When Central Banks Test Bitcoin: Lessons from the CNB $1M Pilot and Taiwan’s Audit

Summary

Why central bank pilots matter now

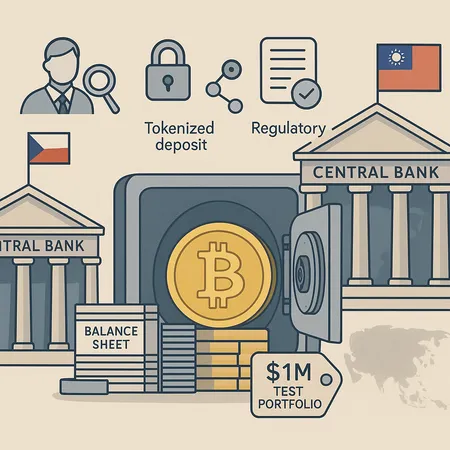

Central banks testing Bitcoin do more than diversify asset lists — they probe operational, accounting and legal boundaries that until recently were academic. The Czech National Bank’s $1M test portfolio and Taiwan’s announced audit (report due end‑2025) are early, deliberate steps to answer pragmatic questions: how to custody BTC securely as a sovereign asset, how to classify and value it on the balance sheet, and whether small, controlled allocations change macro signalling.

These pilots are not votes of confidence in a headline sense; they are experiments. But even small, credible pilots by public institutions recalibrate how markets and policymakers think about BTC as a potential component of sovereign reserves and can create a slowly accreting base of macro demand for BTC (ticker: BTC).

What the Czech National Bank’s $1M experiment looked like

Publicly available descriptions (and reporting anchored to CNB disclosures) indicate the Czech National Bank structured its $1M pilot as a constrained, governance‑heavy experiment: limited notional exposure, clear operational guardrails, and separation from the main FX reserve portfolio.

Key structural choices the CNB made or reportedly considered:

- Limited exposure cap: the entire experiment was capped at $1M to avoid balance‑sheet concentration and signal pilot status. This keeps potential mark‑to‑market swings immaterial to overall reserves.

- Spot exposure preference: the pilot leaned toward direct spot BTC exposure rather than derivatives, reducing counterparty risk but increasing custody requirements.

- Custody segregation: assets were kept in a segregated, auditable custody setup with multi‑party controls and cold‑storage practices.

- Operational transparency and governance: predefined entry/exit rules, audit trails and reporting requirements to internal risk committees.

These structural elements mirror what many institutional strategists would design for an initial sovereign reserve test: minimal macro-risk, strong auditability, and an emphasis on custody and legal clarity over potential upside.

Why Taiwan’s end‑2025 audit matters for Asia‑Pacific policy

Taiwan’s audit is consequential for three reasons: jurisdictional signalling, regional spillovers, and the precedent it sets for large FX managers.

First, an affirmative audit that describes a legally and operationally coherent path for a small BTC allocation would send a strong signal across the Asia‑Pacific region, where large reserve managers (Japan, Korea, Taiwan, Singapore) are traditionally conservative but extremely influential. Taiwan sits at the intersection of advanced financial plumbing and geopolitical sensitivity—any move there is watched closely.

Second, Asia‑Pacific monetary policy frameworks have unique features: higher FX reserve concentrations, sizeable external surpluses or deficits, and often tighter capital‑flow management. If Taiwan shows a feasible way to integrate BTC without undermining currency stability or capital controls, portfolio managers across the region will reassess opportunity costs of holding exclusively fiat assets.

Third, the audit’s analytical framework (how it treats volatility, liquidity, legal custody, and AML compliance) could inform regional regulatory harmonization. That matters because any meaningful sovereign allocation requires cross‑border custodial pathways and confidence that holdings will be recognized under diverse legal regimes.

Collectively, Taiwan’s audit could be the first credible, Asia‑driven blueprint for central bank bitcoin experiments—and that makes the end of 2025 one of the hybrid policy milestones to watch.

Balance‑sheet and accounting implications for sovereign reserves

Adding BTC to a central bank balance sheet isn't just a portfolio choice; it changes the accounting conversation.

Classification. Will BTC be treated like foreign exchange reserves, as a non‑monetary financial asset, or something new? Classification affects how gains and losses flow through profit & loss or revaluation reserves.

Valuation rules. Mark‑to‑market accounting creates volatility in reported reserves. Some central banks may opt for amortized cost for certain crypto instruments (if allowed), but spot BTC is inherently markable. How unrealized gains/losses are recognized affects perceived capital adequacy and independence narratives.

Liquidity buffers and reserve ratios. Central banks must decide if BTC counts towards statutory liquidity requirements. That depends on demonstrable convertibility and market depth at scale.

Seigniorage and monetary policy transmission. Holding BTC doesn’t directly change base money unless central banks choose to use tokenized deposit vehicles or integrate BTC exposures operationally. However, swaps or repo arrangements backed by BTC could introduce new transmission mechanics—something policy teams will model carefully.

Stress testing. BTC’s historical volatility demands new stress scenarios. Even a 0.1–0.5% allocation could create headline effects if BTC experiences a rapid move; stress frameworks must quantify potential capital erosion and systemic signalling consequences.

The accounting choices are not neutral. Conservative frameworks will limit moral hazard but also blunt arguments for BTC as a store of value on sovereign books. More permissive treatment could create precedent but also political backlash if markets turn quickly.

