Stablecoin Counterparty Risk: Lessons from the Dubai Court Freeze of TrueUSD Reserves

Summary

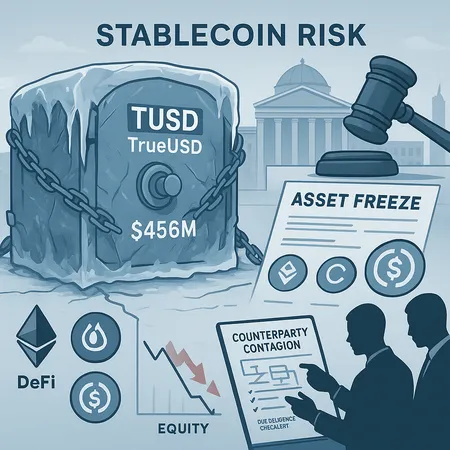

Why the Dubai order matters: a short primer

In recent reports a Dubai court issued an asset freeze covering approximately $456 million connected to TrueUSD (TUSD) reserves. Whether you run a corporate treasury, a DeFi desk, or manage risk for a protocol, the headline is simple: legal action against off-chain entities that hold or control reserves can instantly become a market event on-chain.

There are two structural takeaways. First, a stablecoin’s on-chain coin is only as reliable as the off-chain legal and custodial arrangements that back it. Second, composability in DeFi means a problem in one reserve or issuer can propagate rapidly via liquidity pools, lending markets, and automated market makers.

What the court order did — and what remained unclear

Reportedly the order froze funds tied to TUSD reserves — effectively placing restrictions on a legal entity or accounts that service redemption and custody. Important facts that typically matter but are often missing in first reports:

- Which legal entity or bank accounts were frozen, and under what cause (creditor dispute, fraud allegation, insolvency action)?

- Are those frozen assets a material portion of the circulating TUSD supply, or a subset held for operational purposes?

- Which custodians or jurisdictions are involved — and do global custodians have recourse to move unaffected buckets of reserves?

Without those answers, markets must price uncertainty. That uncertainty, not just the freeze itself, drives liquidity runs and repricing across related instruments.

Stablecoin counterparty risk: what it really means

People often reduce stablecoin risk to “on-chain vs off-chain.” That simplification misses the key channels:

- Issuer credit and governance risk: Who legally controls minting/redemption and how solvent is the issuer’s corporate balance sheet? (Ticker example: CRCL for Circle.)

- Custodial and banking risk: Are reserves in segregated, insured accounts or intermingled in omnibus accounts across jurisdictions?

- Legal/regulatory risk: A freeze in one jurisdiction can block access to fiat rails and impair redemptions elsewhere.

- Operational risk: KYC/AML holds, sanctions screening, and counterparty disputes can slow or stop redemptions.

For treasuries and protocols the relevant metric is not “is there a peg?” but how much credit exposure do we have to an issuer and its reserve arrangements if redemption or transfer access is impaired?

Contagion pathways into DeFi and pegged pools

DeFi amplifies concentration risk through composability. Consider typical contagion routes:

AMM/peg breakdowns: A TUSD/USDC pool relies on arbitrage to maintain a peg. If TUSD faces redemptions or secondary-market sell pressure, arbitrageurs widen spreads, liquidity providers suffer impermanent loss, and pool prices can dislocate.

Lending & collateral channels: Protocols that accept TUSD as collateral can be forced to liquidate positions into stressed markets, cascading margin calls and on-chain liquidations.

Cross-protocol exposure: A vault strategy or yield aggregator could hold TUSD across multiple protocols. A freeze that impairs redemptions in one place can lock funds across several smart contracts.

Market-maker and peg-stabilizer risk: Many peg-stabilizing strategies rely on off-chain lines — bank facilities, settlement windows, or OTC counterparties. If those are restricted, automated systems have no backstop.

These mechanics show why an asset freeze tied to reserves is not a narrow legal event — it is a liquidity and operational stress test for an entire network of positions.

DeFi protocols and treasury teams must ask not just "How much TUSD do we hold?" but "How is that TUSD used across systems where we have contingent exposure?"

Market reaction patterns: issuer equity shocks and stablecoin flows (Circle/CRCL lens)

When an issuer’s equity suffers a shock — for example a sharp decline in CRCL (Circle’s equity ticker) — markets often interpret that as a proxy for increased issuer credit risk. The common market behaviors are:

- Tiering of stablecoins: Market participants begin to prefer alternatives perceived as safer (e.g., migrating from a stressed issuer’s token to USDC or other widely attested tokens).

- Redemption pressure: Corporates and sophisticated desks increase redemptions to fiat or swap into other on-chain equivalents, increasing sell pressure and widening spreads.

- Funding cost repricing: Over-collateralized lending markets and margin facilities repricing the cost of borrowing against that stablecoin.

Circle’s publicly traded equity provides visible signals; a sharp CRCL decline can accelerate outflows even absent concrete proof of reserve shortfall. Reacting to signals is rational — but it can also become self-fulfilling if liquidity providers withdraw precisely when they’re needed.

Practical due-diligence checklist for treasuries and DeFi desks

Below is a pragmatic checklist to operationalize stablecoin counterparty risk into policy and workflows.

