The Future of Cryptocurrency Regulations: How Senate Democrats are Shaping the Landscape

As the cryptocurrency landscape continues to evolve, the influence of government and regulatory frameworks cannot be understated. Recently, Senate Democrats have stepped forward to take a pivotal role in shaping regulations that are anticipated to guide the future of digital currencies.

The Democratic approach has prioritized investor protection while promoting the innovative potential of blockchain technology. In the face of a rapidly growing industry, lawmakers are seeking to implement clear guidelines that not only secure consumer interests but also encourage the healthy growth of cryptocurrency markets.

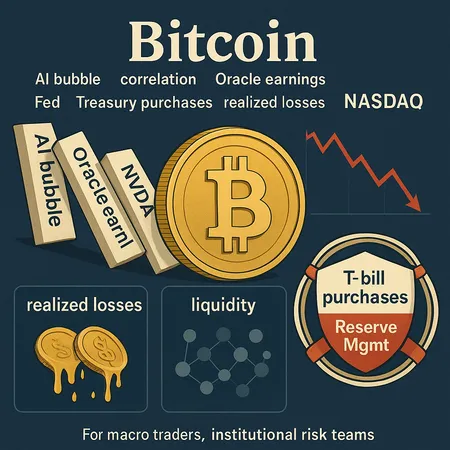

Key areas of focus include:

- Consumer Protection: Ensuring that investors are safeguarded against fraud and market manipulation.

- Market Stability: Establishing measures that reduce volatility and increase trust in digital assets.

- Encouragement of Innovation: Supporting companies that are advancing technology in the blockchain space, recognizing the need for a balance between regulation and innovation.

Furthermore, platforms like Bitlet.app are adapting to these regulatory changes by offering services such as Crypto Installment, which allow users to buy cryptocurrencies now and pay in manageable monthly installments instead of making a full upfront payment. This service not only makes crypto investments more accessible but also promotes responsible financial planning in a volatile market.

In conclusion, as Senate Democrats push for comprehensive regulations, the future looks promising for both investors and innovators in the cryptocurrency sector. Keeping an eye on these developments is crucial for anyone looking to navigate the intricate world of digital currencies.