Custody, legal and regulatory challenges

Moving from intention to implementation exposes thorny operational questions. For central banks the bar is higher: custody must be legally recognized, auditable, and defensible in a crisis.

Custody design: offline cold storage, geographically diversified key‑shares, and regulated custodians are central. Many institutions prefer regulated custodian banks that combine insured cold storage with institutional MPC (multi‑party computation) to balance operational resilience and legal clarity.

Insurance and liability: traditional custody insurance markets are nascent for sovereign‑scale crypto holdings. Sovereigns may need bespoke insurance or legal indemnities from custodians.

Legal title and enforceability: cross‑border custody raises questions of which legal jurisdiction governs assets. Can a sovereign recover holdings quickly if a foreign custodian is subject to sanctions, insolvency or local seizure? Clarity is essential.

AML/KYC and sanctions compliance: integrating BTC into a sovereign reserve mandates robust AML controls and a legal framework that ensures holdings won’t inadvertently facilitate illicit finance. This is especially sensitive for jurisdictions under geopolitical stress.

Tokenized deposit and settlement plumbing: some pilots explore tokenized deposit constructs—effectively tokenized claims on a custodian or bank—to improve settlement and auditability. Tokenization can make intragovernmental transfers simpler, but it introduces its own custody and counterparty‑credit considerations.

These operational choices will determine whether central bank bitcoin is practical at scale or remains an experimental niche. Sovereign risk managers will demand custody arrangements that stand up to court scrutiny and geopolitical pressure.

What this means for BTC’s institutional store‑of‑value narrative

If central banks continue cautious, small‑scale experiments, three broad narratives emerge:

Legitimization without scale. Pilots give BTC regulatory and institutional legitimacy. Even capped pilots increase demand marginally, lower uncertainty for private institutions, and expand the universe of counterparties willing to provide custody and liquidity.

Gradual macro demand. A handful of central bank allocations at 0.01–0.5% of reserves are not transformative for BTC’s price on their own. But adoption is path‑dependent: once custody, accounting and legal wrinkles are ironed out, larger allocations become feasible, and demand could grow materially over time.

Policy risk remains. Central bank adoption does not insulate BTC from macro policy shifts. In crisis scenarios, political pressure could force disposals, or regulatory shifts could make holdings harder to mark to market. The store‑of‑value argument improves with institutional adoption but never eliminates counterparty, operational and policy risk.

For institutional investors and policy‑minded strategists, the takeaway is measured: central bank experiments strengthen the institutional infrastructure (custody markets, legal templates, audit practices), which in turn makes larger allocations thinkable. But moving from proof‑of‑concept to policy instrument requires more than enthusiasm—it needs standardized accounting, tested custody rails, and legal precedents.

Practical signposts to watch (and what strategists should model)

Policy‑minded investors should track a handful of variables that indicate whether these pilots are likely to expand:

- Regulatory templates: Does the audit from Taiwan or CNB documentation include model legal opinions and custody contracts? Standardized templates reduce transaction costs.

- Accounting guidance: Any public guidance from national audit offices or standards bodies on how to treat BTC for sovereign accounts.

- Custody supply: Emergence of bank‑grade custodians offering insured, court‑tested services; institutional MPC solutions; and credible cross‑border custodial chains.

- Liquidity metrics: Depth in BTC spot markets at the sizes relevant to sovereign allocations; slippage and market impact models.

- Geopolitical/legal clarity: Precedents on asset recovery and cross‑border enforcement if a custodian is subject to sanction or insolvency.

Model scenarios that combine small allocations (e.g., 0.05–0.5% of reserves) with conservative pricing and liquidity assumptions. These show limited near‑term balance‑sheet volatility but increasing structural legitimacy if pilots are repeated and scaled.

Conclusion — cautious progress, structural consequences

CNB’s $1M test and Taiwan’s audit are not the start of an immediate flood of sovereign BTC buying. Instead, they are infrastructure signals: experiments designed to resolve custody, accounting and legal questions. If those experiments produce replicable templates, we should expect a slow but persistent erosion of the institutional barriers that have kept BTC outside of many official reserve ledgers.

For crypto investors and institutional strategists, that shift matters more than any single trade. The evolution from anecdote to repeatable procedure — bank‑grade custody, audit‑ready accounting, and regulatory templates — is what will gradually change macro demand dynamics for BTC. Keep an eye on how these pilots codify practices; platforms across the ecosystem (even user‑facing ones like Bitlet.app) will evolve as institutional plumbing deepens.

Bitcoin and other token ecosystems are not just assets; they are experiments in new forms of reserve, settlement and monetary expression. The next 12–36 months of audits, pilot reports and custody contracts will tell us whether central bank bitcoin remains a handful of curiosities or becomes a repeatable reserve tool.

CentralBank decision‑making will be iterative; the earliest wins will be operational, not speculative. Meanwhile, custody innovation — from regulated custodians to advanced MPC — will decide how practical sovereign BTC holdings really are. Read those operational developments closely: they’re the leading indicator for institutional adoption.

For strategists, the most prudent posture is preparation without overcommitment: model conservatively, stress‑test for political and market turns, and watch for legal and accounting precedents that turn isolated pilots into scalable policy options. For now, central bank bitcoin is a slowly accreting signal—one that matters more for infrastructure than for immediate macro flows.

Custody will determine the pace of that signal converting into durable demand.