Libra

An unexpected Libra Trust has appeared, saying proceeds from the Libra token sale will fund grants for Argentine companies. The trust is believed to be financed by Kelsier Ventures CEO Hayden Davis to pursue the token’s original purpose.

Reports say Hayden Davis enlisted high-profile names to promote his LIBRA memecoins, renewing scrutiny over how and when crypto funds can be frozen. The episode highlights custody and regulatory risks for token holders.

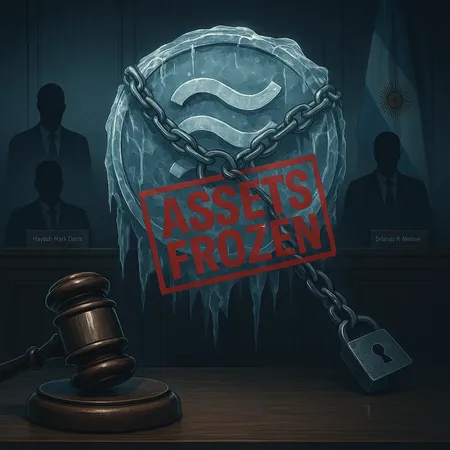

An Argentine federal judge has issued an indefinite precautionary order freezing assets tied to key figures behind the LIBRA token launch, including Kelsier Ventures CEO Hayden Mark Davis. The move targets individuals accused of using crypto wallets to move funds connected to the project’s timeline and raises fresh questions for the broader crypto market.

An Argentine judge ordered a freeze on Kelsier Ventures CEO Hayden Mark Davis' assets amid a probe into the LIBRA token, publicly linked to President Javier Milei. The move tightens legal pressure around Milei’s inner circle and could reshape market confidence in LIBRA.

Argentina's judiciary ordered a broad asset freeze tied to the collapse of the Libra memecoin, targeting U.S. citizen Hayden Davis and two regional associates. The move is part of an escalating probe into alleged fraud and market manipulation that involves roughly $120 million.

Argentina has frozen assets linked to LIBRA co-founder Hayden Davis and others as part of a $57 million crypto investigation tied to alleged political connections. The move raises fresh regulatory risk for LIBRA and could pressure markets and exchanges handling the token.

Argentina issued a sweeping asset freeze against Hayden Davis as part of a cross-border $250 million Libra fraud investigation now active in Buenos Aires and New York. The move raises fresh questions about enforcement reach and investor exposure in memecoins and other crypto products.

A viral selfie and a rapid on-chain transfer have put Argentina's president at the center of a potential memecoin probe. Investigators trace a $500,000 movement within 42 minutes of the post and are examining whether funds have been frozen amid a suspected pump-and-dump.

An Argentine federal judge has ordered a freeze on assets linked to the controversial LIBRA memecoin backed by President Javier Milei. The move raises legal, market and political questions for memecoins and crypto platforms operating in Argentina.

Argentine judge froze funds linked to Hayden Davis and two alleged intermediaries over ties to the Libra meme coin promoted by President Javier Milei; authorities have also opened a payments probe. The move raises fresh legal and regulatory questions for memecoins and Argentina's crypto landscape.