Pi Network's November 2025 Product Update: What Pioneers Must Know

Summary

Executive overview

Pi Network's November 2025 product update is one of the clearest signals yet that the project is moving from a long onboarding and test phase toward mainnet and economic rollout. The update tightens onboarding and KYC, formalizes validator/staking roles inside the flagship product, and adjusts token distribution mechanics that will determine how much PI is claimable by Pioneers versus protocol reserves.

The primary technical and user-facing details were summarized in the official coverage of the rollout; see the main report for a run‑through of the changes here. Later sections below unpack what those announcements mean in plain language and what to do next.

What changed — the essentials

Onboarding and KYC: stricter, faster, and more auditable

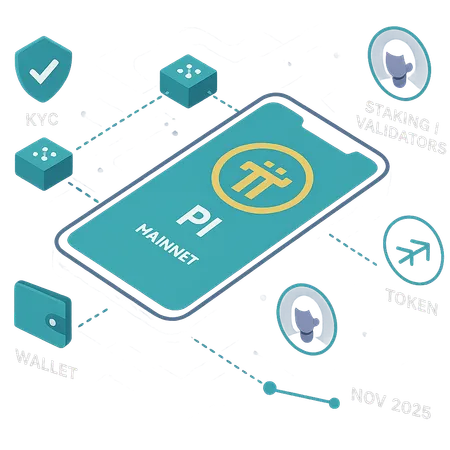

The update introduces a new KYC pipeline and identity attestations embedded in the app flow. Instead of an open, long-duration beginnig where Pioneers could mine by invitation and simple tasks, the product now requires progressive identity checks for broader utility and token unlocks. Expect sequential gates: basic profile, phone verification, document KYC, and finally a proof-of-personhood or liveness check tied to validator attestations.

From a user-experience angle, the app now shows explicit progress bars and unlock thresholds. That reduces ambiguity for Pioneers but increases immediate friction: some users will need to prepare ID documents and devices able to perform live checks.

Validator and staking model: clearer roles and higher bar for nodes

Technically, the update separates lightweight mobile participation (earning small, claimable amounts and referrals) from network validation duties. Validator nodes now require more explicit onboarding: a key-pair export/import flow, a recommended node client, and clearer SLAs for uptime and block proposal/validation. The product includes a new UI for bonding PI (staking) to validator identities, along with slashing warnings for misbehavior or prolonged downtime.

The intent is to make the path from mobile Pioneer to full validator more explicit while reducing Sybil risk by tying on-chain weight to verified identities and bonded stake.

Token distribution and economic changes

The update adjusts the disclosures around how PI supply will be distributed between early Pioneers, validators, protocol reserves, and ecosystem funds. While Pi's team has not published a final immutable issuance contract on-chain in every jurisdiction at the time of the update, the product now contains more transparent counters and unlock schedules for different buckets (e.g., Pioneer claims, community pool, developer incentives).

Two practical outcomes follow: (1) some previously "virtual" balances will now be subject to KYC before they become transferable, and (2) the team has signaled that staking/bonding will be one mechanism by which Pioneers can accelerate or secure claimable balances.

Security and decentralization trade-offs

The update places Pi at a familiar crossroads for emerging protocols: stronger identity and KYC controls help reduce Sybil attacks and fake accounts, but they also introduce more centralized flows and on‑ramps.

Contrast this to the debates in mature ecosystems: the Ethereum Foundation's recent Trustless Manifesto emphasizes minimizing off-chain gating and maximizing on-chain, cryptographic trust assumptions here. Pi's choice to embed KYC and identity attestation inside the app reflects a pragmatic prioritization of usable, low-friction mobile crypto for mass audiences — but it also raises questions about who controls the verification infrastructure and how privacy is preserved.

In short: you get better real‑world Sybil resistance and a cleaner airdrop distribution, at the cost of added centralized components during the critical pre‑mainnet period.

Why this matters for mainnet and value capture

Mainnet value capture depends on three linked variables: supply distribution, utility, and demand. This update materially affects all three.

- Supply: by tying claimability to KYC and staking, the effective circulating supply at mainnet launch becomes more predictable and possibly lower than previously claimed virtual balances. A smaller immediate float can be supportive for price discovery if demand exists.

- Utility: clearer validator tooling and staking opens pathways to on‑chain services (payments, NFT minting, dApps) once mainnet contracts are live; without clean UX and developer traction, utility will lag. For perspective on how developer engagement accelerates utility, see Devconnect and similar gatherings where ecosystem work often translates into real products here.

- Demand: mainstream adoption requires smooth onboarding and real use cases. The mobile-centric approach could drive user growth, but short-term dropoff is possible if KYC and wallet complexity put off non-technical users.

Taken together, this update makes mainnet a more plausible near-term event — but whether it translates into long-term economic value depends on (a) decentralization technical guarantees, (b) marketplace adoption, and (c) transparency about total and unlocked supply.

Likely short‑ and medium‑term community and market reactions

Short-term (days–weeks):

- Increased app activity as Pioneers complete KYC and node setups. Expect helpful guides and some confusion posts across community channels.

