Why Some Altcoins Rallied as Bitcoin Fell — 5 Picks and a Swing-Trader Checklist

Summary

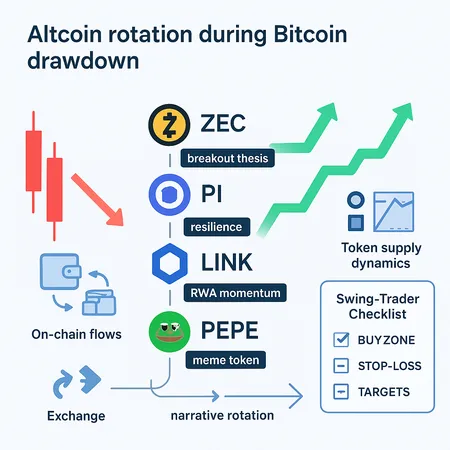

Why altcoins can rally while Bitcoin falls

It’s counterintuitive: market-wide risk-off, yet pockets of speculative strength appear. For swing traders this divergence is an opportunity, not a paradox. When Bitcoin weakens it often squeezes out marginal leverage and rotates capital into shorter-duration, higher-beta plays. That rotation can inflate altcoin prices even as the total crypto cap contracts.

Several structural dynamics explain these moves: idiosyncratic catalysts (protocol upgrades, listings, partnerships), token supply mechanics (burns, low circulating float), on-chain flows (whale accumulation or exchange withdrawals), and fast-moving narrative rotations (RWA, memecoins, L2 optimism). Below we unpack those mechanics and then profile five altcoins that recently outperformed the drawdown.

Structural reasons altcoins can rip during a Bitcoin drawdown

Altcoin rallies during corrections aren’t magic; they follow patterns. The first pattern is catalytic news that only affects a token: a major exchange listing, a governance vote, or an upgrade timeline. That news creates demand disconnected from BTC’s macro picture.

Second, token supply dynamics matter. Tokens with concentrated supply in few wallets, scheduled burns, or low circulating float react more violently to incremental buy pressure. On-chain flows magnify this: when exchange balances drop materially it signals buying that can push price higher regardless of BTC moves.

Third, narrative rotations accelerate flows. If traders switch stories — from L2 throughput to RWA (real-world assets) or from infrastructure to memecoins — capital chases the next narrative. Chainlink’s RWA angle is a fresh example that can attract institutional and DeFi liquidity even when broader markets slump.

Finally, short-term technical setups and concentrated retail positioning can produce squeezes. Small markets with thinner liquidity are particularly prone to sharp moves when sentiment flips.

How to read the on-chain and market signals

Look for three on-chain signals that often precede non-correlated alt rallies: falling exchange balances, rising non-exchange (cold) wallet accumulation, and an uptick in active addresses or smart-contract interactions. Combine these with off-chain indicators — sudden social volume spikes, new listings, or institutional coverage — to triangulate conviction.

Tools and dashboards that surface exchange flows and whale activity help; so does watching order-book depth on centralized venues. For traders who use P2P or installment services, platforms like Bitlet.app can be useful entry points for position building without complex custody moves.

Five altcoins that outperformed — and why they matter

Below are five names that stood out during the recent drawdown. Each profile includes the structural reason for outperformance, evidence from coverage or data, and a practical setup for swing traders.

1) Zcash (ZEC) — breakout thesis and structural signals

Zcash is an interesting case because its technical breakout coincided with fresh narrative momentum around privacy primitives and protocol upgrades. Technical analysts have discussed ZEC’s breakout thesis after strong monthly moves and a decisive resistance test; see a recent take on the breakout thesis here: Zcash four-digit breakout thesis.

Why it rallied: a mix of lower circulating pressure, bargain-hunting flows in privacy-focused assets, and technical breakout triggers that pulled in momentum players. The breakout thesis hinges on structural resistance becoming support and improved on-chain metrics — larger transfers into custody and reduced sell-side pressure.

Practical swing setup (ZEC):

- Timeframe: 4H–Daily.

- Entry: a pullback to the new breakout zone (prior resistance turned support) or a close above the breakout candle with volume confirmation.

- Stop: ~6–10% below entry depending on personal risk tolerance and volatility measure (ATR).

- Targets: partial profit at first resistance (

1–1.5x risk), larger target at measured move equal to breakout range (3x risk). - Notes: watch for renewed BTC weakness; maintain smaller position sizing if BTC volatility spikes.

2) PI Network (PI) — resilience from community and non-correlated flows

PI’s performance during the slump has puzzled some observers because it showed relative resilience. Coverage noting PI’s outperformance and short-term momentum is useful context: PI Network defies the slump.

Why it rallied: heavy retail/community involvement, concentration of holders willing to hold through corrections, and often thinner liquidity leading to sharper moves on buy-side pressure. Projects with strong network effects can see on-chain transaction and staking activity that supports price action.

Practical swing setup (PI):

- Timeframe: Daily for trend, 4H for entries.

- Entry: look for consolidation above a shortened moving average (e.g., 20 EMA) with improving volume profile.

- Stop: tight — 8–12% — because memetic or community-driven coins can reverse sharply.

- Targets: scale out in tranches; expect higher volatility and adjust sizing accordingly.

- Notes: keep a news-tracking alert for any token unlocks or listing changes.

