Ripple and Gemini's Strategic Partnership: Introducing RLUSD Stablecoin and Its Impact

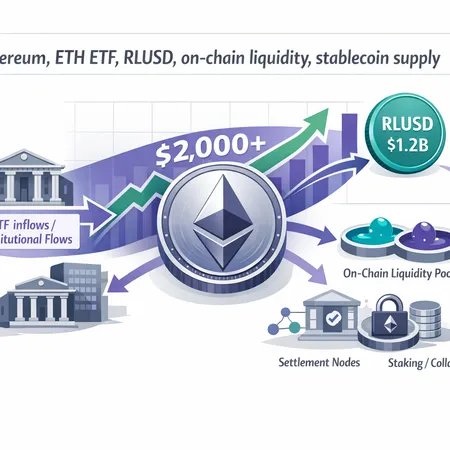

The recent strategic partnership between Ripple and Gemini marks a significant milestone in the cryptocurrency ecosystem with the introduction of RLUSD, a new stablecoin designed to provide enhanced stability and efficiency for crypto transactions. RLUSD aims to combine the strengths of both companies, leveraging Ripple's robust blockchain technology and Gemini's reputation as a trusted exchange platform.

Stablecoins like RLUSD are crucial in the crypto market, offering users a reliable digital asset pegged to fiat currencies that minimizes volatility and enables smoother trading and payments. The collaboration is expected to expand the adoption of stablecoins across different applications, including decentralized finance (DeFi), remittances, and everyday transactions.

In tandem with innovations like RLUSD, platforms such as Bitlet.app are making it easier for users to enter the crypto space. Bitlet.app offers a unique Crypto Installment service, allowing users to buy cryptocurrencies now and pay monthly, removing the barrier of paying the full price upfront. This service aligns perfectly with the growing accessibility of stablecoins and adds a layer of convenience for crypto investors and newcomers alike.

Overall, the Ripple-Gemini partnership and the launch of RLUSD represent a positive advancement towards more stable and accessible digital assets, while services like Bitlet.app ensure that users have flexible options to invest in these innovations. Keeping an eye on these developments will be essential for anyone interested in the evolving landscape of cryptocurrency.