What Mercado Bitcoin’s Six Trends for 2026 Mean for Brazil’s Role in BTC Adoption

Summary

Executive overview

Mercado Bitcoin’s six trends for 2026 present a coordinated picture: improved infrastructure, regulatory maturation, and new product flows will likely accelerate Brazil’s path from retail-led participation to a more institutionalized BTC market. Using their framework as a starting point, this article summarizes each trend, connects them to concrete market-structure changes (including B3’s decision to expand futures trading hours), and draws practical implications for institutional flows, BTC market-cap forecasts, and LATAM market strategy. For allocators and exchanges, these signals are actionable now, not hypothetical.

The six trends — quick summary

Below are concise descriptions of each trend Mercado Bitcoin highlights, each followed by a short line on why it matters for BTC adoption in Brazil. The original whitepaper framing can be found in Mercado Bitcoin’s published outlook and informed our read; see their trend list for full context.

1) Product diversification and derivatives growth

Mercado Bitcoin expects a surge in new tradable products and derivative structures that reduce friction for institutional entry. Broader OTC capacity, regulated futures, and custody services lower operational barriers and enable larger ticket sizes. Products that let investors access BTC exposure without full custody will be particularly important for pension funds and asset managers.

2) Infrastructure and custody improvements

Institutional-grade custody (cold, insured, regulated) and better on/off ramps are rising in Brazil. This trend closes a trust gap: with dependable infrastructure, institutions can meet internal risk controls and compliance frameworks, turning ‘interest’ into deployable capital.

3) Regulatory clarity and supervision

Mercado Bitcoin highlights a movement toward clearer rules for assets and intermediaries. Predictable regulation reduces model risk for fund managers and enables product launches inside formal financial structures, accelerating capital formation.

4) Use-case expansion beyond speculation

Expect growth in real-world and treasury use-cases—payments, corporate treasury holdings, and tokenized assets—that normalize BTC in corporate and institutional balance sheets. This reduces narrative risk tied to purely speculative cycles.

5) Regional liquidity consolidation and LATAM hub status

Mercado Bitcoin anticipates Brazil consolidating liquidity as exchanges scale regionally. A deeper domestic market attracts cross-border flows, creating a virtuous cycle of order-book depth and price discovery.

6) Retail sophistication and hybrid products

Retail participation will become more sophisticated via structured products, yield wrappers, and educational pathways—keeping Brazil’s active retail base engaged while enabling smoother transition to institutionalized market behaviors.

Why Brazil’s market structure and regulatory shifts make these trends actionable now

Two structural shifts turn Mercado Bitcoin’s scenarios from theory into probable outcomes: the ongoing regulatory adjustments and operational upgrades like B3’s expansion of futures trading hours. Brazil’s exchange infrastructure already resembles developed markets in several ways—large incumbent brokers, a strong clearinghouse culture, and a history of futures trading via B3. Extending futures hours (a recent move by B3 to expand crypto and gold futures' trading windows) reduces time-zone arbitrage, improves intraday liquidity, and aligns local product availability with global markets, which is a practical enabler for institutional desks operating across time zones. See the B3 update for details.

Regulatory clarity—both at the supervisory and tax-treatment levels—further reduces uncertainty for institutional compliance teams. Mercado Bitcoin’s forecast assumes regulators will continue to provide defined frameworks; the more predictable that environment becomes, the easier it is for custodians, exchanges, and asset managers to design compliant fund structures and hedging programs.

How extended futures trading hours matter for flows and pricing

Longer futures hours do more than elongate the trading day. They:

- Reduce overnight gaps between local trading and global macro events, lowering basis risk for hedgers.

- Encourage market-making firms to deploy continuous liquidity, improving spreads and enabling larger block trades.

- Make Brazil a more attractive hub for regional prime-broker operations, which in turn channels institutional flows onshore.

These operational gains translate to better price discovery for BTC locally, narrowing the gap between domestic and international market-cap signals. The Cryptopolitan analysis that touches on Brazil’s market-cap forecasts helps frame what deeper liquidity could mean for BTC valuations domestically.

Implications for BTC market-cap forecasts and local institutional flows

If Mercado Bitcoin’s trends materialize, there are two linked implications for BTC market-cap and inflows into Brazil:

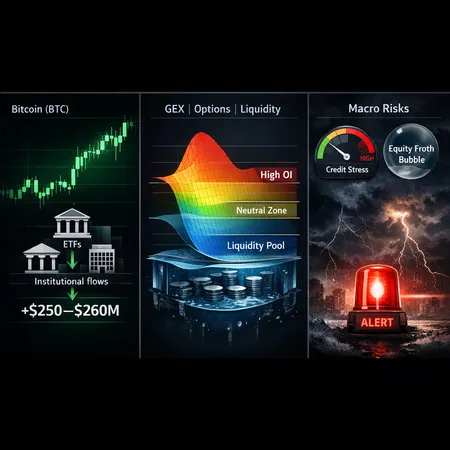

Upward pressure on domestic market-cap multiples: deeper liquidity and broader institutional participation typically raise onshore valuations due to reduced trading frictions and larger, more deterministic purchase programs. Brazil’s growing ETF- or futures-backed demand could support a higher local BTC market-cap relative to purely retail-driven regimes. (See Cryptopolitan’s coverage for a discussion of market-cap forecasts.)

