ICP Price Prediction: Coinbase Launchpad Speculation Fuels 235% Rally

Summary

Market snapshot and recent move

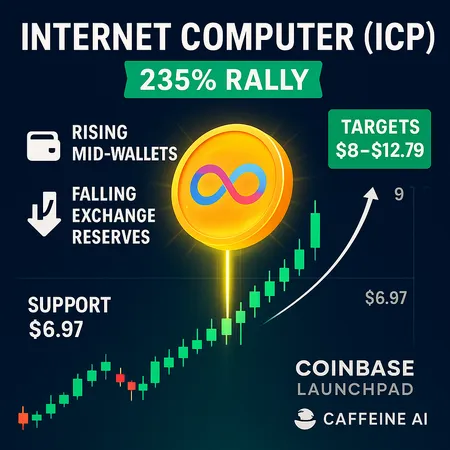

ICP staged a dramatic recovery, rallying from about $2.50 to an intraday high near $9.49 before cooling around the $7 area. Traders attribute the sudden squeeze to persistent rumors of a Coinbase Launchpad listing and fresh interest tied to Caffeine AI developments. The move marks a clear breakout from a multi‑year slump and has refocused attention on Internet Computer as a tradable asset in the broader crypto market.

Immediate catalysts behind the rally

The two primary narratives fueling the move were: speculative listings chatter around Coinbase’s Launchpad and growing developer/attention flows toward Caffeine AI on the network. Speculation often compresses available sell pressure, and when coupled with fundamental upgrades or ecosystem news, price can spike rapidly. Market participants should treat rumor‑driven rallies with caution, but the underlying on‑chain changes described below add credibility to a more sustainable recovery.

On‑chain signals: accumulation and lower exchange supply

On‑chain metrics show rising mid‑wallet accumulation — wallets that are neither tiny retail addresses nor large whales have been increasing holdings. At the same time, exchange reserves have declined, indicating fewer ICP tokens are immediately available for sale. Those two signals combined point to a supply squeeze scenario rather than purely leveraged speculation.

This accumulation trend is a classic bullish sign: fewer tokens on exchanges can amplify upward moves if demand resurges. Traders should also watch liquidity flow and whale behavior, since large single‑address movements can still trigger sharp volatility. For readers tracking different sectors of crypto activity, consider how interest may rotate between ICP, NFTs and memecoins depending on market sentiment.

Technical levels and price targets to watch

From a technical perspective, immediate support sits near $6.97 — a level that has acted as a consolidation base after the pullback. On the upside, the short‑term range to monitor is $8–$12.79. A daily close above $8 would increase the probability of an extension toward the $12 region, while a break below $6.97 could signal a deeper pullback and potential re‑test of lower structural levels.

Risk‑adjusted traders might use scaled entries and clear stop management given ICP’s history of sharp moves. Longer‑term investors inclined toward blockchain fundamentals should weigh network upgrades, adoption metrics and application activity before committing large positions.

Risks, catalysts and what to monitor next

Key upside catalysts: a formal Coinbase Launchpad announcement, sustained developer momentum from projects like Caffeine AI, and broader crypto market strength. Key risks include rumor reversals, short‑squeeze unwind and a decline in overall risk appetite across DeFi and spot markets.

Watchables: exchange reserve trends, mid‑wallet accumulation, on‑chain developer activity, and whether liquidity providers widen spreads. Macro moves in the crypto market and news cycles around memecoins or large token unlocks can also quickly change the narrative.

How traders and investors can approach ICP now

Short‑term traders can look for momentum play opportunities with tight risk controls around the $6.97 support. Swing traders may prefer to wait for confirmation above $8 before adding exposure. Long‑term investors should evaluate ICP’s ecosystem growth and network resilience rather than chasing the top.

For users evaluating service features or trading tools, platforms like Bitlet.app can be helpful for managing installment buys or dollar‑cost averaging into volatile names while keeping exposure controlled.

Outlook — measured optimism

ICP’s breakout from a multi‑year slump is notable: 235% gains caught market attention, and on‑chain trends lend weight to a more durable recovery scenario. That said, the rally is still vulnerable to rumor dynamics and broader market shifts. If accumulation continues and exchange balances stay low, the $8–$12.79 range is a realistic near‑term target; conversely, failure to hold $6.97 would invalidate the bullish case and invite deeper consolidation.

Stay disciplined, monitor on‑chain flows, and treat speculative catalysts as triggers rather than guarantees.