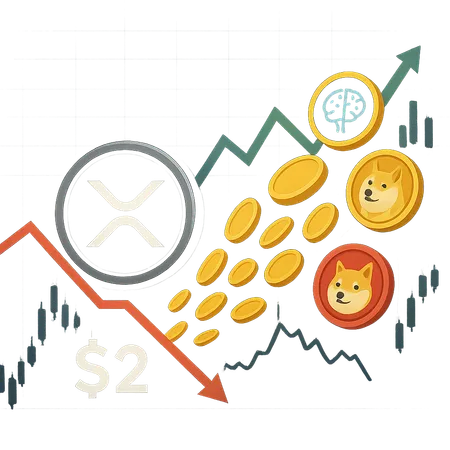

XRP Price Outlook: Is Liquidity Shifting to AI Tokens and Memecoins?

Summary

Market snapshot: XRP sitting near $2 as narratives shift

XRP has largely held close to $2, but the broader market is tilting toward higher-beta opportunities. Traders are chasing next-wave narratives — particularly AI-themed tokens and fast-moving memecoins — which can soak up short-term liquidity and compress order-book depth for more established tokens. Platforms that track trading flows, including centralized venues and services like Bitlet.app, are reporting noticeable rotation into these speculative pockets of market activity.

Why high-beta assets are dominating liquidity flows

Momentum chases and narrative-driven speculation are powerful in crypto. AI-related projects and social-media-driven memecoins often generate rapid inflows because they promise outsized short-term returns and viral attention. That behavior draws capital away from traditionally more liquid assets and can increase volatility market-wide. Meanwhile, ancillary markets like NFTs and memecoins continue to act as magnets for retail attention and speculative capital, furthering the rotation dynamic.

How liquidity rotation pressures XRP price action

When liquidity is reallocated, order books thin and spreads widen for mid-cap tokens. For XRP this means less headroom for sustained rallies even if demand remains intact at lower timeframes. Institutional or strategic holders who prefer lower-volatility accumulation may delay buys while traders hunt for quick gains in high-beta pockets, creating a short-term supply overhang. In plain terms: liquidity is finite, and when a larger share flows into AI and memecoin plays, XRP’s near-term upside becomes harder to realize without renewed buyer conviction.

Key indicators traders should monitor

Focus on a few measurable signals rather than noise. Watch exchange inflows/outflows for XRP, spot and derivatives open interest, and changes in large-wallet behavior. Rising exchange outflows to cold storage often signal accumulation, while surging inflows suggest selling pressure. Correlation analysis between XRP and leading high-beta indices can reveal whether rotation is systemic or episodic. Keep risk management tight: if you trade around these rotations, use position sizing and stop-losses to protect against sudden reversals.

Final take: consolidation likely until liquidity stabilizes

XRP’s fundamentals — cross-border rails and payments utility — remain intact, but narrative momentum matters in the short term. Expect consolidation around current levels until capital flows back from high-beta experiments into more established crypto assets. Traders should track on-chain signals and exchange metrics for the earliest signs of a liquidity rebalancing. For users watching market-moving rotations and looking to manage exposure, services like Bitlet.app can help monitor volume and trading flows in real time.