Solana’s UX Push vs. Treasury Power: Kora Fee-Relayer and Upexi’s $1B Bet

Summary

Introduction

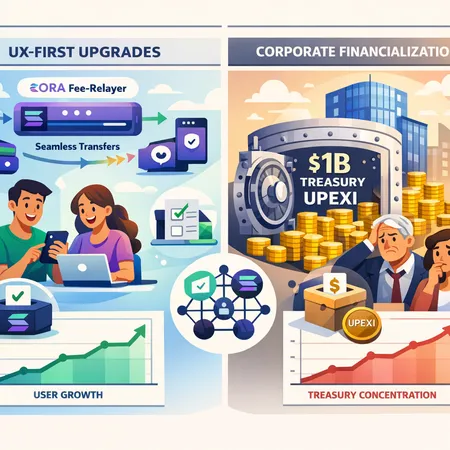

Solana is doubling down on user experience: fewer clicks, simpler onboarding, and fewer visible fees. At the same time, actors within the ecosystem are building large centralized treasuries and financial mechanisms that can shift control and tokenomics in ways the average user never sees. This article explores the technical promise of the Solana Foundation’s Kora fee-relayer and signing node rollout alongside Upexi’s $1B filing to expand its Solana treasury (ticker: UPEXI), comparing the benefits to developers and users with the governance and centralization risks these financial moves introduce.

Kora: a UX-first fee-relayer for frictionless onboarding

The Solana Foundation has introduced Kora, a relayer and signing-node architecture designed to remove fee friction and improve the dApp experience. According to reporting, Kora enables fee-relayed and fee-free transaction flows by letting relayers sponsor transactions and queue signing operations so users don’t have to manage SOL gas constantly (AltcoinBuzz).

On a practical level, Kora implements two consumer-friendly patterns: meta-transactions and gas abstraction. Meta-transactions let a third party submit and pay for a user's transaction, while signing nodes can offload UX complexity (like account creation and funding) away from the user interface. For builders, that means lower bounce rates, fewer “Why do I need SOL?” support calls, and a path to mobile-first wallets that behave like Web2 apps.

Developers should see Kora as an enabler, not a magic bullet. It reduces friction for onboarding and recurring interactions (NFT minting, in-app microtransactions, subscription-style dApp features), but it also changes liability and monetization models: relayers need incentives and risk controls (spam protection, anti-abuse measures), and projects must decide whether to sponsor users, pass costs to merchants, or build hybrid fee models.

For the ecosystem, the UX gains are measurable. Faster signups and lower technical barriers can lift metrics like daily active users (DAU), transaction counts, and NFT mint volumes. That’s the path to mainstream adoption for many consumer-focused projects on Solana.

Upexi’s $1B treasury filing: market reaction and what it signals

In parallel, Upexi — a corporate actor with strong ties to the Solana ecosystem — filed to expand its Solana treasury by as much as $1 billion. The filing prompted an immediate market reaction, with shares sliding as investors priced in dilution, concentration risk, and uncertainty around how a large corporate treasury would be managed (CryptoNews).

A corporate treasury of that magnitude on a single chain concentrates buying power, governance influence (directly or indirectly), and liquidity. Even absent malevolent intent, a big treasury can distort token economics: it becomes a ready source of sell pressure, a bargaining chip in partnership negotiations, and a centralized hub for strategic decisions. That’s especially relevant for ecosystems that prize decentralization and on-chain governance as safety valves against single-party control.

The market’s negative reaction reflects three immediate investor concerns:

- Dilution: large token issuances or treasury allocations can compress the value of circulating holdings.

- Centralized influence: decision-making may drift toward a corporate agenda rather than community priorities.

- Liquidity signaling: such a filing can be perceived as preparing for aggressive market operations, which unsettles traders and partners.

It’s worth noting that exchange activity and spot listings play into this dynamic: new listings and pairings can absorb or amplify treasury flows. Recent coverage of how listings such as LUNA/USDC affect cross-chain liquidity illustrates how exchange decisions interact with treasury moves and market depth (Cryptonomist).

Why UX wins and treasury expansion sit uneasily together

Kora and Upexi represent two levers of growth:

- UX-first infrastructure lowers user acquisition friction and drives organic network effects.

- Large treasuries supply capital for growth, incentivization, and ecosystem programs—but concentrate economic power.

These levers can be complementary: a treasury can fund relayers, subsidize onboarding, and bootstrap liquidity. But they also produce trade-offs. If treasury decisions are centralized, the incentives that shape product design may prioritize short-term liquidity or corporate partnerships over sustainable, community-driven product development.