- Price and sentiment moves (where PI markets exist) will likely oscillate on perceived unlockable supply and uncertain liquidity. Social sentiment may polarize between relief and skepticism.

Medium-term (months):

- A clearer map of who becomes a validator and how much PI is actively bonded will emerge. That will drive deeper technical discussion about decentralization and governance.

- If the team opens transparent, auditable on-chain distribution schedules and a testnet validator census, confidence could rise. If not, critics will press for independent audits and trust-minimizing mechanisms.

Community governance signals and technical audits will be decisive in shifting sentiment from speculative to sustainable.

Practical checklist — what every Pioneer should do now

Below are step-by-step actions prioritized by immediacy and safety.

1) Prepare KYC materials and understand privacy trade-offs

- Gather an accepted government ID, a selfie-capable smartphone, and proof-of-address if required. Begin the in-app KYC early to avoid queue congestion.

- Take screenshots of what the app records and any consent pages. If you care about privacy, read the app's data retention and third-party verification policy before submission.

2) Secure your wallet keys (export/import) and test locally

- If the update enables key export or wallet linking, export your key-pair to a secure hardware wallet or an encrypted backup. Prefer hardware wallets when available.

- Practice a small test transfer on testnet or with minimal amounts once transfers are enabled. Never post private keys or seed phrases in groups.

3) Understand staking/bonding and validator options

- Decide whether you want to run a validator, bond to an existing validator, or remain a mobile-only Pioneer. Running a validator typically requires uptime, a public IP or reliable hosting, and the ability to secure your node keys.

- If bonding PI, read the slashing and unbonding rules carefully: some setups impose long unbonding windows and partial slashes for misbehavior.

4) Complete any required proof-of-personhood or social attestations

- If the product implements social or P2P attestations, prioritize those that come from trusted community members. Be skeptical of paid attestations or services offering to "increase your score" for a fee.

5) Keep records and follow official communication channels

- Archive your in-app receipts, verification IDs, and public-facing profile proofs. Follow official channels for firmware and client releases to avoid malicious clones.

Risks to watch and how to mitigate them

Centralization risk: if a single verification provider or a small number of validators control identity attestation, the network is vulnerable to censorship or policy capture. Mitigation: demand transparency about who runs verification nodes and prefer verifiers with independent audits.

Privacy leakage: KYC means personal data exists in the system. Mitigation: understand data retention policies, and where possible, choose zero-knowledge or minimal disclosure options if offered.

Slashing and custody mistakes: staking/bonding exposes funds to operational risk. Mitigation: start with small amounts, use reputable hosted validators or well-documented self-hosting instructions, and consider multisig or hardware-backed key storage.

Claimable supply surprises: markets hate uncertainty. Mitigation: watch official supply dashboards closely and verify on-chain release events when they occur.

How to evaluate Pi's decentralization progress

Look for these measurable indicators over the next 3–12 months:

- Validator diversity: count of independent validators, geographic distribution, and client diversity.

- On-chain governance: whether protocol rule changes are enforceable on-chain (not only via app updates).

- Data minimization: adoption of cryptographic proofs and minimal KYC disclosure, aligning with trust-minimizing principles discussed in wider debates like the Trustless Manifesto here.

These indicators will tell you if Pi is leaning toward an open, permissionless future or a more centrally gated model optimized for mass mobile reach.

Quick FAQ for Pioneers

- Will I lose my PI if I don't KYC now? Not immediately in most flows, but claimability may be delayed or require KYC later. Start early to avoid surprises.

- Should I run a validator? Only if you have technical capacity and are prepared for uptime and security responsibilities; otherwise, bonding to a reputable validator is a lower-friction alternative.

- Is this the final mainnet launch? The update is a major step, but mainnet readiness hinges on transparency around supply, open validator census, and audited smart contracts. Treat it as a transition phase, not a finalization.

Final notes and resources

The November 2025 update is a turning point: it reduces ambiguity around who can claim tokens and how the network will be validated, but it also raises important questions about centralized verification and the long-term path to trust-minimizing decentralization.

If you're an active Pioneer, prioritize KYC preparation, secure key management, and conservative staking decisions. For technical readers, watch the validator census and on-chain distribution manifests closely; their shape will determine whether PI's economic value gets captured in a way that rewards decentralization and real utility.

For wider context on how developer events and ecosystem coordination often accelerate network utility, see the Devconnect coverage referenced earlier here. For the official summary of the November rollout, review the primary write-up here.

For market-oriented readers keeping an eye on broader crypto trends, remember that established bellwethers like Bitcoin and cross-sector activity in DeFi will influence PI's price discovery and integration opportunities. And if you use third‑party services for swaps, custody, or earn products, check compatibility with Bitlet.app or other platforms before moving large balances.

Checklist (one-line): prepare KYC, backup keys, test small transfers, decide validator/bonding role, watch supply dashboards, and demand transparency.

Stay safe, and treat this update as the start of a more operational phase for Pi — one that rewards careful preparation and critical attention to decentralization and privacy trade-offs.