Canton Network

Canton Network Milestone: Tokenized Deposits and On‑Chain Collateral Mobility for Institutions

The Canton Network’s recent completion of cross‑institution transactions with new members including Euroclear, Euronext, LSEG and TreasurySpring marks a practical step toward tokenized deposits and frictionless on‑chain collateral mobility. For institutional market infrastructures this is a meaningful signal that tokenized bonds, repo and cross‑border liquidity workflows can move from pilots to production-ready plumbing.

Published at 2026-01-15 16:26:42

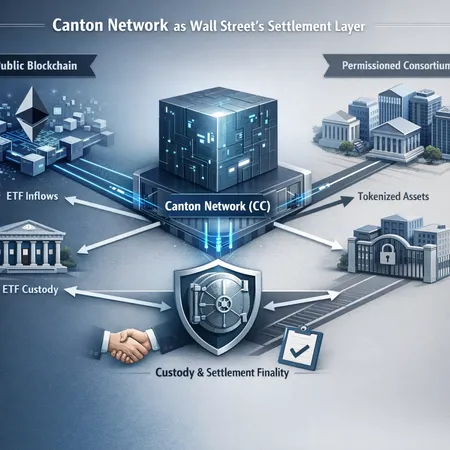

Canton Network and the Rise of Institutional Blockchain Settlement: Banks, ETFs, and Custody

As tokenized assets and ETF flows surge, institutions are choosing settlement rails that balance compliance, privacy and liquidity. Canton Network is positioning itself as a permissioned settlement layer that aims to bridge bank-grade controls with crypto-native settlement needs.

Published at 2026-01-03 15:47:52