Why Vitalik Says Ethereum Is ‘Not Fully Trustless’ — The Case for Simplification Now

Summary

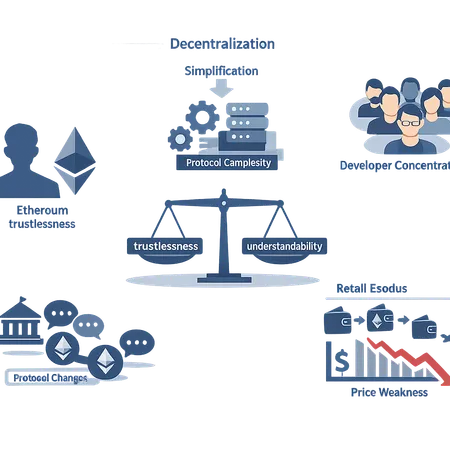

A short framing: trustlessness is partly about understandability

Vitalik Buterin’s recent, blunt observation that Ethereum is still not fully trustless reframes an old conversation. It’s not enough that consensus rules are theoretically secure; users and independent verifiers must be able to understand and reproduce those rules without trusting opaque layers of tooling, services, or a concentrated group of developers. As Vitalik put it, greater understandability is a route to greater trustlessness — a point he reiterated when urging simplification of the protocol and ecosystem (Coinpedia and Cryptopolitan).

Why this matters now: the network is showing signs of retail fatigue. Recent reporting documented a slump in Ethereum network activity and a retail exodus that coincided with price weakness, a signal that user confidence is eroding even as the technical roadmap grows more complex (CryptoPotato). For ETH-focused portfolio managers, on-chain governance watchers, and protocol devs, understandability — not ideology — is the practical lever that can restore user trust.

What Vitalik means by “not fully trustless”

- Trustless in the classical sense means you don’t need to trust any single actor to verify the state of the ledger. But that assumes users can, in practice, run independent verifiers or light clients and reason about the system.

- Vitalik’s critique is pragmatic: complexity in execution environments, client implementations, and governance processes creates de facto trust dependencies — we rely on large teams, centralized services, and auditors.

- Simplification lowers the cognitive and technical barriers for independent verification, shrinking the space where trust must be placed.

This point is more political than purely cryptographic. It ties the technical design of software to the social reality of who writes, audits, and runs it.

Market signals that add urgency

Short-term market data backs up the rhetoric. Ethereum has experienced measurable retail address declines and renewed price softness, which together create a feedback loop: fewer small users lead to less economic diversity and fewer independent nodes, which magnifies centralization risks and weakens narratives that attract new users (CryptoPotato).

Price weakness has multiple causes — macro, regulatory, and competition from alternative L1s/L2s — but when retail exits because the system feels opaque or risky, that’s a solvable problem through improved user-facing simplicity and stronger guarantees about who controls critical infrastructure.

Where simplification is already part of the roadmap

Several parallel movements and proposals implicitly aim at simplification or at least a reduction in trust assumptions:

- Rollup-centric roadmaps: shifting most execution to L2 rollups can simplify the base layer’s role to finality and data availability, reducing surface area that full-node operators must reason about.

- Data-availability solutions and proto-danksharding (EIP variants) intend to make rollups cheaper and more verifiable, which helps independent verifiers validate L2 state via the L1.

- Efforts toward better light clients and statelessness (research and client work) aim to lower hardware and bandwidth requirements for running validation-capable software.

None of these are silver bullets. Rollups introduce their own UX and trust tradeoffs; proto-danksharding is complex to design and deploy; stateless client work involves deep protocol changes. But they point in a consistent direction: move complexity into modular, well-audited layers and make the base layer easier to understand and run.

Simplification vs decentralization: tradeoffs and synergies

Simplification can both help and hurt decentralization depending on how it’s pursued.

- Positive synergy: lowering resource requirements for clients (better light clients, smaller state) reduces the cost of independent verification and encourages more nodes — that’s decentralization-enhancing.

- Negative risk: if simplification means outsourcing execution to a handful of dominant rollups or trusting a small set of sequencers, you concentrate power off-chain. Without careful design, the burden shifts rather than disappears.

Developer concentration is a critical axis here. When protocol complexity is high, only a small group of experts can contribute safely. That creates gatekeepers and social centralization. Simplification must therefore be paired with governance and funding mechanisms that broaden participation: more funded client teams, clearer specs, and modular codebases that make safe contribution paths for newcomers.

