Ethereum 2026 Tactical Outlook: Glamsterdam, Hegota, Options Expiry & Risk Playbook

Summary

Executive snapshot

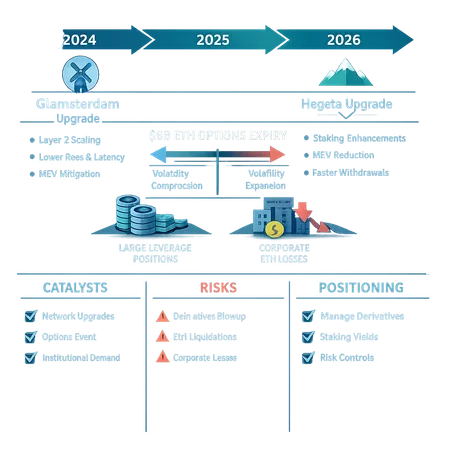

Heading into 2026, ETH's narrative will be driven by a mix of protocol improvements—most notably Glamsterdam and Hegota—and concentrated market events such as a large ETH options expiry and visible leveraged corporate bets. This note gives active traders and mid-term investors a tactical roadmap: what the upgrades actually change, how derivatives risks can compress or expand volatility, lessons from big leveraged losses, and an actionable checklist to manage positions.

For many traders, Ethereum remains the primary market bellwether for DeFi and layer-1 sentiment, and its technical upgrades will interact with macro and derivatives flows in ways that matter for both direction and liquidity.

Upgrade timelines and expected technical benefits

What Glamsterdam and Hegota aim to deliver

Glamsterdam and Hegota are the two marquee upgrades planned as part of Ethereum's 2026 roadmap. In plain terms: Glamsterdam targets gas accounting and transaction efficiency—reducing microcosts for common DeFi and NFT interactions—while Hegota focuses on execution layer optimizations that can tighten block processing and improve MEV (miner/validator-extractable value) handling. The overall objective is the same: cheaper, faster, and more predictable user flows that improve UX and widen on‑chain product design options.

The public roadmap and summaries show these upgrades will be delivered through staged client releases and coordinated network activation windows across 2026 (see the overview in this Crypto‑Economy roundup). Expect the market to price in upgrade certainty ahead of activation and then reprice again post-activation as real-world throughput and fee data arrive.

Real technical benefits that matter to traders and holders

- Lower friction for DeFi: Marginal gas reductions can materially improve arbitrage and MEV economics. That means faster rebalancing and potentially tighter spreads for liquid pairs.

- Staking & validator economics: Execution optimizations can increase block efficiency and slightly alter rewards/fees that ripple into staking yield assumptions—relevant for those sizing long-term staking allocations.

- Product innovation: With reduced gas overhead, more complex on-chain strategies, batching, and programmable money flows become practical, attracting protocol revenue that could support long-term ETH demand.

These are not immediate price catalysts by themselves; they change fundamentals and the incentive structure around gas, MEV, and staking over months.

Key near-term market risks

The $6B ETH options expiry: how it can move price

Large concentrated options expiries compress risk in two ways: gamma squeezes and forced hedging flows. CoinTribune highlighted a potentially market-moving ~$6B ETH options expiry that can act as a volatility exogenous shock around settlement windows (CoinTribune analysis).

Mechanically, when options are large and clustered by strike:

- Dealers who sold large option blocks will hedge dynamically—buying or selling ETH as delta changes—creating endogenous directional flows. If gamma is positive for the market-makers, hedging reduces volatility; if dealers are short gamma, hedging exacerbates moves.

- Expiry clustering near an on-chain catalyst (e.g., an upgrade milestone or release of a client patch) magnifies liquidity stress: order books thin and slippage increases.

For traders, this means the expiry could either compress realized volatility (if positions unwind cleanly) or expand it dramatically (if forced liquidations or hedge runs collide with low liquidity). The outcome hinges on concentration of strikes, calendar roll behavior, and the balance of gamma across counterparties.

Lessons from large leveraged positions and corporate losses

Corporate leveraged bets matter because they change the distribution of potential forced sellers or buyers. The Bitmines example—where a multi‑billion dollar ETH position suffered heavy losses—illustrates how a single large levered player can create outsized market spillovers when markets move against them (Ambcrypto analysis).

Key takeaways:

- Concentration risk matters: Large balance-sheet players can transmit stress across venues via repo financing, margin calls, and OTC unwind.

- Liquidity cliff risk: In sharp moves, liquidity providers pull back; large positions then need to be executed into thinner markets, causing feedback loops.

- Information leakage: Publicized losses influence sentiment and counterparties, sometimes triggering pre-emptive deleveraging.

Combined with the options expiry, leveraged positions can create a perfect storm: expiry-driven flows push price into levels where a levered player is forced to exit, which further accelerates the move.

Tactical scenarios and how to act

Below are realistic scenarios and recommended trader/investor responses.

