Understanding the Impact of Major Cryptocurrency Market Downturns and Managing Volatility with Bitlet.app

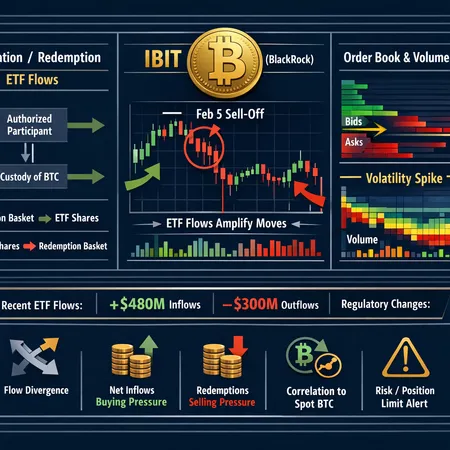

Cryptocurrency markets are often characterized by their price volatility and susceptibility to sharp downturns. These major market downturns can result from various factors including regulatory changes, macroeconomic events, or market sentiment shifts. For investors, such volatility can lead to uncertainty, potential losses, and hesitancy to invest.

Understanding how these downturns affect portfolios is crucial. Many investors experience fear-driven sell-offs or miss the opportunity to dollar-cost average into positions during market dips. Managing volatility effectively requires tools and strategies that provide financial flexibility and reduce upfront investment burdens.

Bitlet.app offers an innovative solution with its Crypto Installment service. This feature enables users to acquire cryptocurrencies immediately but pay for them in manageable monthly installments instead of a lump sum. Such a model allows investors to better navigate volatile markets by spreading out their investment costs and minimizing exposure to sudden price drops.

By leveraging Bitlet.app’s Crypto Installments, investors can build their crypto portfolios steadily, taking advantage of market fluctuations without the pressure of full upfront payments. This service enhances accessibility to cryptocurrency investments while promoting smarter risk management.

In conclusion, while cryptocurrency market downturns pose challenges, platforms like Bitlet.app provide practical options to manage volatility effectively. Utilizing installment-based purchasing can help investors maintain composure, plan strategically, and take advantage of long-term growth opportunities in the crypto space.