3) Chainlink (LINK) — RWA narrative and institutional flows

Chainlink benefited from renewed attention as an RWA oracle infrastructure — a narrative that appeals to both DeFi builders and institutional players bridging real-world assets. Analysis of potential whale activity and narrative-driven positioning suggested a buildup ahead of key developments: see commentary on Chainlink whales and breakout potential here: Are Chainlink whales preparing a LINK breakout?.

Why it rallied: stronger demand from DeFi integrators and protocols experimenting with RWA primitives, plus visible large-holder accumulation in on-chain data. RWA use cases create longer-duration demand compared with purely speculative plays.

Practical swing setup (LINK):

- Timeframe: Daily–Weekly.

- Entry: after a confirmed hold above the long-term moving average or upon a favorable retest of a breakout level.

- Stop: 5–8% under the retest for conservative traders; wider for swing traders targeting multi-week moves.

- Targets: first target at recent highs; second target at measured extension while trimming positions.

- Notes: monitor DeFi integration announcements; RWA partnerships often drive durable flows.

4) PEPE (PEPE) — memecoin nonlinearity and social-driven pumps

Memecoins like PEPE show how social momentum and concentrated liquidity can drive asymmetric returns. During corrections traders sometimes rotate into high-beta memecoins for quick gamma gains. Coverage of alt outperformers during the crash highlights memecoin strength among other winners: altcoins that skyrocketed while Bitcoin crashed.

Why it rallied: explosive social volume, lower liquidity thresholds, and coordinated buying from retail communities. These moves are often short-lived but can create tradable ripples.

Practical swing setup (PEPE):

- Timeframe: Intraday to 4H for entries, daily for swing positions.

- Entry: wait for volume confirmation and ideally a higher low on short timeframes.

- Stop: tight (5–10%), given memecoin drawdowns can be extreme.

- Targets: aggressive — scale out quickly as your thesis proves correct.

- Notes: treat memecoins as lottery tickets with position sizing under strict risk caps.

5) Solana (SOL) — L2-like throughput narrative and developer activity

Solana often acts as a high-beta infrastructure trade when investors chase throughput and low fees. During drawdowns differentiated developer activity, NFT drops, or DEX volume can re-attract flows and support price spikes. The cryptoticker roundup also lists infrastructure winners who outperformed BTC during crashes, a pattern Solana fits into: altcoins that skyrocketed while Bitcoin crashed.

Why it rallied: ecosystem-specific catalysts (new DEX launches, NFT cycles) and inflows following low-fee narratives. On-chain metrics like daily transactions and new program deploys are leading indicators.

Practical swing setup (SOL):

- Timeframe: Daily.

- Entry: accumulation during consolidation on declining volatility, or breakout above a descending resistance trendline.

- Stop: 7–12% below entry depending on volatility.

- Targets: trimmed into strength; maintain stop-as-profit to protect gains.

- Notes: watch for network outages or congestion risk; Solana’s technical incidents can quickly reverse sentiment.

A trader's checklist to find altcoin opportunities during corrections

Use this checklist to filter candidates quickly and consistently:

- Catalyst: Is there a near-term idiosyncratic catalyst (listing, upgrade, partnership)?

- Supply dynamics: Is circulating supply low or concentrated? Any scheduled unlocks? Burns?

- On-chain flows: Are exchange balances falling? Are large non-exchange wallets accumulating?

- Narrative fit: Is the token tied to a rotation theme (RWA, memecoins, L2s, NFTs)?

- Liquidity & spreads: Can you enter/exit without unacceptable slippage? Avoid illiquid tokens unless sizing tiny.

- Technical setup: Does price show a clear breakout, consolidation, or higher-low pattern?

- Risk controls: Define stop, size, and max drawdown before entering.

Apply the checklist objectively. In practice, two or three checked boxes plus volume confirmation are a reasonable threshold for many swing traders.

Position sizing, risk management and exit rules for swings

Risk control is the most under-discussed edge. Decide the % of capital you’ll risk per trade (commonly 1–3% of total portfolio). For altcoins with higher volatility use the lower end. Use ATR to set stop placement and adjust size so that dollar risk equals your chosen %.

Exit rules should be simple: take partial profits at first target, tighten stops to breakeven on core positions, and scale out into strength. For narrative-driven trades (RWA, memecoins) shorten the timeframe; for infrastructure trades (LINK, SOL) allow more time.

Final thoughts — narrative rotators create opportunity

Corrections compress time horizons and force rotation. When capital searches for yield or growth it doesn’t always flow evenly. Idiosyncratic catalysts, supply quirks and on-chain accumulation can lift specific altcoins even as the broader market sells.

This dynamic rewards active, disciplined traders who combine a structural checklist with good risk management. Watch for RWA-led demand in infrastructure tokens like Chainlink, privacy and protocol upgrades that fuel Zcash, community-driven resilience in PI, and social momentum in memecoins like PEPE. For practical trade execution and alternative entry avenues consider reputable on-ramps and P2P options; for example, Bitlet.app is one of many platforms traders use to build alt positions without complex custody moves.

Remember: higher potential returns come with higher risk. Use the checklist, size positions conservatively, and treat every trade as part of a repeatable process rather than a gamble.

For deeper reading on recent outperformers see this roundup of altcoins that surged while Bitcoin crashed: https://cryptoticker.io/en/5-crypto-coins-that-skyrocketed-while-bitcoin-crashed/ and further context on Zcash, PI and Chainlink from the sources cited earlier.