Can Shiba Inu’s 812M+ SHIB Burn Outweigh Shibarium Outages? A Tokenomics Reality Check

Summary

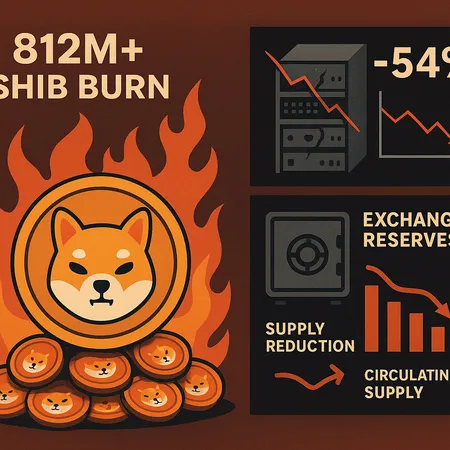

Overview: burn headlines versus network reality

The last few weeks delivered a classic crypto tug-of-war: dramatic on-chain supply action on one side and sharp questions about underlying infrastructure on the other. On-chain trackers reported an 812,840,391 SHIB token burn and a 2,405% surge in burn rate, numbers that make for easy headlines and social-media momentum. At nearly the same time, analysts flagged a 54% drop in Shibarium activity, a decline broad enough to trigger concern about user experience and demand for SHIB-denominated utility.

Both phenomena matter, but they operate on different timelines. Burns are an engineered, supply-side lever that can gradually tighten economics; network outages or activity drops are immediate hits to utility and confidence. For retail altcoin investors and on-chain analysts, the practical question is whether supply engineering alone can offset technical setbacks on a network designed to expand SHIB’s real-world use.

The scale and mechanics of the 812M+ SHIB burn

Reports pegged the recent burn at 812,840,391 SHIB, and coverage noted a 2,405% jump in burn rate relative to prior windows (U.Today reports the burn and surge). Mechanically, most SHIB burns follow common patterns: transfers to known dead addresses, automated burns embedded in smart-contract flows (fees routed to burn wallets), or one-off administrative burns from centralized wallets.

Put bluntly: 812 million SHIB sounds large in isolation—but context matters. SHIB’s original supply was astronomic (the token’s narrative has always leaned on huge nominal counts), so a burn of this size is symbolically significant rather than transformational to market cap overnight. The more meaningful signal is the rate and recurrence of burns. A single spike can stoke optimism and social FOMO; repeated, predictable burns integrated into protocol mechanics or real utility consumption (e.g., fees burned during network activity) progressively remove supply and compound effects.

Two practical takeaways for observers: monitor whether burns continue at an elevated cadence, and check where burned tokens originate (small-user burns, exchange-assisted burns, or whale-originated burns). Burns sourced from exchanges or major holders can imply deliberate supply engineering, while fragmented small burns are often community-driven signaling.

What fell in the 54% Shibarium drop — and why it matters

The Shibarium slowdown reported as a roughly 54% fall in activity covered several on-chain metrics: transaction counts, active addresses, gas consumption and bridging throughput (U.Today analysed the sudden downturn). A dip of this size is not merely noise; it suggests a meaningful pullback in on-chain demand or temporary inability for users and dApps to interact reliably.

Why would Shibarium activity crater? Several proximate causes are common in layer-2 and emerging chains: node instability or outages, temporary RPC endpoint failures, mempool backlogs, or even coordinated front-end downtimes that prevent users from accessing wallets. Equally important is perception — users who hit errors or stalled transactions often pause activity, reducing fees and the burning that might be tied to those fees. That creates a feedback loop: less activity means fewer burn events and weaker narrative support for price moves.

From a tokenomics standpoint, network reliability underpins demand. If Shibarium is positioned as a utility-bearing layer for NFTs, microtransactions or DeFi primitives, outages erode the core proposition. Short-term traders may exploit volatility, but long-term holders care deeply about sustainable throughput and the developer ecosystem rebuilding trust.

Burns, exchange reserves and price behavior: causation vs correlation

A common bullish narrative for memecoins: burns + falling exchange reserves = less sell pressure = higher price. Analysts at Crypto.News argue that rising burn metrics and declining exchange balances can set the stage for a rebound. The logic is straightforward — fewer tokens on exchanges means fewer tokens immediately available to dump, and ongoing burns slowly tighten effective supply.

