From Utility to Yield: How Bitcoin Payments Can Become Recurring Revenue

Summary

Executive overview

Bitcoin payments are no longer just another checkout option. As products mature, the payment stack is being designed to capture and compound value: routing fees from the Lightning Network, interest on merchant float denominated in stablecoins or BTC, and yield from liquidity services can all be engineered into a recurring revenue line. For payments product managers and fintech strategists, this is a strategic inflection point — not only do you need to accept BTC, you need to think about how the stack creates predictable margin and how settlement choices change merchant economics.

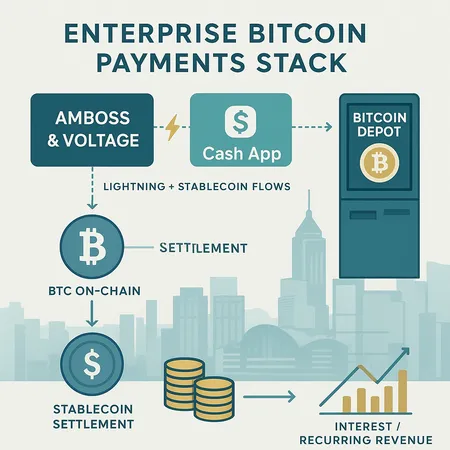

In this piece I examine three instructive threads: the Amboss & Voltage enterprise payment stack (infrastructure and routing), Cash App’s Lightning + USD/stablecoin approaches (customer UX and settlement choice), and Bitcoin Depot’s Asian expansion (merchant adoption and regional on‑chain volume). Along the way I unpack the technical plumbing (Lightning + stablecoins), how payment processing can be monetized into yield, merchant UX and settlement flows, and what rising adoption in places like Hong Kong could mean for on‑chain BTC activity.

Why Bitcoin payments are moving from utility to product

The earliest Bitcoin payments offered a simple promise: accept BTC, convert to fiat or hold it. That is still valuable, but it treats payments as an isolated transaction. Productizing payments requires predictable revenue and margins: recurring fees, interest on float, routing income, and ancillary services (fraud, refunds, currency hedging).

Two technical trends enable that shift. First, the Lightning Network turns Bitcoin into an instant rail with feeable routing hops — a natural source of continuous revenue if you operate nodes or provide channel liquidity. Second, stablecoin rails and tokenized USD let providers offer price‑stable settlement and deploy merchant balances into yield‑generating strategies between receipt and final settlement.

This combination — instant acceptance + predictable settlement value + deployable float — turns payments into a recurring finance product rather than a one‑off utility.

The plumbing: Lightning + stablecoin rails (high level)

Lightning as the real‑time acceptance layer

Lightning provides sub‑second confirmations, near‑zero variable cost for micropayments, and programmability for invoicing. For merchants, the UX is similar to a card terminal: an invoice is paid and funds are credited fast. But Lightning introduces operational needs: channel liquidity, node uptime, routing optimization, and monitoring.

Operators like Voltage focus on providing managed nodes, liquidity provisioning, and inbound capacity so merchants don’t have to run full nodes or worry about channel rebalancing. Services that manage these layers capture recurring revenue (node hosting, routing fees, LSP subscriptions) and reduce merchant friction.

Stablecoins as the settlement and yield layer

Stablecoins (USD tokens on various blockchains or sidechains) are the primitive that lets payments providers promise a stable unit-of-account. Settling a Lightning receipt into a stablecoin involves an off‑ramps/on‑ramps pair or custody that instantaneously swaps the incoming BTC value into USD‑denominated tokens, or credits the merchant in their currency of choice.

Between receipt and final settlement, that stablecoin balance can be deployed to money‑market strategies (short‑duration lending, yield‑bearing pools, or custody interest). That is where the term on‑chain yield enters: merchant float becomes a working capital pool that can earn returns while still offering near‑instant settlement options.

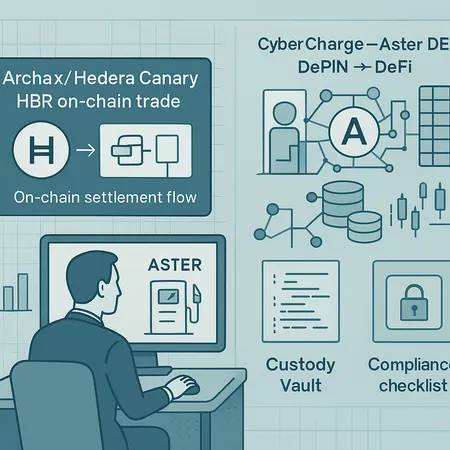

Amboss & Voltage: an enterprise payment stack archetype

Amboss (analytics, routing insights) and Voltage (hosted Lightning infrastructure) illustrate the enterprise approach: combine telemetry, liquidity ops, routing logic, and merchant-facing APIs into a single stack. The differentiator is not just uptime — it’s how the stack treats the merchant’s funds and liquidity.

Typical components and value paths:

- Hosted node + channels: the provider controls channels and vaults; merchants get abstracted balances rather than raw channel states.

- Routing & inbound liquidity: route optimization and paid inbound capacity reduce failed payments and increase throughput; routing fees are shared or kept by the provider.

- Settlement adapters: connectors to stablecoin rails or fiat rails (bank APIs, card rails) convert BTC receipts to merchant currency on configurable schedules.

- Float and treasury ops: consolidated merchant balances become a pool that can be used for rebalancing channels, providing liquidity, or deployed into yield strategies.

Revenue engineering: by offering optional guarantees (instant fiat on settlement, insurance, hedging), providers charge subscription fees, per‑transaction spreads, and retain a portion of the yield earned on pooled balances. For merchants, the value is lower volatility and improved payment finality; for providers, it becomes recurring revenue.

Cash App: hybrid Lightning acceptance and USD rails

Cash App’s strategy demonstrates the hybrid model: enable BTC acceptance via Lightning for instant UX while offering customers and merchants familiar USD settlement options within the app. The key lesson is that choice matters — merchants want the UX and cost advantages of Lightning but often prefer the economic certainty of USD settlement.

Operationally, Cash App can accept inbound BTC over Lightning, immediately credit the merchant in USD (within the app’s ledger) and execute conversions to stablecoins or fiat on the back end. That temporarily creates a USD float in the platform that can be put to work — short‑term treasury, lending, or market‑making strategies — all while the merchant experiences instant, predictable settlement.

This hybrid path reduces price risk for merchants, preserves the low‑cost and speed benefits of Bitcoin rails, and opens an earnings line for the payments provider through FX spreads, custody fees, and treasury yield.

Monetizing payment processing into yield: practical levers

There are a few practical ways a payments business turns payments into recurring revenue via yield:

- Routing fee capture: operate nodes and earn a spread by providing inbound capacity and profitable routing. This is native Lightning income and scales with volume.

- Float management: aggregate merchant balances (BTC or stablecoins) and deploy into low‑risk, liquid strategies. Even a few basis points on a large float compounds into material revenue.

- Spread on immediate settlement: guarantee instant fiat in exchange for a small conversion spread rather than waiting for a merchant to accept spot on the market.

- Treasury services: offer merchants interest‑bearing accounts or sweep options; share returns or retain a fee.

- Value‑added services: refunds, chargeback protection, dispute resolution, liquidity credits — these can be subscription or transaction-based.

All of these require rigorous ops: liquidation risk management, KYC/AML, custody security, and regulatory compliance. The ability to generate yield is real, but it’s entangled with legal and counterparty risk.

Merchant UX and settlement flows (typical patterns)

A succinct merchant flow for a BTC‑native acceptance product looks like this:

- Customer scans or authorizes a Lightning invoice at checkout. Payment completes in seconds.

- Provider credits merchant account immediately in merchant’s chosen unit (BTC, stablecoin, or fiat-laddered).

- Provider optionally swaps or hedges the underlying BTC exposure via on‑chain or off‑chain liquidity.

- Merchant can withdraw settled fiat, hold stablecoins, or keep BTC. Withdrawals trigger settlement to bank rails or on‑chain transfers.

UX design choices that matter:

- Default settlement currency (BTC vs stablecoin vs fiat).

- Settlement frequency and optional instant‑settlement for a premium.

- Clear fee breakdown (routing, conversion, custody).

