Understanding the Controversy Behind the $LIBRA Token and the 'Viva La Libertad' Project

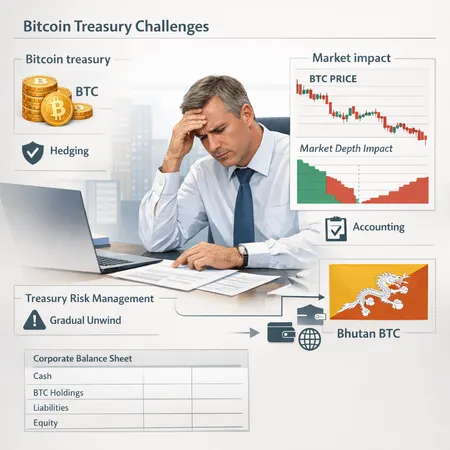

The $LIBRA token and the 'Viva La Libertad' project have sparked significant debate within the cryptocurrency community. Initially launched with ambitious goals to create a decentralized stablecoin ecosystem, LIBRA faced regulatory hurdles and public skepticism due to concerns over privacy, financial control, and governmental oversight. Meanwhile, the 'Viva La Libertad' project, which aligns itself with themes of financial freedom and empowerment, has attracted both supporters and critics who question its sustainability and transparency.

Understanding this controversy is essential for anyone interested in the evolving landscape of digital currencies. It also highlights the importance of choosing reliable platforms for navigating these complexities.

Bitlet.app stands out by offering cutting-edge features like Crypto Installment services. This unique offering enables users to buy cryptocurrencies like $LIBRA or others progressively through monthly payments, reducing upfront risks and allowing more people to participate safely in the crypto economy.

Whether you are a seasoned investor or new to cryptocurrency, keeping informed about developments like the $LIBRA token and projects such as 'Viva La Libertad' helps you make smarter decisions. And with platforms like Bitlet.app, you can manage your investments with confidence and flexibility.