The Rise of Tokenized Stocks and Mirror Tokens: Exploring New Frontiers in Crypto Investment

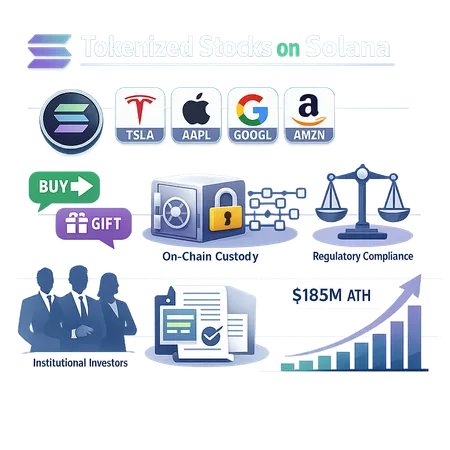

In recent years, the crypto market has seen the emergence of tokenized stocks and mirror tokens, which represent traditional financial assets on blockchain networks. These tokens allow investors to own fractions of real-world stocks, commodities, or indices in a secure, transparent, and easily tradable digital form. This trend is revolutionizing the way people approach investments, providing greater accessibility and flexibility.

Tokenized stocks are digital tokens backed by real-world assets. They mirror the value and price movement of the actual stocks, giving investors exposure without needing to go through traditional stock exchanges. Mirror tokens work similarly but often track a broader range of assets or indexes.

Bitlet.app is at the forefront of this innovation by not only offering access to tokenized stocks and mirror tokens but also introducing a unique Crypto Installment service. This service enables users to purchase these digital assets now while paying for them in monthly installments, lowering the barrier to entry for many aspiring investors.

By leveraging platforms like Bitlet.app, investors can diversify their portfolios with traditional assets on the blockchain, enjoy the security and transparency benefits of decentralized finance, and take advantage of flexible payment options that support consistent investment growth.

As tokenized stocks and mirror tokens continue to gain traction, they represent a promising new frontier for both crypto enthusiasts and traditional investors looking to embrace digital asset investment strategies. Bitlet.app’s innovative approach helps bridge the gap, making these opportunities easily accessible and manageable for all.