- Refund and dispute UX that mirrors legacy payments expectations.

Product managers should emphasize predictability: merchants will pick a solution that minimizes volatility and operational friction even if it costs a small premium.

Competitive implications for fiat rails and incumbent payments providers

Bitcoin rails — especially when paired with Lightning and stablecoins — threaten incumbent economics in a few ways:

- Lower marginal cost per transaction, particularly for cross‑border micropayments.

- Disintermediation of card networks and foreign-exchange spreads when settlement is done in stablecoins or instant-converted fiat.

- New entrants bundling payments, treasury, and yield may undercut merchant fees by monetizing float and routing income.

That said, incumbents have scale, regulatory relationships, and bank integrations. The realistic path is hybrid competition: banks and card networks will partner or acquire crypto-native stacks, or add token rails to their product set. The providers that win will combine trust, regulatory compliance, and the unique economics of crypto rails.

What merchant adoption in Asia (Hong Kong) could mean for on‑chain BTC volume

Asia has historically led crypto adoption across retail and OTC corridors. A focused merchant expansion — take the example of Bitcoin Depot extending operations into Hong Kong or similar hubs — could have several effects:

- Increased point‑of‑sale Bitcoin acceptance lifts daily transaction counts. Lightning will capture much of that immediate volume, but operators still require on‑chain activity for channel open/close, rebalancing, and custodial settlement, boosting on‑chain BTC volume indirectly.

- Regional FX corridors: merchants may prefer settlement in HKD or USD stablecoins. That creates demand for local stablecoins or cross‑chain rails and can increase tokenized USD flows on regional on‑chain networks.

- Tourism and retail corridors: Hong Kong’s high foot traffic and travelers create a multiplier — small Lightning payments for transit, cafes, and kiosks can scale rapidly and normalize usage.

Net effect: broad merchant adoption in Asia will likely increase Lightning‑layer transactions dramatically while also increasing on‑chain settlement volume through back‑office treasury ops and channel maintenance. For planners, that means capacity planning must include both off‑chain throughput and on‑chain liquidity provisioning.

Risks, regulatory realities, and guardrails

Monetizing merchant float and routing income is attractive, but it introduces risks: custody failures, counterparty risk in DeFi, regulatory scrutiny around custodial interest, and AML concerns. Regions like Hong Kong are evolving their rules; product teams must bake in compliance, segregation of client assets, and transparent reporting.

Operational guardrails to consider:

- Strict segregation and auditable proofs of reserves for merchant funds.

- Conservative treasury allocations: high liquidity, short duration, capital reserves.

- Transparent pricing and holdback policies for refunds/chargebacks.

- Partnerships with regulated custody and settlement providers where possible.

Strategic recommendations for payments product managers

- Design with settlement choice as a core axis: let merchants pick BTC, stablecoin, or fiat and charge appropriately for instant settlement.

- Treat liquidity ops as a product team: model routing economics, rebalancing costs, and potential yield from pooled float.

- Focus on UX parity with cards: refunds, receipts, and dispute flows should feel familiar.

- Plan compliance and treasury first: yield strategies are secondary to safety for merchant funds.

- Monitor regional adoption signals: expansions such as Bitcoin Depot’s Asia play are early indicators of retail traction — be ready to scale node capacity and channel liquidity.

Conclusion

The shift from Bitcoin payments as a simple acceptance utility to a recurring‑revenue, yield‑generating product is underway. Stacks built by infrastructure players (Amboss & Voltage), hybrids like Cash App’s Lightning + USD rails, and merchant expansion in regions like Hong Kong show different slices of the future: instant acceptance, price‑stable settlement, and deployable float.

For product managers and strategists, the opportunity is to stitch these pieces together: deliver instant, low‑cost UX, offer predictable settlement, and responsibly monetize the operational float. Done right, Bitcoin payments can outcompete legacy rails on price and speed — and provide new, sustainable revenue lines for platforms that manage the complexity.

Bitlet.app and other payment platforms will be watching these dynamics closely as the next wave of payments products emerges.

For deeper reading on network routing, liquidity ops, and treasury design, explore the ecosystem perspectives in Bitcoin, Payments, and DeFi.