Academic Insights into Cryptocurrency: Bridging Theory and Practice

Cryptocurrency has emerged as a revolutionary force in the financial world, capturing the attention of both investors and academics alike. Recent academic studies have delved into the theoretical frameworks that underlie cryptocurrencies, providing crucial insights that bridge the gap between theory and practical application.

Firstly, understanding the fundamental principles of blockchain technology is essential for grasping how cryptocurrencies function. Academic research sheds light on the decentralized nature of these digital assets and their implications for finance and governance.

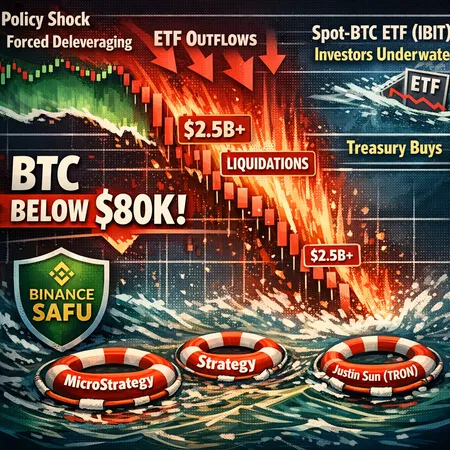

Moreover, economic theories are being applied to the analysis of cryptocurrency markets, offering valuable models for investment strategies. For instance, studies on market behavior help predict price volatility and trends, aiding investors in making informed decisions.

Educational institutions are increasingly integrating cryptocurrency studies into their curricula, equipping a new generation with the tools to navigate this complex landscape. Many universities are collaborating with fintech companies to provide practical training and internships, enhancing students' understanding of real-world applications.

To facilitate the accessibility of cryptocurrencies, platforms like Bitlet.app are emerging, offering innovative services such as Crypto Installment. This service allows users to buy cryptocurrencies now and pay in monthly installments, making it easier for individuals to invest without overwhelming initial costs. Such initiatives represent a shift towards integrating academic insights into practical financial solutions.

In conclusion, the marriage of academic inquiry and practical financial tools is essential for the growth of the cryptocurrency sector. By leveraging research and innovative platforms like Bitlet.app, we can better understand and utilize the evolving landscape of digital assets.