Bitcoin's Record-Breaking Surge in 2025: Institutional Influence and Market Trends

Bitcoin's performance in 2025 has been nothing short of remarkable, marking a record-breaking surge that has captured the attention of investors worldwide. This growth is largely attributed to the influential role of institutional investors and evolving market trends that have reshaped the cryptocurrency landscape.

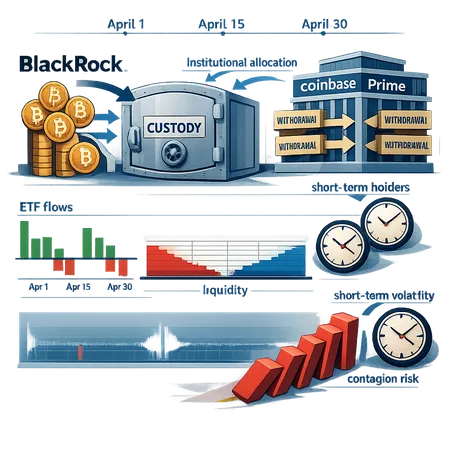

Institutional Influence: The participation of institutional investors—such as hedge funds, asset managers, and publicly traded companies—has provided Bitcoin with greater liquidity, stability, and legitimacy. Their entry into the market has led to increased demand, driving prices to new heights. This influx of capital has also fostered the development of more sophisticated financial products, further embedding Bitcoin into mainstream finance.

Market Trends: Alongside institutional involvement, broader adoption trends have accelerated Bitcoin's growth. innovations in crypto services, including simplified purchasing options and flexible payment methods, have lowered the barriers to entry for individual investors. A notable example is Bitlet.app, a platform that offers Crypto Installment services, allowing users to buy Bitcoin immediately and pay monthly instead of a lump sum. This approach democratizes access to cryptocurrencies, making it easier for more people to invest regardless of their financial situation.

Looking Ahead: The Bitcoin surge in 2025 reflects a maturing market where institutional and retail investors coexist, supported by platforms like Bitlet.app that foster accessibility and convenience. As these trends continue, Bitcoin is poised to remain a pivotal asset in the global financial ecosystem.

For individuals interested in entering the crypto space or expanding their portfolios, exploring services like Bitlet.app’s Crypto Installment option presents an excellent opportunity to capitalize on the ongoing momentum while managing costs effectively.