Persistent, structural inflows: With better custody, extended hours, and clearer regulation, institutional investors—pension funds, insurers, and family offices—can convert stated interest into allocation. The first wave will likely be allocations to derivatives and structured product wrappers, followed by spot custody once operational and regulatory conditions are fully tested.

Together, these dynamics suggest a multi-year path where Brazil’s BTC market becomes less correlated with short-term retail sentiment and more reflective of strategic institutional demand curves.

Evolving retail vs institutional participation in Brazil

Brazil starts with a highly engaged retail base—active traders who drive volume during local hours. As markets institutionalize, expect the following evolution:

- Short-term: a hybrid market where retail remains volume-heavy but institutions set directional flows through large derivatives positions and custody mandates.

- Medium-term: institutional market makers and custodians narrow spreads and absorb larger orders, which reduces volatility and makes long-only strategies more viable for allocators.

- Long-term: retail benefits from improved products (ETFs, wrapped yield products) that offer transparent pricing and regulated custody, but true price discovery sits more with institutional liquidity providers.

This shift won’t erase retail influence, but it will change market microstructure—order books deepen, settlement risk falls, and volatility regimes moderate.

Practical takeaways for investors and LATAM exchanges

For market strategists, asset managers, and exchange operators planning LATAM expansion, prioritize the following actionable items:

- Product roadmap: prioritize derivative and custody capabilities first. Derivatives let institutions manage exposure without immediate spot custody overheads.

- Partnerships: build ties with local custodians and broker-dealers that understand B3’s clearing and settlement norms; operational fit can shortcut time-to-market.

- Compliance-first product design: design funds and wrappers that meet local tax and reporting rules—regulatory certainty is the oxygen of institutional flows.

- Liquidity commitments: exchanges should incentivize market-makers to operate extended hours. B3’s longer futures windows mean a 24/5 approach is increasingly feasible and expected.

- Retail education and tiered offerings: keep retail engaged with structured products that hedge downside while giving BTC upside, but keep a clear separation between speculative retail offerings and institutional-grade products to manage reputational and compliance risk.

Exchanges looking to scale regionally should view Brazil as a near-term hub: the combination of infrastructure, active retail, and a path to clearer regulation creates a favorable arbitrage to capture LATAM order flow. For allocators, small tactical allocations to spot or futures exposure—paired with robust custody due diligence—could capture early-stage institutional flows before spreads compress further.

Signals to watch in 2026

Track these measurable signals to validate Mercado Bitcoin’s thesis in real time:

- Net new institutional AUM reported by local custodians and exchanges.

- B3 liquidity metrics in BTC futures (open interest, average daily volume, bid-ask spreads).

- Regulatory rule-making milestones (tax guidance, custody licensing, fund structure approvals).

- Product launches: ETFs, regulated spot custody products, or derivatives listed on regulated venues.

- Cross-border flows into Brazil-based exchanges vs. offshore venues.

A confluence of positive moves across these metrics would materially increase the probability of the Mercado Bitcoin scenario.

Conclusion

Mercado Bitcoin’s six trends for 2026 are more than forecasting rhetoric—they are a practical checklist. When combined with operational changes like B3’s expanded futures trading hours and improving custody/regulatory clarity, Brazil is poised to deepen BTC adoption in a way that attracts meaningful institutional capital. For allocators, exchanges, and strategists positioning in LATAM, the key is to act on infrastructure, compliance, and liquidity commitments now while monitoring the concrete signals above. Bitlet.app users and other regional participants should watch these developments closely as they reshape allocation and go-to-market decisions.

Sources

- Mercado Bitcoin’s six trends for 2026: Mercado Bitcoin highlights six key crypto trends for 2026

- Market-cap and broader forecast coverage: Cryptopolitan coverage of Mercado Bitcoin’s market-cap forecast

- Operational change on futures trading hours: Brazil’s B3 to expand trading hours for crypto and gold futures

For many allocators, the initial practical move will be small, governed allocations into regulated derivative exposure while custodial and ETF-like structures continue to mature. For further reading on BTC market dynamics, see commentary on Bitcoin and how on-chain/DeFi primitives interact with institutional products like futures and custodial services in DeFi.