Canton Network and the Rise of Institutional Blockchain Settlement: Banks, ETFs, and Custody

Summary

Executive summary

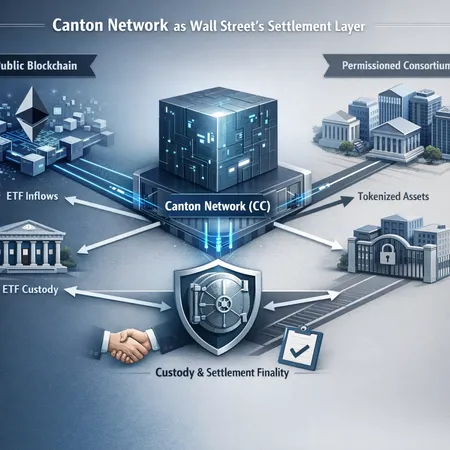

Institutional traders, custodians and asset managers now face a split-path choice: continue building tokenized asset workflows on public L1s like Ethereum (ETH), or adopt permissioned/consortium rails purpose-built for regulated settlement. Canton Network (ticker CC) is emerging as a prominent option in the latter camp, pitching itself as a Wall Street-friendly settlement layer that can sit between banks, custodians and public liquidity venues. That pitch is resonating because ETF and custody flows are bringing real-dollar liquidity — and with it, stricter demands for compliance, privacy and operational controls.

Why Wall Street is eyeing specialized settlement rails

Public blockchains offer composability and deep liquidity. But they also expose institutions to operational patterns and privacy models designed for permissionless participants. For banks and funds, the checklist is different: legally enforceable settlement finality, clear custody boundaries, controlled counterparty access and auditability.

Canton sells itself against that checklist. As covered in recent reporting, Canton has been positioned as an infrastructure choice for Wall Street because it layers enterprise controls atop interoperable ledger technology, helping institutions enforce policy while still using tokens for settlement (Blockonomi profile of Canton Network). The value proposition is straightforward: preserve the legal and operational expectations of traditional finance while enabling token-level settlement and asset portability.

For many strategists this raises a practical question: can a permissioned rail co-exist with public liquidity pools, or will it become an isolated silo? The short answer: both. Canton’s interoperability design is explicitly intended to bridge heterogeneous ledgers so institutions can settle privately yet route assets to public venues when needed.

What SEC approval or engagement implies for enterprise rails

When regulators like the SEC begin to engage or implicitly approve aspects of enterprise rails, the implications are twofold. First, it signals that permissioned architectures can plausibly meet investor-protection and market-integrity requirements — a prerequisite for bank adoption. Second, regulatory engagement tends to standardize expectations around custody, disclosure and governance, which reduces legal uncertainty for custodians integrating tokenized workflows.

That does not mean a blanket greenlight. Regulatory approval is often conditional and incremental: it focuses on personnel controls, custody segregation, reconciliation procedures and the ability to suspend or freeze activity under legal orders. For Canton and similar networks, demonstrating those controls in production — and proving interoperability without sacrificing compliance — is what turns regulatory interest into usable product adoption.

ETF and custody flows: liquidity forcing enterprise rails to evolve

The institutionalization of crypto markets is not theoretical. Large ETF and exchange custody flows are pumping liquidity into token markets and forcing enterprise rails to integrate with custody providers and exchanges. A recent example is the surge of ETF-related ETH inflows to custodial and exchange venues, showing how ETFs and related custody mechanics drive concentrated liquidity that settlement rails must accommodate (Coinpaper on Ethereum ETF inflows).

Meanwhile, protocol-level institutional moves — such as revenue-sharing initiatives and enterprise-focused roadmaps from projects like Aave Labs — further underline demand for settlement rails that can interface with regulated entities (Blockonomi on Aave Labs' institutional plans). Those initiatives implicitly require custody, compliance and predictable settlement behavior.

In short: when large ETFs push ETH into custody at centralized venues, and protocols plan features targeting institutional asset bases, the plumbing must support secure custody + legally-recognized settlement. That’s exactly the problem Canton and similar models aim to solve.

Canton’s value proposition for banks and funds

Canton’s positioning rests on several technical and commercial pillars:

- Privacy-preserving settlement: permissioned access and selective data-sharing let institutions reconcile trades without exposing full economic details to public view.

- Deterministic settlement finality: enterprise workflows require predictable finality windows and strong auditing trails, reducing intraday settlement risk.

- Policy-enforced interoperability: Canton emphasizes contractual interoperability — enabling different ledgers to transfer value while preserving counterparty rules.