Reality is messier. Exchange reserves dropping can reflect genuine off-exchange accumulation by long-term holders, but they can also be driven by whale movements into custody, cross-exchange arbitrage, or temporary withdrawals to private wallets ahead of a planned sell. Price is ultimately set by liquidity and order-book depth at the margin: if large holders choose to realize gains, scarcity on exchanges won’t stop them; it will just move selling pressure to OTC channels or reduce visible depth until buyers step in.

Burns help the economics only if they’re sustained and significant relative to typical daily volumes and new issuance (if any). A single 812M burn is unlikely to change the supply-demand equilibrium materially for a token with extremely high nominal supply unless matched by increased real-world utility or continued large burns. Traders should therefore treat burns and reserve drops as directional signals, not definitive proof of a trend reversal.

On-chain signals to watch next

- Exchange reserves: the slope of the decline matters more than individual snapshots; watch for net outflows sustained over weeks.

- Burn cadence: recurring, automated burns tied to usage (gas or fees) are higher quality than one-off burns.

- Active addresses and transaction counts on Shibarium: a rebound in these suggests utility recovery.

- Whale behavior: large transfers, concentration of supply and OTC trade rumors.

- Cross-protocol integration: new dApps or NFT drops that consistently use SHIB for fees or purchases increase the long-term probability that burns matter.

For many traders, Bitcoin still acts as the market’s macro bellwether; altcoin performance will often lag or lead depending on liquidity and narrative rotation. Meanwhile, growth in adjacent sectors — whether NFTs or DeFi activity on Shibarium — is what converts token-engineering into durable demand.

A practical risk/reward framework for traders and holders

Below is a compact framework to use when deciding whether SHIB’s tokenomics outweigh network risk. Tailor any advice to your time horizon, position size and risk tolerance.

Time horizon and objectives. Traders (days–weeks) should prioritize liquidity and volatility; long-term holders (years) should prioritize protocol adoption and sustained burn mechanisms.

Entry sizing and staging. Break exposure into tranches. If you believe burns will matter only if sustained, consider smaller initial allocations and add on confirmed recovery in Shibarium metrics.

Stop-loss and fail-safe triggers. For short-term positions, use technical levels tied to liquidity pools or exchange order-book gaps. For long-term positions, set mental stop points based on fundamental degradation (e.g., protracted Shibarium instability or developer abandonment).

Scenario planning (three outcomes):

- Bull case: Burns become recurring and Shibarium recovers with growing dApp activity; exchange reserves continue to decline; price appreciation accelerates as scarcity meets utility.

- Base case: Burns remain irregular, Shibarium oscillates between outages and fixes; price drifts with market cycles, offering periodic trade opportunities but limited structural appreciation.

- Bear case: Shibarium utility fails to scale, technical issues persist, social interest wanes — burns are one-off marketing events with little lasting effect and price underperforms broader crypto.

Monitoring checklist. Weekly check-ins on burn cadence, exchange reserves, Shibarium txs/gas and major wallet moves give you early warning on regime shifts. Use on-chain dashboards and community channels, but weigh data against noise and wash trading risks.

Conclusion: can supply engineering offset technical setbacks?

Supply engineering — burns and reserve management — is a legitimate lever and a useful narrative tool. But it rarely substitutes for reliable utility. The recent 812M+ SHIB burn and surge in burn rate are meaningful as part of a broader program, not as a lone act. Conversely, Shibarium’s reported 54% activity drop underscores that utility and user confidence can evaporate quickly, muting the positive impact of token burns.

For retail investors and on-chain analysts the right posture is pragmatic: burns and falling exchange reserves reduce potential sell pressure and improve the asymmetry for holders, but only sustained burn programs tied to genuine Shibarium growth will convert that asymmetry into lasting price appreciation. Short-term traders can trade the volatility; long-term holders should demand repeated proof of both supply discipline and network reliability.

Bitlet.app users and altcoin traders alike should keep an eye on the metrics that bridge tokenomics and utility — not just the headlines. For now, the narrative is mixed: tokenomics are improving at the margin, but technical stability remains the gating factor for durable upside.