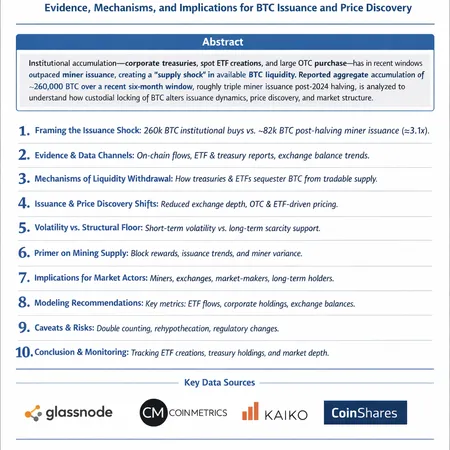

Corporate Treasuries and the Bitcoin Issuance Shock: Evidence, Mechanisms, and Market Implications

Summary

Executive summary

Corporate treasuries and institutional buyers have moved from fringe participants to dominant marginal buyers of BTC. On-chain reporting and market coverage indicate these entities added roughly 260,000 BTC over six months, a pace that recent reporting describes as about three times the amount miners produced in the same window. That divergence — an issuance shock driven by demand rather than protocol changes — materially alters the available liquid supply, the mechanics of price discovery, and the macro narrative for BTC (ticker: BTC).

This paper synthesizes the public reporting and on‑chain evidence, explains the mechanics by which treasury purchases remove supply (ETF vehicles vs direct custody), provides a primer on miner issuance and variance (including notable solo miner events), and draws implications for miners, exchanges, long‑term holders, and institutional modelers.

For baseline context, many market participants still look to Bitcoin as the core store-of-value and unit of account among crypto assets; but the supply side is rapidly being reshaped by corporate treasuries and ETF demand.

Evidence of corporate accumulation and scale of the gap

Multiple independent reports converged on the same headline: corporate and private accumulation of BTC accelerated materially in recent months. Coverage compiled and analyzed on‑chain and custodial flows shows companies and large institutional allocators purchased roughly 260,000 BTC over a six‑month period. Reporting that collates exchange and custody inflows makes the point bluntly: corporate buying outpaced miner issuance by roughly three times during that interval (Coinpaper, NewsBTC).

On‑chain and treasury reporting analysis reached similar conclusions: corporate treasury purchases in aggregate moved materially faster than freshly minted miner supply (Coinspeaker). The scale matters: when balance sheets are adding BTC at multiples of miner issuance, the net new BTC entering the liquid market from protocol issuance is dwarfed by institutional absorption.

How treasury purchases remove circulating supply: ETFs vs direct buys

Not all institutional purchases remove supply in the same way. Two dominant channels are: (1) direct purchases into company treasuries or custody accounts, and (2) allocations acquired via spot BTC ETFs.

Direct custody: When a company purchases BTC and holds it in a custodial wallet (or self‑custody), those coins typically leave exchange inventories and are effectively removed from the liquid float available to traders. Corporate treasuries do not tend to rotate holdings frequently; the intent is often long‑term reserve management rather than market making. That makes these BTC structurally less available for price discovery and intra‑day liquidity.

ETFs and creation/redemption mechanics: Spot BTC ETFs accumulate underlying BTC for their assets under management. ETF shares trade on traditional markets, but the underlying BTC is custodied and generally not available on exchanges. While ETF creation and redemption provide a mechanism to arbitrate supply/demand between markets, the practical effect of sustained ETF inflows is similar to direct custody: substantial amounts of BTC are moved into custodians and away from exchange order books. ETF demand therefore reduces the effective circulating supply even if ETF shares remain tradable.

Both channels compress what traders call the liquid float — the subset of BTC that is readily available for margin, market‑making, and large block trades. Lower liquid float increases the price impact of large trades and alters volatility dynamics.

Primer on mining issuance and variance

Protocol issuance remains a well‑defined input: new BTC are minted to miners as block rewards plus transaction fees, following the halving schedule written into the protocol. That issuance curve is predictable on aggregate, which historically made miner supply a stable part of supply‑side forecasting.

However, several practical features complicate the simple issuance story:

Miner sell behavior: miners often sell a portion of their daily issuance to pay operating costs (power, hardware), which converts protocol issuance into exchange liquidity. The proportion sold varies with BTC price, cost curves, and risk appetite.

Variance in distribution: block rewards are probabilistic and concentrated; solo miners or small pools may experience stretches of high reward accumulation or dry spells. Recent reporting highlighted an example of solo mining variance where a miner captured an outsized run of blocks during a 12‑month period, illustrating how mining outcomes can deviate from the mean and momentarily affect supply flows (CryptoSlate).

Operational and geopolitical risk: changes in mining capacity, relocations, and policy can change miner economics and their propensity to sell.

