PriceForecast

Bitcoin bulls tried to spark a recovery but ran into heavy selling near $107,000, pulling most altcoins back from resistance. Sellers dominated across ETH, XRP, BNB, SOL, DOGE, ADA, LINK and BCH, leaving the market tone cautious.

On Nov. 12 investors stayed cautious as Bitcoin climbed to $104,700 from this month's $100,000 low; analysts warn ICP, Trump Coin and XRP could face continued downside if risk-off sentiment persists.

Rising appetite for high-beta AI tokens and memecoins is drawing liquidity away from established assets, leaving XRP consolidating around $2. Traders and investors should watch on-chain flows and exchange volumes for signs of deeper rotation.

A recent liquidation heatmap highlights nearby liquidity clusters at $0.303 and $0.328 for TRX, setting the stage for a potential short squeeze. Clearing these levels could trigger a roughly 10% rally as stops cascade and buying pressure accelerates.

As Chainlink expands beyond DeFi into tokenization infrastructure, analysts expect LINK to benefit from higher demand. With Chainlink trading at $16 today, 2025 could bring a wide range of outcomes depending on adoption and macro conditions.

Bitcoin is consolidating near $104.5K, compressing into a tight range below the key $108K resistance as traders weigh ETF flows and macro signals. The setup suggests a potential breakout if buying pressure resumes, but failure could pull BTC back toward psychological supports.

Analysts set a 2025 ceiling for Polkastarter at around $0.3168, while long-term forecasts project a possible rise to $2.4057 by 2030; hitting $1 this year looks unlikely but not impossible under bullish conditions.

dYdX (DYDX) shows bullish long-term potential with a 2025 ceiling near $1.42 and a 2030 optimistic target around $10.80. This forecast weighs protocol adoption, DeFi demand, and market risks to help investors decide if DYDX is a buy.

CryptoQuant founder Ki Young Ju released a balanced bull-bear outlook for Bitcoin, flagging short-term risks from large holders while acknowledging a plausible macro-driven rally. Traders should monitor on-chain flows and key liquidity zones as potential triggers for either scenario.

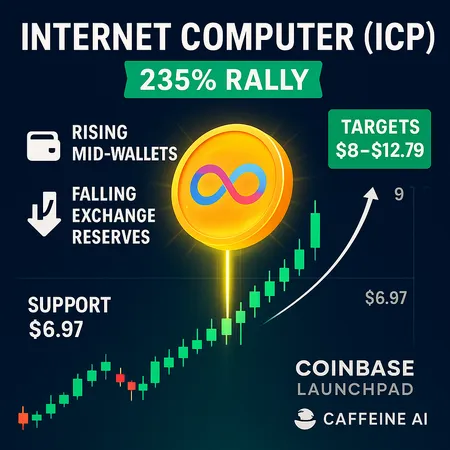

ICP surged from $2.50 to $9.49 before settling near $7, driven by Coinbase Launchpad rumors, Caffeine AI excitement and improving on-chain fundamentals. On-chain metrics show mid‑wallet accumulation and falling exchange reserves, with $6.97 support and an $8–$12.79 upside range in view.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility