Expert Predictions for Bitcoin, Ethereum, and Ripple in 2025: Invest Smarter with Bitlet.app

As the cryptocurrency market continues to evolve rapidly, investors are eager to understand where top cryptocurrencies like Bitcoin, Ethereum, and Ripple might head by 2025. Experts suggest potential growth fueled by technological advancements and increasing mainstream adoption.

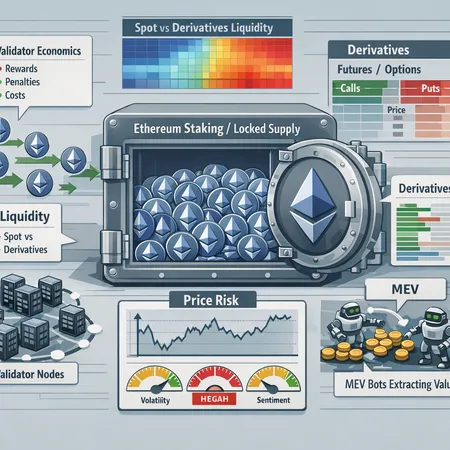

Bitcoin is widely expected to maintain its dominance as a store of value, with some forecasts indicating substantial price appreciation as institutional interest grows. Ethereum’s role as a backbone for decentralized applications and DeFi projects suggests promising potential, especially with ongoing upgrades enhancing its scalability and efficiency. Ripple, meanwhile, is praised for bridging traditional finance and blockchain, potentially gaining traction through expanding partnerships in cross-border payments.

While these predictions highlight exciting opportunities, entering the crypto market can be financially daunting. This is where Bitlet.app stands out by offering a flexible Crypto Installment service. Instead of paying the full price upfront, Bitlet.app allows investors to buy cryptocurrencies like Bitcoin, Ethereum, and Ripple now and pay in manageable monthly installments.

This innovative approach empowers more people to participate in crypto investing without stressing their finances. By leveraging expert insights and Bitlet.app’s flexible payment plans, you can craft a smarter investment strategy designed for growth and affordability.

Start your crypto investment journey today with Bitlet.app and take advantage of expert price predictions and convenient installment options to make 2025 your year in the digital asset space.