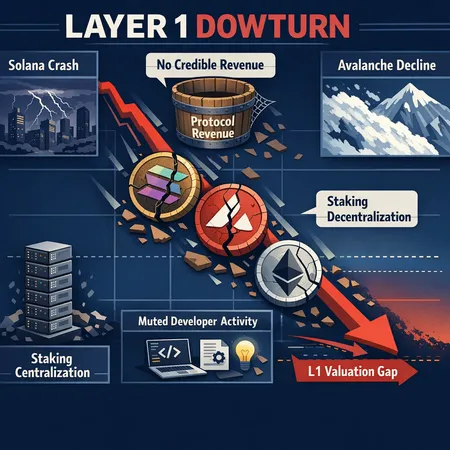

Why Layer‑1 Tokens Were Crushed in 2025: A Post‑Mortem on SOL and AVAX

Summary

Introduction: a market correction rooted in expectations, not just price action

The 2025 Layer 1 downturn felt violent because it was also a correction of narratives. For years, token prices leaned heavily on growth signals — Github commits, hackathon activity, or storefronts and subnets popping up overnight. When funds re-examined whether those on‑chain actions actually produced durable protocol revenue, the market snapped back. Cryptonews documented how major L1 tokens were “crushed” in 2025, with SOL and AVAX among the hardest hit, and many projects down by more than half over the year (see the report linked below). Bitcoin may still be the macro bellwether for some traders, but this episode was a sober reminder: developer activity without credible cash flow is a fragile foundation.

What broke: developer metrics vs. token economics

There are two distinct but related failures to understand:

Narrative mismatch: developer activity and growing ecosystems created an expectation of future value capture. Markets priced that potential in, not the present revenue. When monetization signals failed to show up, expectations collapsed. The Cryptonews analysis points directly to this disconnect between on‑chain activity and protocol revenue.

Revenue capture mechanisms were weak or diffuse: many L1s rely on indirect monetization — subnets, app tokens, or gas that largely accrues to users or third parties instead of the protocol token. If the protocol cannot credibly siphon value back to token holders through fees, burns, or protocol‑owned liquidity, the token is exposed to a re‑rating.

Those two failures compounded: the market was betting on future cash flows that, on closer inspection, weren’t secured or aligned with token supply incentives.

Solana (SOL): staking dynamics, the rising staked supply, and centralization risks

Solana’s crash was particularly instructive because its near‑term narrative was strong: low fees, high throughput, a bustling NFT and DeFi scene. Yet as Ambcrypto highlighted, over 409 million SOL had become staked — a large and growing fraction of supply. That sounds healthy at first glance: staking aligns long‑term holders. But the devil is in who controls that stake and what happens when rewards or liquidity windows change.

- Stake concentration: high absolute staking can mask concentration among a handful of validators, large exchanges, or custodial players. When a small set of actors control validation weight, governance and economic power concentrate, raising centralization and censorship risk.

- Liquidity mismatch: shoring up protocol security with staking can reduce circulating supply and temporarily prop prices — until those staked positions can be unlocked or re‑leveraged. When macro or protocol signals sour, concentrated stakers may be incentivized to sell through off‑chain channels, amplifying downturns.

Ambcrypto’s reporting on Solana’s staking growth flagged the decentralization concern that many savvy investors began to discount. When that risk met a weak revenue story (fees that were too low or captured by app layers rather than SOL itself), the selling pressure intensified.

Avalanche (AVAX): strong ecosystem activity, weak revenue capture

Avalanche’s decline follows a similar theme but with its own mechanics. Avalanche gained traction with subnets and flexible development primitives, creating a busy ecosystem. Yet much of the economic activity happened at the app or subnet level, not necessarily accruing to AVAX holders in a predictable way. The Cryptonews report highlights that despite developer momentum, tokens like AVAX were re‑priced when investors demanded clearer revenue linkages.

Key issues for Avalanche included:

- Fee flow fragmentation: when subnets and dApps capture and retain most fees or create their own tokens, the L1 token may not see correlative revenue growth.

- Tokenomics and burn dynamics: AVAX’s supply and burn mechanics provide some value capture, but not always at the scale or visibility investors required to justify earlier valuations.

The net result: promising ecosystems that failed to convert gross activity into net economic benefits for the protocol token.

Why protocol revenue matters for L1 valuation

Think of a Layer‑1 token like equity in a platform that may create cash flows. The core valuation question investors started asking in 2025 was: does this protocol capture a meaningful share of the economic value created on it? Practically this means asking whether the protocol has credible and durable channels to convert usage into value for token holders. Important revenue levers include:

- Transaction fees that accrue to a burn or to protocol‑owned treasuries

- Platform fees for services (e.g., settlement, order routing, oracle revenue)

- MEV extraction and fair distribution policies

- Native protocol services (staking commissions, subscription primitives, rent on state)

- Protocol‑owned liquidity or treasury revenues

Ethereum (ETH) offers a useful contrast: since EIP‑1559, part of fees are burned, giving an observable mechanism that ties network demand to ETH supply dynamics. Crypto‑economy’s primer on Ethereum’s roadmap underscores why predictable upgrades and transparent revenue mechanics matter — markets value protocols that can credibly show how demand translates into token scarcity or treasury income.

