Bitcoin Approaching $103K Resistance: Key Market Trends and Smart Investment Strategies for Mid-2025

As Bitcoin approaches the significant resistance level of $103,000 in mid-2025, investors are closely watching market trends to make informed decisions. This level is pivotal because breaking above it could signal a strong bullish trend, leading to new all-time highs. Conversely, failure to breach this resistance might indicate a period of consolidation or correction.

Key Market Trends to Watch:

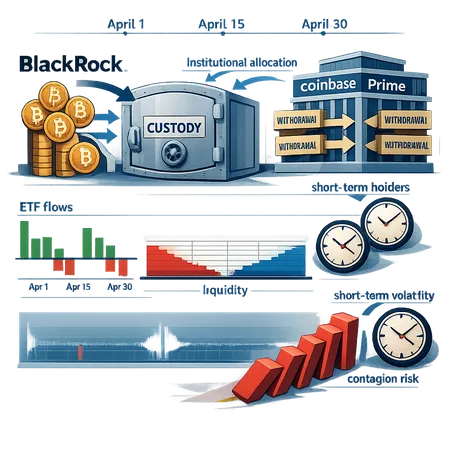

Increased Institutional Adoption: More institutional investors are entering the crypto space, which tends to stabilize prices and contribute to upward momentum.

Regulatory Developments: Ongoing regulatory news can impact market sentiment. Positive regulations can boost confidence, while negative ones may cause price dips.

Network Upgrades and Innovations: Technological improvements in Bitcoin and related infrastructure can enhance security and usability, increasing demand.

Investment Strategies for Mid-2025:

Dollar-Cost Averaging (DCA): Investing fixed amounts regularly can reduce the impact of volatility.

Setting Stop-Loss Orders: Protects your investments from major downturns.

Diversification: Combining Bitcoin investment with other assets to manage risk.

Bitlet.app stands out as a user-friendly platform supporting these strategies by providing a Crypto Installment service. This service allows investors to buy Bitcoin immediately and pay over time in monthly installments, lowering the barrier to entry and enabling more flexible financial planning.

Whether you're a seasoned investor or new to crypto, understanding these trends and utilizing platforms like Bitlet.app can optimize your strategy as Bitcoin tests the $103K resistance level.