- Custody and operational controls: the network model accommodates existing custody relationships and custody segregation expectations.

- Governance and legal wrappers: consortium governance aligns with institutional needs for liability, dispute resolution and regulatory responsiveness.

These features combine into a narrative that matters to asset managers and custodians: you can tokenize assets and settle them on-chain while maintaining the control and compliance attributes institutions require. For portfolio managers watching liquidity on Bitcoin and ETH, that’s an attractive compromise: use permissioned rails for settlement and public markets for price discovery and liquidity.

Operational and regulatory hurdles that remain

No rail is a turnkey cure. Adopting a permissioned settlement layer introduces its own operational and legal trade-offs:

- Interoperability risk: bridging assets between permissioned and public rails introduces complexity and potential attack vectors. Robust bridge design and custody models are essential.

- Custody separation vs. portability: institutions demand custody segregation, but token portability requires trusted handoffs between custodians and settlement systems.

- Regulatory fragmentation: different jurisdictions will demand varying degrees of disclosure and control; global institutions must design for multi-jurisdiction compliance.

- Liquidity friction: while permissioned rails can connect to public markets, routing and settlement timing can add friction versus native public L1 trades.

- Governance and upgrade risk: consortium governance can slow upgrades or create concentration risk if not well-distributed.

These hurdles are pragmatic — not fatal. But they require institutions to invest in legal opinions, sound custody integrations and rigorous operational playbooks before moving material asset bases onto a new rail.

Public L1s vs permissioned/consortium rails: a decision framework for architects

When institutional architects evaluate options, consider three vectors:

- Regulatory clarity and legal enforceability. If you need clear legal recognition of settlement events and native custody segregation, permissioned rails often win.

- Access to liquidity and composability. If your workflow depends on DeFi primitives, AMMs or broad liquidity pools, public L1s like Ethereum (ETH) are essential.

- Privacy, controls and operational SLAs. If bank-grade privacy and operational SLAs are required, consortium models offer easier contractual enforcement.

Practical guidance:

- Use permissioned rails (e.g., Canton) for primary settlement and custody-sensitive workflows, then bridge selectively to public L1s to access liquidity and DeFi rails.

- If your strategy depends on active AMM trading, on-chain lending or open composability, anchor core positions on public L1s but overlay custody controls via qualified custodians and transaction-monitoring tools.

- Adopt hybrid architectures where settlement and legal recourse live on a permissioned ledger while market-facing liquidity lives on public networks.

This hybrid approach preserves the best of both worlds: legal clarity and custodial controls for institutional bookkeeping, plus access to the broader crypto market for price discovery and execution.

Implementation checklist for adoption

Before you commit to a permissioned rail, validate these items:

- Legal opinions confirming the enforceability of on-ledger settlement in your jurisdiction.

- Integration tests with primary custodians and exchanges to confirm custody handoffs and settlement timings.

- Bridge and interoperability risk assessments, including threat models and insurance considerations.

- Operational playbooks for incident response, forced freezes and regulatory requests.

- Performance testing for settlement finality under peak load and network partition scenarios.

Bitlet.app and other market platforms are beginning to reflect these new plumbing realities in product design; when building product flows, ensure your custodial and settlement choices are aligned end-to-end.

Conclusion: pragmatic interoperability, not ideological purity

The institutionalization of crypto markets will not be won by a single technical model. Instead, adoption will favor pragmatic architectures that combine legal clarity, custody integration and access to liquidity. Canton Network’s pitch — a permissioned, interoperable settlement layer designed for institutional constraints — responds directly to that demand, and regulatory engagement strengthens its credibility. At the same time, public L1s like ETH will remain indispensable for liquidity and composability.

For institutional architects and crypto strategists, the choice is rarely binary. Evaluate which parts of your workflow require bank-grade controls and settle those on permissioned rails, while keeping a clear, secure channel to public markets for liquidity. With measured integration, custody providers and enterprise-friendly protocols can reshape settlement in a way that satisfies both regulators and markets.

Sources

- Canton Network profile and Wall Street positioning: https://blockonomi.com/canton-network-emerges-as-wall-streets-blockchain-infrastructure-of-choice/

- ETF inflows and ETH custody dynamics: https://coinpaper.com/13511/ethereum-floods-binance-as-et-fs-pile-in-is-3-250-the-line-that-changes-everything?utm_source=snapi

- Aave Labs institutional plans and implications: https://blockonomi.com/aave-labs-announces-revenue-sharing-plans-as-protocol-targets-500-trillion-asset-base/