speculative alts mean‑revert. Taking profits and consolidating into higher‑quality assets preserves gains.

Scenario B — BTC continues lower (extended downtrend)

- Immediate objective: protect capital and redeploy into idiosyncratic opportunities.

- Actions:

- Increase cash/stablecoin reserve to 15–25% to capitalize on low prices and reduce overall portfolio volatility.

- Rotate toward yield tokenization and cash‑flow attributes (PENDLE) and infrastructure names with clear revenue or usage metrics (LINK). These can generate relative outperformance or faster recoveries than pure memecoins.

- Tighten rebalancing thresholds: trim winners at smaller gains (10–15%) and widen stop discipline to avoid forced selling into illiquid markets.

Rationale: In a persistent downtrend, capital preservation is paramount; owning tokenized yield and utility tokens that can be monetized or used provides asymmetric upside.

Execution checklist (quick reference)

- Monitor ALT/BTC ratio daily; set a dashboard alert for >8% moves in a week.

- Maintain discipline: adhere to allocation bands and rebalancing rules.

- Size new positions as 2–4 tranches across 10–21 days.

- Keep 10–25% in stablecoins depending on conviction level.

- Use on‑chain metrics and developer activity as primary signals for infrastructure and L1 bets.

Final notes and risks

Altcoin rotation in a BTC trough is tactical and requires active risk management. The ALT/BTC ratio is a useful signal but not a trading system on its own — combine it with on‑chain fundamentals, developer signals, and tokenomic catalysts. Tokens mentioned here (PENDLE, SUI, LINK, SOL) illustrate different resilience vectors: yield tokenization, tokenomic catalysts, middleware utility, and L1 throughput. None are guaranteed to outperform, and liquidity risk, macro shocks, and regulatory events can overwhelm idiosyncratic narratives.

For intermediate investors and portfolio managers, the goal is not to predict the exact bottom but to implement repeatable, rules‑based rotation and risk management that capture upside while limiting permanent capital loss.

Sources

- https://blockonomi.com/altcoins-show-rare-strength-amid-bitcoin-downtrend-expert/

- https://coinpedia.org/news/altcoins-hold-strong-as-bitcoin-falls-24-in-november/

- https://crypto-economy.com/pendle-price-prediction/

- https://coinpaper.com/12537/grayscale-calls-chainlink-key-bridge-between-crypto-and-traditional-finance-as-link-tests-11-65-floor?utm_source=snapi