Scenario A — Smooth upgrade rollout, orderly expiry

Probability: moderate. If Glamsterdam/Hegota rollout tests pass and the $6B expiry unwinds without concentrated gamma shocks, we should see modest positive re-rating as protocol improvements are priced in.

Tactics:

- Long-mid-term holders: stagger staking commitments over weeks to avoid being fully illiquid at an expiry date.

- Traders: favor directional exposure through delta-positive positions and small, time-limited option buys (calendar spreads) to capture potential post-upgrade upside with capped risk.

Scenario B — Expiry-driven volatility with liquidity squeeze

Probability: material. If option hedging collides with weak books or a levered player’s stress, expect rapid intraday swings.

Tactics:

- Reduce concentrated spot exposure and widen stop-loss bands to avoid being stopped out by headline-driven whipsaws.

- Use liquid, exchange-listed options for hedging rather than deep-OTC when possible; prefer buying protective puts or put spreads to limit downside with known cost.

- Keep position sizes manageable: limit any single trade to a small percentage of deployable capital.

Scenario C — Upgrade delays + forced deleveraging

Probability: non-trivial. Bugs, client disagreements, or delayed activation combined with deleveraging can push sentiment negative.

Tactics:

- Avoid aggressive leverage. If you run leverage, use conservative maintenance margins and stagger exit plans.

- Consider dynamic hedges: short-term ATM put purchases that roll if the delay lengthens.

- For liquidity providers/market makers, pre-position risk limits and increase quoting spreads around upgrade windows.

Practical trade and risk-management checklist for 2026

- Monitor dates: keep a visible calendar for Glamsterdam/Hegota client release candidates and the major options expiries; mark expiries where open interest clusters. See the roadmap summary here: Crypto‑Economy roundup.

- Size for adverse moves: cap any single ETH trade to a percent of portfolio sized for a fast 15–30% adverse move in the short term.

- Use hedges with defined risk: prefer bought puts or verticals over naked short positions if you lack the margin to absorb squeezes.

- Staking staging: don’t shift 100% into long lockups right before known expiry windows—stagger stake unlocks and maintain some liquid ETH for opportunities or hedges.

- Watch on‑chain indicators: exchange inflows, large transfers, and concentration in derivative venues can warn of looming liquidity stress.

- Options-specific: if you sell premium, be explicit about gamma exposure and have stop-losses or size limits tied to implied move thresholds.

- Counterparty awareness: if dealing OTC or with institutional desks, ask about hedge posture and who is taking the other side—large corporate levered positions increase tail risk.

Execution tactics for active traders

- If you expect a volatility spike around expiry: buy short-dated straddles or strangles sized to known risk budgets; keep expiries short to reduce theta decay risk.

- If you want upside with protection: buy call spreads and fund via selling deeper OTM puts, but only if you can tolerate assignment and have capital to cover it.

- Liquidity management: use limit orders and slice large fills; during high-stress windows, expect wider spreads and route across venues.

- Use exchange-native risk tools: portfolio margin, conditional orders, and pre-approved block trades can help execute without slippage.

Behavioral and operational safeguards

- Avoid narrative bias: upgrades feel bullish, but upgrades are often priced in months ahead—don't let optimism override risk rules.

- Keep checklists: before activating a large trade, run through expiry dates, staking/lockup timelines, counterparty concentration, and funding costs.

- Prepare for fast unwind: have a pre-defined de-risk plan (e.g., reduce exposure by X% when funding rates exceed Y or when exchange inflows spike Z%).

Conclusion — balancing tech progress with derivatives reality

Glamsterdam and Hegota materially improve Ethereum's long-term product and staking economics, but they are not instantaneous price guarantees. In the near term, the $6B options expiry and concentrated leveraged positions create asymmetric risks: upgrades change the long-run reward profile; derivatives and leverage shape short-run realized volatility and liquidity.

Active traders should treat 2026 as a periodized market: rotate between tactical hedges around expiries and longer-tail positioning that benefits from improved on‑chain economics. Mid-term investors benefit from staged staking and conservative overlays rather than aggressive, illiquid commitments right before known risk windows.

Remember: liquidity, counterparty concentration, and gamma are the variables that convert a technical upgrade from a benign fundamental into a volatile market event. Keep risk defined, use durable hedges, and maintain optionality—Bitlet.app users and others should build trades that survive both orderly and disorderly outcomes.

Sources

- Crypto‑Economy: What will happen to Ethereum next year — key points on 2026 roadmap and upgrades: https://crypto-economy.com/what-will-happen-to-ethereum-next-year-here-are-the-key-points/

- CoinTribune: Ethereum options expiration and potential market impact: https://www.cointribune.com/en/ethereum-options-expiration-a-potential-shock-for-traders/?utm_source=snapi

- AMBCrypto: Bitmines' large ETH bet and the implications of leveraged corporate positions: https://ambcrypto.com/bitmines-15b-ethereum-bet-suffers-a-3-5b-loss-is-a-relief-likely/