Taken together, the protocol’s deterministic issuance is filtered through miner economics and the market behavior of miners — which is the real source of day‑to‑day supply available to traders.

What the issuance shock does to price discovery and volatility

When corporate treasuries and ETFs soak up material amounts of BTC, several linked market effects emerge:

Reduced liquid float increases price impact for large orders. With less BTC on exchanges, block trades move price more. That means the same sized flow that once caused a 1% move might now cause 3–4%, all else equal.

Price discovery shifts toward off‑exchange venues and custodial inventories. If significant supply sits in custody, price formation increasingly reflects the willingness of long‑term holders and institutional allocators to buy or sell, rather than intra‑exchange market‑making. That can both smooth and skew discovery depending on holder concentration.

Potential for a structural floor — and higher tails. On one hand, persistent accumulation by long‑duration treasuries and ETFs can create a binding lower bound in some scenarios: if a large fraction of wallets are designated as cold, long‑term assets, forced sellers may face fewer natural buyers beneath certain price levels. On the other hand, thinner liquidity can amplify drawdowns during forced-liquidation events, increasing realized volatility in the short term.

Amplified reflexivity. As price rises on persistent institutional demand, mining revenue often increases, which can bring forward capital expenditures and marginal selling; conversely, during stress periods miners may sell more, which interacts with the reduced float to create sharper reversals.

This means the issuance shock is not a simple linear scarcity effect; it modifies how supply is distributed across liquidity tiers and how price responds to flows.

Implications for miners, exchanges, and long‑term holders

Miners

Revenue composition changes: higher BTC prices driven by scarcity may raise nominal miner revenue, but operational costs and capital cycles matter. Some miners may accelerate selling to fund growth; others may hedge less and thus increase selling pressure during drawdowns.

Strategic responses: miners can adjust hedge programs, optimize holding policies, or seek service contracts from custodians and institutional buyers. The presence of large treasury buyers may create new off‑take channels.

Exchanges

Inventory and market‑making economics change: with less exchange inventory, exchanges need to price liquidity risk into spreads and fees. Market makers may require deeper compensation for providing liquidity.

Custody flows and settlement: exchanges may see reduced inflows but higher custody demand; the line between exchangeable supply and custodial supply blurs.

Long‑term holders (and corporate treasuries)

Structural floor vs concentration risk: while accumulation creates a theoretical floor, high concentration among a small set of treasuries or ETFs produces single‑point risks (e.g., policy or accounting decisions that prompt selling).

Portfolio construction: long‑term holders should model an evolving liquidity premium for BTC and account for asymmetric crash dynamics due to thinner exchange float.

Modeling guidance for institutional researchers and strat teams

For strategists building long‑term supply‑demand models, the following adjustments are essential:

Model liquid float separately from on‑chain supply. Track exchange reserves, custodial wallets, and long‑duration treasuries to estimate available liquidity.

Include ETF AUM flows as a dynamic demand term with elasticity parameters. ETF inflows have both persistent and mean‑reverting components; treat them as partially persistent in scenarios.

Simulate miner selling as a function of price, cost curves, and hedging behavior rather than treating issuance as instant liquidity. Incorporate stochastic variance informed by examples such as solo miner block runs (CryptoSlate).

Stress test for liquidity black‑swans. Thin liquidity can produce outsized moves; build tail scenarios where forced liquidity events interact with concentrated custody holdings.

Use on‑chain accumulation signals and custodial reporting to update priors. Public coverage that companies added ~260k BTC in six months (Coinpaper, Coinspeaker, NewsBTC) should be treated as a regime shift indicator: when institutional absorption exceeds miner issuance, scarcity premium dynamics warrant upward revisions to equilibrium price estimates under many demand scenarios.

Practical note: platforms like Bitlet.app that offer custody-adjacent services and P2P liquidity should be monitored as part of the broader custody ecosystem because changes in retail and institutional routing also affect where BTC sits and how it can re‑enter markets.

Conclusion: a structural shock with nuanced outcomes

The recent wave of corporate treasury and institutional accumulation — roughly 260,000 BTC in six months, reportedly about three times miner issuance — represents a meaningful supply shock to the BTC market. It reduces the effective liquid float, reshapes price discovery, and changes volatility dynamics. That shock can create a structural floor under some scenarios, but it also increases the potential for amplified drawdowns because thinner liquidity magnifies large flows.

For institutional researchers and crypto strategists, the takeaway is clear: update models to separate mined issuance from available supply, treat ETF and treasury flows as persistent demand factors, and simulate liquidity events where concentrated custodial holdings interact with thin exchange inventories. Doing so will produce more realistic forecasts and scenario analyses for BTC’s long‑run supply‑demand imbalances.