XRP ETFs Surpass $1B: What Rapid Inflows Mean for Liquidity, Price Discovery and Volatility

Summary

Introduction

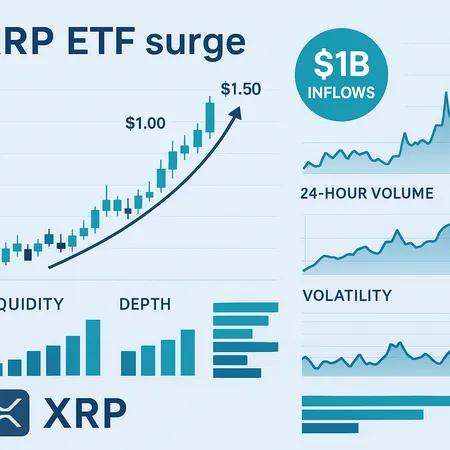

The rapid adoption of XRP exchange‑traded funds—surpassing $1 billion in inflows in under a month—is more than a headline. It signals a structural change in how large pools of capital can access XRP, with consequences for liquidity, price discovery and short‑term volatility. This piece walks through the ETF mechanics that amplify spot liquidity, parses immediate market signals, outlines a plausible bull case for multi‑dollar targets, and draws trading and allocation implications for both speculators and institutional investors.

How ETF inflows can amplify spot liquidity

ETFs are not passive blips. When investors buy ETF shares, authorized participants (APs) typically create those shares by delivering the underlying asset (or cash) to the ETF issuer; conversely, redemptions remove supply. That creation/redemption mechanism ties ETF demand directly into the spot market.

Creation pressure: Large inflows require APs to source XRP on exchanges or OTC desks, increasing spot demand and tightening bid‑ask spreads. The recent milestone—XRP ETFs surpassing $1 billion quickly—demonstrates how fast that demand can accumulate and how much liquidity is conscripted from the open market (U.Today report).

Market‑maker activity: ETF providers and APs hedge by hedging ETF exposure with spot or derivative positions, which often improves order book depth. That can lower short‑term execution costs, but it also concentrates counterparty exposure with a handful of liquidity providers.

Feedback loop: As ETF AUM grows, secondary liquidity on exchanges can improve, which in turn makes the ETF more attractive to allocators who prefer tradable, regulated wrappers over spot custody. We’ve seen similar dynamics in legacy markets and in crypto with other ETF‑style products; compare how flows into Bitcoin institutional products historically altered futures funding and spot spreads.

In short, ETFs can act as a conduit for institutional capital into the spot market, turning paper demand into real buy pressure and changing the microstructure of XRP liquidity.

Short‑term market signals: volume, flows and technical warnings

The immediate market evidence is mixed but instructive.

On the bullish side, XRP has shown short‑term volume strength: it was the only top‑10 token posting positive 24‑hour volume gains in a recent snapshot, a sign that spot activity and exchange turnover have picked up (CryptoUpdates report). Higher on‑chain and exchange volumes often accompany ETF creation flows because APs and OTC desks must transact sizable blocks.

Similarly, ETFs have shown days when net inflows into XRP vehicles outpaced even Bitcoin on a flow basis, pointing to rotation and fresh allocation into XRP‑centric products (U.Today flows piece). That rotation matters: when ETF flows are directional and persistent, they can override short‑term technical patterns.

But technical and structural warnings persist. Rapid inflows can produce fast rallies that trigger stretched momentum indicators—overbought RSI, compressed VWAP bands and rising open interest in derivatives. These conditions tend to amplify volatility: when reallocations slow or reversals occur, stops cascade and funding pressures rise. Market makers and APs may widen spreads or pull liquidity during stressed moments, creating slippage for aggressive traders.

The takeaway: short‑term on‑exchange volumes and ETF flow snapshots show real demand, but they don’t eliminate execution risk. Monitor order book depth, funding rates and ETF creation/redemption cadence as high‑signal metrics.

The bull case: can XRP reach multi‑dollar price targets?

A disciplined bull case for XRP reaching multi‑dollar levels (theoretical $5+ targets circulated in some analysis) rests on a handful of assumptions rather than wishful thinking.

Key bullish mechanics:

Sustained ETF demand: If ETFs continue to aggregate flows and AUM grows into the tens of billions over several quarters, APs will need to continuously source spot XRP, draining available sell‑side liquidity and pushing prices higher.

Constrained circulating sell pressure: Unlike Bitcoin, XRP’s distribution involves large historical holdings and concentrated supply. If long‑term holders and custodians don’t unlock significant sell pressure, price impact from incremental ETF buying rises.

Positive macro and crypto conditions: Lower rates, improved institutional risk tolerance, and rotation from large cap tokens into XRP all support higher multiples.

