XRPC Paradox: Record First-Day ETF Volume as XRP Price Plummeted — What Went Wrong

Summary

Overview: the XRPC debut and the paradox

Canary Capital’s spot XRP ETF (XRPC) arrived with fanfare and extraordinary trading interest: independent coverage reported roughly $58 million in day‑one trading volume, described as a record for a single‑issuer spot XRP vehicle, and other outlets framed the debut as unusually liquid for a new crypto ETF (Crypto.news report, NewsBTC coverage). Yet, in the same session XRP’s spot market saw a sharp intraday decline. Post‑listing analysis found the token plunged more than 7% amid a broader market sell‑off and ETF‑linked dynamics (CoinDesk analysis). How can record ETF volume and falling spot price coexist? The short answer: ETF trading volume is not the same as immediate net buy pressure on the underlying token.

Below I unpack the mechanics and market context that produced the XRPC paradox and offer tactical takeaways for institutional and retail players navigating single‑asset crypto ETFs.

Intraday flows versus spot mechanics: why volume didn’t equal price support

At a surface level, higher ETF volume suggests demand. But the ETF wrapper and market‑making plumbing create points where trading activity can be neutralized or even pressuring to the underlying spot market.

Authorized Participants (APs) and market makers provide liquidity by creating and redeeming ETF shares in large blocks (creation units). When APs see sustained buying in the ETF, they may create shares by delivering the equivalent basket of underlying assets — or, in many cases for crypto spot ETFs, by delivering cash and acquiring the token on the open market. Either route can result in selling pressure or distribution into the spot market depending on AP strategy and balance‑sheet constraints.

Add to that intraday hedging: many APs and dealers hedge exposure to ETF flows using derivatives (futures, swaps) rather than immediate spot purchases. Hedging is efficient for risk management but can detach ETF trade flow from instantaneous demand for the underlying token. APs often prefer hedging first and sourcing spot later, which can delay or fragment the effect on price.

Creation/redemption timing and settlement lags

ETF creation/redemption cycles are not instantaneous. Settlement lags, custody windows, and on‑chain transfer times for tokens like XRP mean that APs will frequently neutralize risk using short‑term instruments. That latency opens arbitrage windows: an AP might sell spot into a falling market that they otherwise would have used to back a creation unit, or they might borrow tokens to meet immediate obligations.

This technical pathway helps explain how headline ETF volume — which is a measure of exchange trading in ETF shares — can be high without producing one‑for‑one buys of the token on spot venues.

The macro trigger: Bitcoin‑led sell‑off and ETF outflows

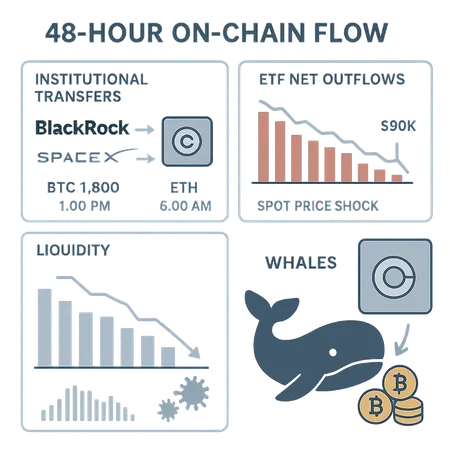

The XRPC debut did not occur in a vacuum. The same session featured a broader crypto market drawdown led by Bitcoin, which prompted rapid de‑risking across correlated assets. CoinDesk’s post‑launch coverage notes that the ETF launch failed to prevent a sharp XRP sell‑off amid a BTC‑led retracement (CoinDesk analysis).

Why does Bitcoin movement matter? Many market participants run cross‑asset risk engines and margin constraints. When BTC drops, liquidity providers and leveraged funds may be forced to reduce exposure across altcoins, triggering ETF redemptions or selling of the underlying token to meet margin calls. Even if ETF share buyers appear, net flows can be negative once those broader deleveraging forces are counted.

Coinpedia’s post‑mortem on XRP’s price drop emphasized that despite the ETF headline, market psychology — fear, de‑risking, and forced sales — drove much of the adverse price action, at least in the short term (Coinpedia explainer).

On‑chain signals: whales, retail behavior, and liquidity fragmentation

On‑chain data often tells a nuanced story. Large holders (whales) can amplify moves by either accumulating into ETF‑related headlines or distributing into the news to capture liquidity. In the XRPC case, exchanges and major wallets showed clustered selling windows that aligned with the broader sell‑off, suggesting some large actors used the increased liquidity to exit positions.

