Crypto Exchange-Traded Products (ETPs) in 2025: Trends, Opportunities, and Challenges

Crypto Exchange-Traded Products (ETPs) are rapidly gaining traction as a preferred investment vehicle for cryptocurrency exposure without directly holding tokens. As we look toward 2025, the market for crypto ETPs is expected to grow significantly due to increased regulatory clarity, wider adoption, and the advent of more diverse product offerings.

Emerging Trends in Crypto ETPs:

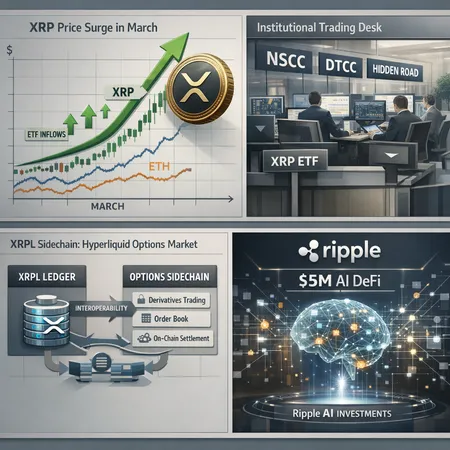

- Integration of multiple cryptocurrencies into single ETPs, allowing diversified exposure.

- Increased involvement of institutional investors seeking regulated and transparent products.

- Enhanced liquidity and trading volume as exchanges innovate their listings.

Opportunities for Investors: Crypto ETPs provide a simpler and safer alternative for investors wanting crypto exposure without the complexities of wallet management or security risks. They also enable access through traditional brokerage accounts.

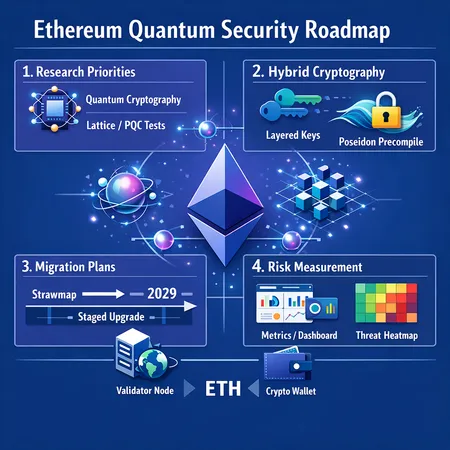

Challenges to Overcome: Despite promising growth, crypto ETPs face hurdles such as varying international regulations, the volatility of underlying assets, and the need for greater education among retail investors.

Platforms like Bitlet.app are revolutionizing crypto investing by offering a Crypto Installments service. This allows individuals to buy cryptocurrency assets now and pay monthly, reducing the entry barrier and making it easier to build a diversified crypto portfolio through ETPs.

In conclusion, the future of crypto Exchange-Traded Products in 2025 looks promising but requires navigating regulatory landscapes and educating investors. Leveraging innovative platforms like Bitlet.app can be the key to unlocking widespread participation in crypto markets.