Leverage

Kraken has rolled out round‑the‑clock perpetual trading for tokenized U.S. stock derivatives with up to 20x leverage, widening access to equities exposure through crypto markets. The move bridges traditional shares and digital derivatives but raises questions about risk and regulation.

Bitcoin continued to fall as a broader deleveraging hit crypto markets, prompting traders to reassess its role as a near-term inflation hedge. Forced liquidations and risk-off flows amplified the move.

Ethereum fell after breaking the $3.4K support level, highlighting how fragile market confidence becomes when most positions are levered. Traders should monitor on-chain leverage, funding rates and open interest for clues on whether selling pressure will continue.

Binance traders’ ETH exposure has climbed as the exchange’s leverage ratio reached a record high while ether reclaimed levels above $3,000. The build-up comes just ahead of the Fusaka upgrade and raises the risk of amplified volatility.

Leveraged ETFs built on a bitcoin-hoarding strategy are among the biggest victims of this year’s crypto downturn, after a bitcoin price slide dragged down shares of the largest corporate holder of the token.

Binance CEO Richard Teng said bitcoin’s recent steep drop reflects investors cutting leveraged crypto positions and a wider shift toward risk aversion, bringing BTC volatility in line with other major asset classes.

MicroStrategy (MSTR) stock fell after its market capitalization dropped below the estimated value of the company’s Bitcoin holdings as investors shift toward ETFs and shy away from corporate crypto exposure and leverage. The move underscores growing preference for direct ETF access and raises questions about balance-sheet risk for crypto-heavy firms.

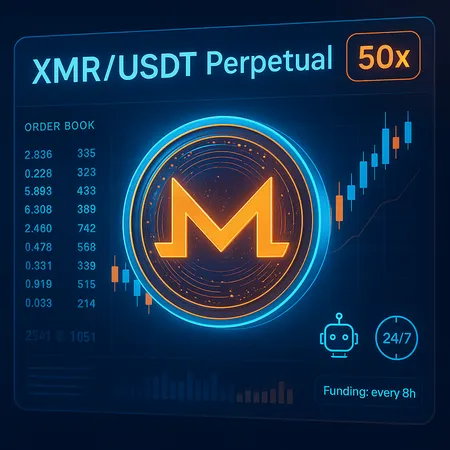

Bitget has launched XMRUSDT perpetual futures with USDT-settled margins, up to 50x leverage, 24/7 trading and funding every eight hours. The exchange also introduced automated futures bots for Monero, enabling programmatic strategies for privacy coin derivatives.

Gemini rolled out 100x leverage on XRP derivatives in Europe, intensifying liquidity and volatility while accelerating institutional interest in digital assets. Traders should weigh the upside of amplified exposure against heightened liquidation and regulatory scrutiny.

The trader known as qwatio has experienced eight liquidations within a week, recently including a partial liquidation of an Ether position leveraged 25 times. This highlights the high risks involved in leveraged crypto trading.