Ethereum’s Surge to $4,470: What Institutional Demand Means for DeFi Tokenization

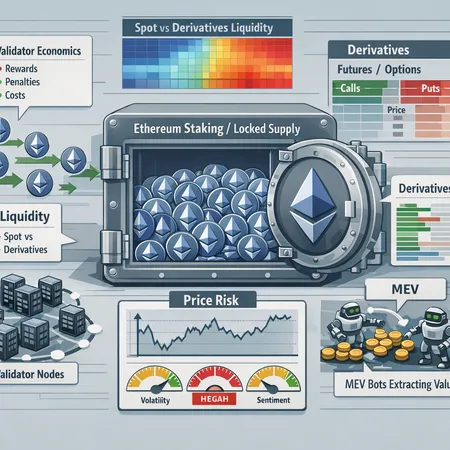

Ethereum has made headlines by reaching a new high of $4,470, a surge fueled largely by growing institutional demand. As big investors and institutions turn their attention to Ethereum, the implications extend beyond price increases—they highlight a transformative future for DeFi (Decentralized Finance) and tokenization. Institutional interest brings more liquidity, stability, and legitimacy to the Ethereum ecosystem, which is critical for the growth of tokenized assets and decentralized applications. Tokenization on Ethereum allows real-world assets to be represented digitally, enabling greater accessibility and efficiency in financial services.

For individual investors looking to capitalize on Ethereum's growth and the expanding DeFi ecosystem, platforms like Bitlet.app offer innovative solutions. Bitlet.app provides a Crypto Installment service, allowing users to buy cryptocurrencies like Ethereum now and pay monthly instead of upfront. This lowers the barrier to entry, making it easier for more people to participate in this exciting market.

As Ethereum continues to evolve with network upgrades and increasing institutional involvement, the future of DeFi tokenization looks promising. Tools and platforms that support flexible investment options, such as Bitlet.app, will be key enablers for wider adoption and growth.

Stay updated with Bitlet.app to explore crypto purchasing options tailored for today's investors and to be part of the DeFi revolution powered by Ethereum.