Concrete protocol and governance changes that increase trustlessness

Below are realistic, near-term and mid-term levers that improve practical trustlessness — the kind Vitalik is emphasizing:

- Invest in light-client infrastructure and formalize incentives for running them. A widely-used, well-documented light client makes independent verification accessible to mobile and browser users.

- Prioritize modularity: separate consensus, execution, and data availability concerns. Clear module boundaries reduce blast radius for bugs and make formal review manageable.

- Fund and legally support multiple independent client teams. Client diversity reduces monoculture risk and is a direct response to developer concentration.

- Strengthen the specification and test-suite culture. A single canonical, machine-checkable spec and exhaustive interop tests lower the risk that clients diverge in subtle, trust-weakening ways.

- Enhance governance transparency and broaden funding mechanisms (grants, coordinated treasury use) so that more constituencies can maintain critical infrastructure without vendor lock-in.

- Design rollups and sequencer models with on-chain dispute or fallback mechanisms that reduce counterparty trust needs for users.

These are both technical and social fixes: the protocol alone can’t solve developer concentration without changes to incentives and funding.

What validators, devs, and large holders should do now

Practical, actionable steps for ETH stakeholders that line up with the simplification agenda:

Validators

- Run more than one client implementation when possible, or join pools that intentionally rotate clients to strengthen diversity.

- Prioritize simple, well-understood staking setups and keep backup procedures (keys, slashing safety) documented and rehearsed.

- Support light-client advocacy — validators can sponsor testing and monitoring tools for light clients.

Developers

- Favor modular design and clear, minimal interfaces when building protocol features. Complexity may seem productive in the short run but compounds trust issues.

- Contribute to specs, tests, and documentation: the high-leverage work is making systems auditable for non-experts.

- Advocate for and participate in client diversity initiatives; fund junior contributors to build long-term capacity.

Large holders and portfolio managers

- Avoid single-point custody: diversify staking providers and prefer non-custodial, transparently-operated validators where feasible.

- Use treasury allocations or community grants to underwrite client teams, audit programs, and light-client engineering. This aligns economic incentives with the public good of trustlessness.

- Factor network-level trust metrics (client diversity, number of full nodes, light-client usability) into risk models — not just price and TVL.

These are practical mitigations that help Ethereum’s decentralization profile even while the protocol evolves.

Risks and open questions

Simplification is not risk-free. Moving complexity off-chain can create new, less-visible trust dependencies. Aggressive push for simplification without broad input risks breaking composability or marginalizing smaller ecosystem players. Governance reforms that centralize budget decisions under a single authority would be antithetical to the goals Vitalik describes.

A deeper question remains: how do you measure understandability? Code coverage, user-run verifiers, and audit counts are proxies, but designing concrete metrics for trustlessness — and tying funding to them — could be a useful next step.

Conclusion: simplify, but decentralize intentionally

Vitalik’s provocation that Ethereum is still not fully trustless is an invitation to align technical design with social reality. Simplification — in the form of better light clients, clearer specs, modular architectures, and broad funding for client diversity — can materially increase practical trustlessness. But it must be pursued with explicit anti-concentration measures so that simplification does not become a cover for new central points of control.

For practitioners and stewards of the chain: prioritize transparency, fund diversity, and measure understandability as a first-class metric. For portfolio managers: incorporate these network-health signals into allocation decisions. For builders: when in doubt, prefer the path that makes the system easier for more people to verify.

Small moves — funding a client team, improving a test-suite, reducing on-chain state bloat — add up. The difference between a theoretically trustless protocol and a practically trustless one is whether enough people can independently confirm it. That should be the north star.

On a practical note, services like Bitlet.app and other observability tools that track node counts and staking decentralization can help stakeholders monitor progress toward these goals.

Sources

- Vitalik Buterin: Ethereum is still not fully trustless — https://coinpedia.org/news/vitalik-buterin-says-ethereum-is-still-not-fully-trustless/

- Buterin urges simplification as route to greater trustlessness — https://www.cryptopolitan.com/buterin-urges-ethereum-simplification/

- Ethereum network slump and retail exodus analysis — https://cryptopotato.com/ethereum-network-slumps-to-12-month-low-what-the-retail-exodus-means/

For developers building on Ethereum and teams working in DeFi, these questions are not abstract—how the community answers them will shape the protocol’s credibility and economic future.