Legal & structural checks

- Know the legal entities: Identify the exact issuer entity, the custody chain for reserves, and the jurisdictions governing each legal relationship.

- Redemption mechanics: Test redemption paths periodically (small redemptions on-chain and off-chain) to measure friction and settlement windows.

- Contractual rights: Obtain contract language or attestations that clarify priority of redeemer claims vs. other creditors.

Financial & reserve transparency

- Attestation cadence and coverage: Prefer issuers with frequent, independent attestations of reserves and a breakdown of asset types. Require attestations covering both nominal amounts and custodial composition.

- Reserve composition: Understand how much is cash, short-term commercial paper, repos, or other assets; each has different liquidation profiles.

- Segregation assurances: Check if reserve accounts are segregated or pooled; segregation reduces counterparty credit risk.

Operational controls & exposure limits

- Issuer concentration limits: Set pragmatic thresholds. For example, limit any single issuer exposure to a conservative percentage of liquid reserves (institutional guidance often ranges 10–30% depending on organization size and risk appetite).

- Pool and protocol limits: For DeFi desks set lower limits on protocol-exposed stablecoins (eg. stricter caps when token is used as collateral in lending markets).

- On-chain monitoring and alerts: Deploy real-time trackers for large transfers, reserve-related addresses, and sudden changes in peg behavior.

Stress testing & playbooks

- Scenario stress tests: Simulate complete loss of redemption capability for an issuer for T+0, T+3, and T+30 days and measure cashflow and liquidity impact.

- Emergency procedures: Pre-authorized actions for liquidity migration, unwind levels for LPs, and legal notification chains.

- Counterparty onboarding: Incorporate reserve and legal checks into onboarding for market-makers and custodians.

Technical & settlement hygiene

- Slippage/impact thresholds: Only allow automatic market exits within predefined slippage limits; require human sign-off for larger rebalances.

- Multi-rail capability: Maintain operational connections to multiple fiat rails and on-chain stablecoins (eg. USDC, other high-attestation tokens) to minimize single-route failure.

A quick incident playbook: if an asset freeze hits your holdings

- Immediate triage: Flag all positions with TUSD exposure across wallets, smart contracts, and off-chain custodians.

- Halt nonessential actions: Pause automated strategies that will on-chain interact and potentially worsen slippage (eg. rebalancers, yield harvesters).

- Contact counterparties: Inform counterparties, custodians, and settlement banks to understand the scope of the freeze and any operational holds.

- Execute liquidity waterfall: Use pre-approved alternative liquidity sources (other stablecoins, fiat lines, market-maker facilities).

- Legal & compliance: Escalate to legal counsel to understand recovery prospects and to prepare for regulatory disclosures if necessary.

- Communicate: For public protocols, craft a transparent update to users and counterparties to reduce panic and avoid misinformation.

Longer-term architecture: building resilience into the treasury stack

- Diversity of holdings: Maintain a mix of stablecoins and traditional cash equivalents. Don't rely solely on a single issuer.

- Prefer higher transparency and regulated frameworks: Favor issuers with frequent third-party attestations, clear custody segregation, and established redemption rails.

- Design for worst-case settlement: Architect treasury liquidity so it can operate even if sizable portions of a given stablecoin are temporarily unavailable for redemption.

- On-chain & off-chain observability: Combine blockchain analytics (token flows, peg spreads) with off-chain monitoring of issuers’ legal and financial health (equity movements like CRCL, banking notices, regulatory filings). Tools and analytics can be integrated into treasury dashboards for continuous risk scoring.

Practical thresholds and examples (illustrative guidance)

- Issuer exposure cap: Consider a starting policy of a 20% cap for any single issuer across cash-like holdings; reduce caps to 10% for protocol-exposed or collateralized usage.

- Redemption buffer: Keep an operational buffer of 5–15% of liquid assets in on-demand fiat or highly liquid alternatives to cover short-term settlement needs.

- On-chain liquidity buffer: Hold enough alternative on-chain stablecoins to cover expected worst-case withdrawals from automated strategies for 72 hours.

These numbers are illustrative and should be adapted to your organization’s size, sector, and regulatory constraints.

Final thoughts: the TUSD freeze is a reminder — not the whole story

The Dubai asset freeze alleged to affect TrueUSD reserves is not just a headline — it’s a practical stress test of how legal, custodial, and market structures interact. On-chain visibility is necessary but not sufficient. Firms must combine legal diligence, attestation analysis, and robust operational playbooks to manage stablecoin risk.

For treasuries and DeFi desks, the modern answer is layered: smaller issuer concentration, regular stress tests, multi-rail liquidity, and live monitoring that connects on-chain signals with off-chain legal and financial health (for example, tracking an issuer’s equity like CRCL or changes to banking relationships). Tools and platforms such as those integrated into treasury operations at Bitlet.app can help operationalize some of these steps, but governance, policies, and legal clarity remain central.

Stablecoins like TUSD and USDC will remain critical plumbing for crypto markets. The lesson from an asset freeze is straightforward: trust, but verify — on-chain, off-chain, and legally.