Quantitatively, hitting a $5 price target requires order‑book and flow math: multiply current circulating float available for immediate execution by the cumulative net buying from ETF creations and secondary demand. Analysts who model a $5 scenario typically assume sustained, multi‑quarter inflows plus a compression of available liquidity. More narrative detail and assumptions behind a $5 projection are discussed in longer‑form pieces evaluating supply, demand and adoption paths (Fool analysis on XRP price targets).

It’s worth stressing: the route to multi‑dollar XRP is plausible, but not inevitable. It requires persistent structural changes in demand and a favorable macro backdrop.

Key risks that could derail the path

Every upside narrative has vectors for sharp downside. For XRP ETFs, the main risks are:

- Regulatory setbacks: Any unexpected regulatory action or a change in ETF rules could trigger outflows and force APs to unwind hedges quickly.

- Liquidity reversal: ETF inflows can be bidirectional—if sentiment shifts, redemptions can create significant selling pressure as APs unwind positions, quickly reversing price discovery.

- Concentration of liquidity providers: Heavy dependence on a few APs or market makers increases systemic risk if one withdraws or alters hedging behavior.

- Derivatives spillovers: High leverage in futures or options could magnify drawdowns via liquidations and gamma squeezes.

- Narrative risk and correlation: A broad crypto market collapse or a shift into other narratives (e.g., memecoins, new layer‑1s) could reallocate flows away from XRP.

These risks argue for contingency planning: position sizes, stop frameworks and diversified execution channels (OTC, multiple exchanges, staged ETF exposure).

Trading and portfolio implications for speculators and institutions

ETF inflows change the calculus for both short‑term traders and long‑term allocators.

For speculators:

- Use order book analytics: With ETF trading, spreads can tighten during normal conditions but widen during stress. Favor limit orders for entries and exits; avoid large market buys if order depth is thin.

- Arbitrage and pair trades: Monitor NAV vs. secondary market ETF pricing for arbitrage. Consider long‑spot / short‑ETF or the reverse if dislocations appear; note execution and borrowing costs.

- Volatility plays: Options strategies (long straddles or call spreads) can capture upside while capping downside exposure if you expect ETF flows to continue but want protection.

For institutional allocators and multi‑asset desks:

- Gradual tilting: Move exposure incrementally as ETF AUM and creation activity proves persistent. A staged rebalancing helps avoid buying at a temporary euphoric top.

- Custody and counterparty due diligence: ETFs reduce custody overhead, but direct spot allocations require secure custody solutions and vetted OTC desks. Platforms like Bitlet.app can be part of the custody/trading toolbox for retail and smaller institutional investors.

- Portfolio sizing: Treat ETF exposure like any other liquid allocation—set explicit stop or rebalancing triggers tied to inflow/outflow metrics and correlation shifts with BTC/ETH.

Across both camps, the smart edge is monitoring flow data. Net ETF flows, AUM trajectories and creation/redemption reports are high‑signal for future price paths.

Practical setups and watchlist items

If you’re evaluating a move into XRP exposure because of ETF momentum, keep this checklist:

- Flow and AUM metrics: Weekly and daily net flows into XRP ETFs, plus total AUM. Rapid AUM growth suggests continuing demand; plateaus or outflows are red flags.

- On‑exchange volume and order book depth: Look for sustained volume gains (the short‑term volume uptick noted earlier) and increasing depth across major venues.

- ETF premium/discount to NAV: Persistent premiums can indicate demand that’s outstripping creation, a bullish sign; persistent discounts can indicate redemption pressure.

- Derivatives landscape: Funding rates, implied vols and open interest will show where leverage and risk are concentrated.

- Regulatory watch: Any policy changes or clarifications affecting ETF operations or XRP’s legal status.

Also watch narrative drift—if capital starts moving from large cap rotation into other sectors like NFTs and layer‑2s or into DeFi primitives, ETF flows may ebb.

Conclusion: positioning for asymmetric outcomes

The $1 billion milestone for XRP ETFs in under a month is meaningful—it demonstrates product‑market fit and the ability of ETF wrappers to mobilize capital into a token quickly. That capital changes price discovery and liquidity dynamics, often for the better, but it also brings new volatility regimes and concentration risks.

For speculators, the environment offers tradeable patterns in volume, spread compression and ETF/spot dislocations. For allocators, ETFs provide a regulated and accessible channel to gain XRP exposure, but allocations should scale with proven, persistent flows and robust risk controls. Whether that interest justifies larger portfolio tilts depends on how confident you are in sustained ETF demand, regulatory clarity, and the resilience of on‑exchange liquidity.

If you’re actively watching flows, tie sizing decisions to measurable signals—AUM growth, net creation days, and order‑book depth—rather than narrative alone.

Sources

- https://u.today/xrp-etfs-hit-1-billion-milestone-what-comes-next?utm_source=snapi

- https://u.today/xrp-beats-bitcoin-in-net-etf-flows?utm_source=snapi

- https://www.thecryptoupdates.com/xrp-only-top-10-token-posting-volume-gains/

- https://www.fool.com/investing/2025/12/06/can-xrp-ripple-reach-5-in-2026/