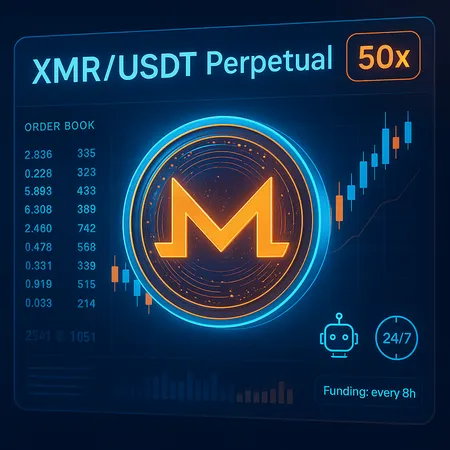

Bitget Adds XMRUSDT Perpetuals with 50x Leverage and Automated Futures Bots

Summary

Bitget expands Monero derivatives with high-leverage perpetuals

Bitget has added XMRUSDT perpetual futures to its derivatives suite, giving traders a new way to express views on Monero — the privacy-focused cryptocurrency. The contract is USDT-settled, offers up to 50x leverage and operates 24/7, while funding payments occur every eight hours. Tick size is set to 0, and the product launch includes integrated automated futures bots designed specifically for Monero.

Product details: leverage, settlement, funding and tick rules

The new XMRUSDT perpetual follows common derivatives conventions but with a few noteworthy specifics. Traders can open positions with as much as 50x leverage on a USDT-margined contract, enabling larger directional exposure but significantly increasing liquidation risk. Funding is exchanged every eight hours, aligning incentives between long and short counterparties, and the tick size of 0 allows for fine-grained pricing — useful in fast-moving markets.

These mechanics make the contract suitable for active traders and algo strategies that need continuous access to Monero exposure without holding the underlying asset. As with any high-leverage product, prudent position sizing and risk controls are essential.

Automated futures bots: programmatic Monero trading arrives

A headline feature of this launch is the availability of automated futures bots configured for XMR. These bots let users deploy rule-based strategies — for example, systematic rebalancing, spread trading versus other venues, or volatility-based entries — without manual intervention. For traders interested in algorithmic approaches, the bots reduce execution friction and can help capture opportunities around funding payments or intraday volatility.

Automated strategies introduce new technical and operational considerations: monitoring, backtesting, and robust stop logic are critical. The bots also expand the ways liquidity can form in Monero derivatives, potentially smoothing spreads for institutional and retail participants alike.

Market implications, risks and token context

Adding Monero perpetuals deepens derivatives liquidity for a major privacy coin and may attract traders who previously lacked a straightforward way to trade XMR with margin. That said, privacy tokens can show outsized volatility and regulatory scrutiny in some jurisdictions — factors that amplify the risks of 50x leverage. Traders should be mindful of liquidation mechanics and margin requirements.

Bitget’s native token (BGB) may see increased utility or demand as derivatives volumes climb, depending on fee-rebate and margin programs. Broader impacts could touch other sectors of the crypto ecosystem — from blockchain infrastructure to decentralized finance strategies — as traders mix derivatives with spot, lending and hedging flows. Those exploring cross-asset tactics may also integrate insights from markets for NFTs, memecoins and other altcoins when building diversified playbooks.

How traders can start and where to watch next

Accessing XMRUSDT perpetuals typically requires KYC-complete accounts and sufficient USDT margin. Traders should test strategies on small sizes or in simulated environments before scaling, especially when using automated bots. Keep an eye on funding rate trends around major events, since funding spikes can materially change carry costs.

For users comparing execution, risk tools and automation features across platforms, services like Bitlet.app can help evaluate product differences and manage positions across exchanges in one place.

Outlook and final takeaways

Bitget's launch of XMRUSDT perpetuals with 50x leverage and automated futures bots signals growing demand for sophisticated privacy-coin derivatives. The offering broadens tactical options for traders but also raises the importance of sound risk management. As liquidity and strategy toolsets evolve, monitor funding cycles, volatility and regulatory developments to navigate this segment of the crypto market effectively.