Retail traders further magnify short‑term volatility. ETF launches attract attention, but retail flows are often momentum‑driven and emotionally reactive. Retail participants can buy the ETF intraday, then panic‑sell the token when they see declining prices or widening spreads — the feedback loop accelerates volatility on both ETF and spot venues.

The net effect: higher nominal volume (both on ETF and spot) but directional fragmentation — trades in both directions — which can push prices lower even as turnover rises.

Market structure and arbitrage: how the plumbing decouples price

Several market‑structure features systematically reduce the probability that ETF volume will immediately support spot prices:

- Arbitrage mechanics: Legitimate arbitrage requires synchronization. APs will arbitrage ETF share price vs. NAV, but the route to neutralize exposures often uses futures or borrowing, not instantaneous spot buys.

- Short‑term inventory management: Market‑makers manage balance sheets. If their inventory is long ETF shares but short spot, they may choose to hedge with swaps rather than buy the token outright.

- Dark pools and OTC blocks: Significant creation/redemption activity can happen off‑exchange or through OTC desks, where trades may execute at prices that do not immediately lift visible spot order books.

- Settlement and custody constraints: Cryptocurrency transfers are subject to chain confirmation times and custody policies. These frictions mean that cash creations are often settled later, and interim hedging can create temporary imbalances.

All of these structural points create plausible, repeated pathways for ETF flows to be functionally neutral or even net‑negative for immediate spot price.

So what does the XRPC episode mean for future single‑asset crypto ETFs?

The Canary Capital fallout teaches several durable lessons:

- ETF volume ≠ instant buy pressure. High turnover on debut tells you about interest and liquidity, not necessarily about durable accumulation of the underlying token.

- Cross‑asset correlation dominates short windows. A broad BTC correction can overwhelm any single‑asset ETF inflows, especially when market participants are leveraged or running cross‑product hedges.

- Expect more complex plumbing. As institutional demand grows, APs and market makers will increasingly use derivatives, borrowing, and OTC channels to manage exposure — which keeps ETF share trading somewhat decoupled from spot liquidity.

For regulators and product designers, the episode also highlights the need to outline clear settlement conventions and disclosure around creation/redemption processes for tokenized ETFs, to help investors understand how ETF flows feed into on‑chain markets.

Tactical takeaways for institutional and retail investors

Below are practical points for different participant types.

For institutional investors and asset managers:

- Model the plumbing: quantify how APs may hedge (futures, swaps) and include slippage and funding costs in expected ETF/spot flow models.

- Be mindful of balance‑sheet and margin feedback loops: during market stress those internal constraints can produce sudden reversals across correlated holdings.

- Use phased execution: if seeking exposure via an ETF, consider balancing allocation between ETF shares and futures or OTC spot to manage timing and custody nuances.

For retail and active traders:

- Don’t assume ETF inflows = instant price support. The debut day volume is a signal of interest, not a guarantee of upward price momentum.

- Watch spreads and liquidity: early trading can have wider bid/ask spreads and odd intraday behavior. Entry timing matters.

- Monitor on‑chain flows and whale wallets: sudden accumulation or distribution by large addresses often precedes meaningful volatility.

For both groups, keep one eye on Bitcoin and macro liquidity: single‑asset crypto ETFs will still be vulnerable to broader market stress and cross‑product liquidation cycles.

Final perspective: a maturing ecosystem with growing complexity

Canary Capital’s XRPC debut was a milestone in product distribution — notable volume and attention — but it also exposed growing pains in how traditional ETF mechanics intersect with native crypto market microstructure. This was not necessarily a failure of the ETF concept, but a reminder: as spot crypto ETFs proliferate, investors must learn to read both on‑exchange ETF flows and off‑chain or off‑exchange plumbing that ultimately determines whether those flows become durable token demand.

As the ETF ecosystem matures — and as APs, custodians, and exchanges refine settlement and hedging protocols — some of these decoupling effects should diminish. In the meantime, treat headline XRPC volume as one data point among many: combine it with on‑chain signals, funding and futures curves, order book depth, and macro context before drawing conclusions about token price direction.

For practitioners looking for execution or custody options, remember platforms like Bitlet.app are part of a broader infrastructure evolution; product selection and an understanding of market mechanics matter as much as headline volumes when navigating this next phase of crypto ETF adoption.