Why Robert Kiyosaki’s $2.25M Bitcoin Sale Isn’t a Market Death Knell

Summary

A headline that grabbed attention — and why it needs context

When Robert Kiyosaki — the author of Rich Dad Poor Dad and a vocal Bitcoin advocate — sold roughly $2.25 million worth of BTC, mainstream crypto feeds lit up. Reports say the proceeds were shifted into real‑world businesses intended to generate cashflow, even as Kiyosaki reiterated a long‑term bullish stance and previously predicted price targets as high as $250k for BTC. The sale is documented in several outlets, including a report that he sold $2.25M in Bitcoin to buy businesses (CryptoNews), coverage of his exit despite long‑term optimism (TheNewsCrypto), and reporting that he liquidated some holdings at around $90k per BTC (NewsBTC).

Headlines are fast; motivations are layered. Before reacting, investors should ask: was this a portfolio tilt, a personal liquidity move, tax planning, or a strategic reallocation to income? The answers matter.

Timeline and reported details: what we know

The sale: Multiple outlets report that Kiyosaki liquidated roughly $2.25M of BTC. The coverage indicates some of the position was sold when BTC traded near ~$90k per coin. See the consolidated reporting from CryptoNews and NewsBTC.

The reinvestment: Reports state proceeds were being redirected into ‘real‑world’ cashflow businesses rather than being moved fully to fiat or stablecoins; this is framed as a move to generate income rather than exit the crypto thesis entirely (TheNewsCrypto).

The narrative tension: Publicly Kiyosaki remains bullish long term — he has earlier floated $250k BTC price targets — which creates a seeming contradiction: selling now while promising a much higher eventual price.

Together these data points create the story investors saw: a large name selling at a lofty price while still signaling long‑term conviction. But that story is incomplete without motivations and market context.

Reconciling the sale with bullish rhetoric and $250k calls

The simplest reconciliation is that rhetoric and portfolio actions serve different functions. High‑profile figures often talk in long‑term narratives while simultaneously acting on short‑term needs: liquidity, diversification, or business opportunities. Kiyosaki’s sale can be consistent with a bullish macro view if the sold allocation was a small portion of total holdings, or if the goal was to convert unrealized gains into cashflow assets that better suit his personal cash‑flow needs.

A few practical mechanisms explain how both can be true at once:

- Rebalancing: Even believers rebalance. If BTC appreciated substantially, a sale locks gains and trims concentration risk.

- Cashflow conversion: Moving capital into income‑producing businesses reflects a preference for recurring revenue rather than solely capital appreciation.

- Tactical tax or estate planning: Sales can be timed for tax reasons, estate liquidity, or to fund immediate liabilities.

So the $250k price target may remain Kiyosaki’s macro forecast, while the sale is a tactical decision. Investors should separate price predictions (market commentary) from portfolio moves (personal financial decisions).

Why celebrity liquidations trigger outsized reactions

Celebrity investors are a special class of market participants. Their public actions carry extra velocity in retail channels for several reasons:

- Visibility: A named sale is easy to headline and share; retail investors see the name and often assume large‑scale capitulation.

- Narrative fit: Many retail traders view celebrities as proxies for ‘smart money’ even when the celebrity’s motives are personal.

- Media amplification: Stories get repeated across outlets and social feeds, creating reflexive selling.

But the actual market impact depends on scale and context. A $2.25M trade is meaningful for an individual but tiny relative to global BTC liquidity. Institutional selling differs in structure and potential impact.

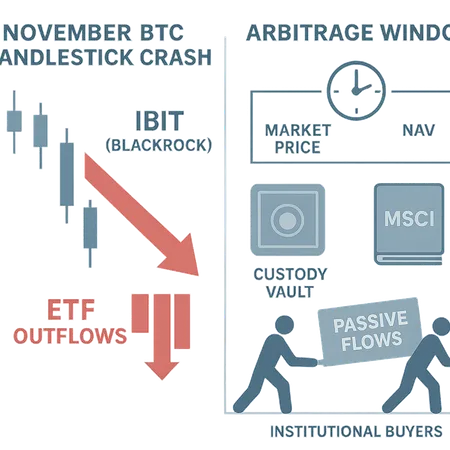

Celebrity selling vs institutional selling: motivations and market mechanics

Motivations

- Celebrity: Personal liquidity, taxes, lifestyle, PR, or opportunistic reallocation. Sales are often not part of a fiduciary mandate; they reflect an individual’s needs.

- Institutional: Mandates, client redemptions, systematic rebalancing, risk management, or hedging. Institutions often manage flows that must be executed irrespective of near‑term prices.

Execution and scale

- Celebrity sales are typically smaller, executed over short windows, and sometimes on retail platforms or OTC desks. Institutions use algorithmic execution, block trades, and derivatives to minimize market impact and slippage.

- Institutions also may hedge with futures or options, so the on‑chain transfer picture (e.g., exchange inflows) might not tell the full story.

PR and signaling

- A celebrity exit gets framed as a moral: “sell now.” Institutions rarely get the same splash unless the selling is visible across on‑chain flows or regulatory filings.