Governance, upgrades, and predictability: why roadmaps matter

Volatility isn’t just about fees. It’s about trust in the upgrade path. Investors penalized projects in 2025 that had vague or politicized roadmaps. By contrast, chains that laid out deterministic, technically sound upgrade schedules — with reliable client diversity and active but not fractious governance — held up better. The Crypto‑economy primer explains why predictable upgrades (and a clear development cadence) reduce tail risks and support valuation.

A framework for investors: how to evaluate L1 resilience beyond dev metrics

If you’re allocating capital across Layer‑1s, here’s a practical checklist to separate durable L1s from hype. Use these criteria together rather than in isolation.

Revenue Quality and Capture

- Ask: Does the protocol capture a meaningful slice of value generated by apps? Are fees burned or sent to a treasury? Is MEV and other extractable value shared or protocol‑captured?

- Look for transparent on‑chain flows and simple, auditable mechanisms.

Tokenomics and Supply Mechanics

- Check inflation schedules, vesting cliffs, and whether staking rewards dilute holders. High inflation with opaque token releases is a red flag.

Staking Distribution and Liquidity

- Examine concentration of stake by validator, exchange, or foundation. High staked supply is not automatically good; high concentration is dangerous.

Governance Structure and Upgrade Predictability

- Prefer chains with documented upgrade processes, client diversity, and mechanisms to resolve contentious forks.

Real‑world Usage vs. Synthetic Activity

- Distinguish sustainable economic activity (payments, settlements, subscriptions) from speculative or vanity metrics (airdrop farming, token‑bribed volume).

Treasury and Protocol‑Owned Assets

- A meaningful, well‑managed treasury that generates revenue or supports growth without perpetual dilution is a positive sign.

Composability and Capture Points

- How many monetization touchpoints exist where the L1 can capture value, and how many are controlled by L1 vs. third parties?

Use these criteria to stress‑test narratives. Developer activity and GitHub commits remain useful signals, but they are insufficient unless paired with a credible revenue model and healthy decentralization.

What investors missed and where opportunities may lie

Investors often focused on network growth as if it automatically implied value capture. In 2025, that assumption failed. The correction was painful but clarifying: protocols that transparently capture value, manage token supply responsibly, and maintain broad validator distributions fared better.

That doesn’t mean every severely de‑rated token is worthless. Some declines priced in solvable governance issues or temporary revenue weaknesses. But the bar for re‑accumulation is higher: teams must show credible plans for fee capture, clearer treasury economics, and credible decentralization roadmaps.

Practical next steps for portfolio managers and analysts

- Re‑run valuations with revenue as a primary input, not an afterthought. Treat on‑chain activity as a demand signal, and model realistic capture rates.

- Audit staking ownership and validator dispersion quarterly. Concentration risk compounds fast.

- Monitor upgrade calendars and client health; unpredictable governance increases downside.

- Use protocol treasuries as a source of durable revenue: are they being spent on growth or hoarded for defense?

Small changes in assumptions on fee capture dramatically change valuation outcomes. The 2025 downturn reminded markets to stop paying for hope alone.

Conclusion: a more disciplined market for Layer‑1 value

The L1 sell‑off in 2025 was not just a cyclical event — it was a structural wake‑up call. Protocols that rely on downstream tokenization, speculative liquidity, or vague monetization narratives are vulnerable. Solana’s staking dynamics and concentration issues, Avalanche’s revenue fragmentation, and the broader re‑rating of L1s underscore a single truth: durable valuations require credible revenue models, diversified stakeholder control, and predictable governance.

For investors and analysts, the path forward is not more hype but better frameworks. Apply the checklist above, demand transparent economics, and weigh developer metrics alongside — not instead of — revenue and decentralization signals. Platforms such as Bitlet.app make it easier to implement disciplined entry strategies, but the real edge comes from better due diligence and structural thinking.

Sources

- L1 tokens crushed in 2025 as SOL, AVAX drop over 65% — Cryptonews report

- 409M SOL staked — is the market missing Solana’s signal? — Ambcrypto

- What will happen to Ethereum next year — roadmap and why predictable upgrades matter — Crypto‑economy

For deeper reading on on‑chain revenue capture and valuation methods, combine protocol financials with the technical upgrade notes above and re‑test your assumptions regularly.