Understanding these differences helps retail investors avoid conflating a public name’s personal decision with a systemic change in demand.

How to read headlines versus on‑chain and flow data

Headlines are a starting point, not a verdict. When a celebrity sale breaks, walk through this checklist before you react:

- Position size context: Is the reported sale large relative to the market or the person’s known holdings? A few million can be small relative to BTC’s market cap.

- Exchange flows: Are major exchanges seeing sustained inflows? Check net exchange balance trends — rising exchange balances can indicate selling pressure; withdrawals tend to signal hodling.

- Whale behavior: Are clusters of large wallets moving coins to exchanges? One wallet selling isn’t a systemic signal.

- Stablecoin and fiat flows: Are stablecoin supplies and on‑chain stablecoin flows rising? Big inflows often precede buying demand.

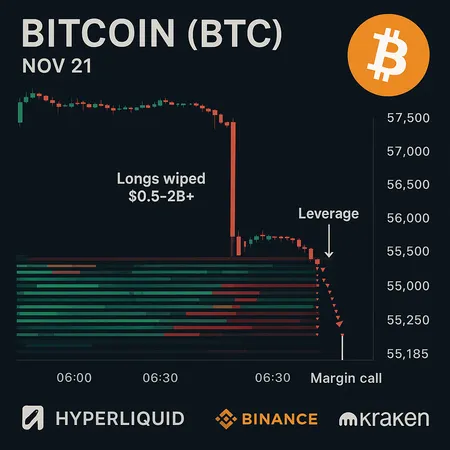

- Futures and OI: Rising open interest in futures with concentrated liquidations can amplify price moves; conversely, a quiet derivatives market reduces the chance of cascade liquidations.

Tools and platforms that provide these metrics — on‑chain dashboards, order‑book trackers, and derivatives monitors — are more informative than a single headline. For many traders, Bitcoin still remains the primary market bellwether, but the full picture lives in flows and positioning.

Tax, allocation and personal finance reasons behind the move

Tax planning is a frequent, under‑discussed driver of visible sales. Realizing gains in a particular tax year, shifting into tax‑efficient businesses, or creating liquidity to cover liabilities are all legitimate reasons to sell. Allocation strategy also matters: converting a paper gain into diversified assets or income can be prudent for someone approaching a different life stage.

A few technical notes:

- Realized gains: Selling to realize gains can simplify estate or business planning, especially if the seller wants to invest in taxable or illiquid ventures.

- Wash sale and jurisdiction nuances: Crypto tax rules vary; the sale may be shaped by local tax law and timing.

- Liquidity for business buys: Acquiring cashflow businesses often requires on‑hand capital that can’t be promised by a hope in future appreciation.

These motivations are typically personal and should not be treated as macro calls.

Practical guidance for retail and semi‑professional investors

- Keep allocation rules: Decide in advance how much of your portfolio is BTC and stick to rebalancing rules rather than reacting to named sales.

- Use on‑chain signals: Monitor exchange balances, whale activity, stablecoin flow and futures OI before making trading decisions.

- Focus on flow, not soundbite: A celebrity selling a few million is news — not necessarily a systemic market event.

- Tax awareness: Consider the tax impact of your trades and consult a tax advisor. Like celebrities, retail investors must factor realized gains into planning.

- Dollar‑cost and installment options: If your goal is exposure rather than timing, using dollar‑cost averaging or platforms that offer installment buying can reduce headline risk. (Platforms like Bitlet.app provide tools to automate periodic buys and help avoid headline‑driven timing mistakes.)

What to watch next in the market

- Exchange net flows over the next 7–30 days (sustained upticks deserve closer attention).

- Concentration shifts among large wallets: are any long‑term addresses changing behavior?

- Stablecoin issuance and movement into exchanges: this often precedes demand surges.

- Derivatives volumes and leveraged positions: rapid shifts can create volatility that looks like selling but is actually liquidations.

Combining these indicators gives a clearer read than a single celebrity sale headline.

Conclusion: read people’s trades, not just their quotes

Robert Kiyosaki’s partial liquidation illustrates a broader truth in crypto markets: public rhetoric and private portfolio actions can serve different aims. Celebrity sales are headlines that must be married to context — size, motive, timing, and on‑chain flows — before they should change your strategy. For disciplined retail investors, the best defense against volatility is a clear allocation plan, attention to flow data, and the humility to separate market narrative from market mechanics.

Sources

- Robert Kiyosaki sells $2.25M in Bitcoin to buy real‑world businesses — CryptoNews: https://cryptonews.com/news/robert-kiyosaki-sells-2-25m-in-bitcoin-moves-profits-into-real-world-businesses/

- Kiyosaki exits Bitcoin position despite bullish long‑term outlook — TheNewsCrypto: https://thenewscrypto.com/kiyosaki-exits-bitcoin-position-despite-bullish-long-term-outlook/?utm_source=snapi

- Kiyosaki dumps Bitcoin at ~$90k after predicting a $250k moonshot — NewsBTC: https://newsbtc.com/news/bitcoin/kiyosaki-dumps-bitcoin-at-90k-after-predicting-a-250k-moonshot-heres-why/