From a governance perspective, this raises questions about accountability and transparency. Does the ecosystem rely on on-chain governance to steer decisions, or will off-chain corporate treasuries effectively veto or override community preferences? For token holders and builders, the difference matters.

Practical implications for developers

- Adoption strategy: Integrate Kora or equivalent relayer support to reduce onboarding friction. Consider pay-as-you-grow relayer models so early-stage projects can subsidize users without exposing themselves to runaway costs.

- Risk management: Expect to build anti-abuse layers (rate limiting, gas price caps, bot detection) around relayer flows. Relayers are targetable infrastructure that can be gamed if not protected.

- Monetization and UX trade-offs: Decide whether fees should be invisible (sponsored by you or a treasury) or visible and refundable; both models change user behavior and product KPIs.

- Partnership design: If a large treasury funds a relayer program, contract terms should be explicit about duration, data sharing, and exit mechanics to avoid later centralization of user relationships.

Practical implications for token holders and investors

- Monitor treasury concentration: Look at the percentage of circulating supply held by corporate treasuries and long-term lock schedules. High treasury shares increase systemic risk.

- Watch emissions and dilution schedules: A large filing often precedes token allocations. Know the vesting timeline and triggers for distribution.

- Assess governance levers: On-chain governance is meaningful only if token holders can exercise it. If the treasury controls most voting power or finances off-chain bodies, the nominal governance system weakens.

- Liquidity and exchange dynamics: Big treasuries can interact with exchange listings, affecting spreads, market depth, and arbitrage. Keep an eye on listings and pairs that can absorb large sell-side flows (Cryptonomist).

For investors who use services like Bitlet.app, these are the same signals you’d track for risk-adjusted exposure: token concentration, on-chain flows, and ecosystem revenue growth.

Governance options and guardrails to consider

If the ecosystem values UX growth while wanting to avoid dangerous concentration, some practical guardrails include:

- Time-locked treasury disbursements and multi-signature custody with independent signers.

- Clear, public treasury mandates and accountable KPIs for funded programs (e.g., how relayer subsidies are measured by DAU uplift, not just transaction volume).

- On-chain reporting dashboards and periodic independent audits of treasury activity.

- Governance participation incentives for retail token holders so control isn’t captured by whales or corporate treasuries.

These fixes are not novel, but they matter. The difference between a well-governed treasury and a de facto corporate piggy bank is transparency and enforceable constraints.

Scenario analysis: when UX wins outweigh concentration — and when it doesn’t

Scenario A — UX wins: Kora-driven onboarding reduces user friction, TVL grows, projects monetize via secondary services, and treasury funding is used for measurable growth that benefits token holders (higher TVL, rising fee revenue, diversified usage). Here the network effect of users and real economic activity offsets treasury dilution.

Scenario B — Financialization wins: a large treasury centralizes incentives, funds speculative trading or short-term partner deals, and sells into growth narratives rather than supporting long-term product-market fit. User numbers may rise artificially for a time, but engagement, retention, and on-chain economics suffer.

Which scenario unfolds depends on incentives and safeguards. Builders should ask whether treasury capital is being deployed to create sustained user value (infrastructure, developer grants, liquidity for real products) or to buy temporary metrics.

What to watch next (metrics and signals)

- Treasury share of supply and vesting schedules.

- Relayer adoption rates: number of dApps using Kora, relayer uptime, and relayer failure modes.

- User retention and monetization: are new users sticky or churn after promo periods end?

- Governance activity: proposal throughput, voter participation rates, and whether treasury proposals are contested publicly.

- Exchange listings and liquidity: new pairs or spot listings can change market absorption capacity (Cryptonomist).

Bottom line — pragmatic stance for builders and investors

Kora is a clear step toward making Solana apps feel native to mainstream users. UX-first moves reduce friction and are essential if the chain wants to scale consumer products. But UX improvements alone don’t immunize the network from the economic dynamics of large, centralized treasuries. Upexi’s $1B filing is a useful wake-up call: capital can accelerate growth, but it can also concentrate influence and change incentives in ways that undermine long-term decentralization.

For product-focused builders: adopt relayer patterns, instrument growth carefully, and insist on transparent funding agreements. For token holders and investors: insist on governance guardrails, track treasury metrics, and price in the risk of centralized treasury influence when modeling returns for SOL and related tokens (including UPEXI exposure).

If you’re building or allocating capital in this environment, use developer tools and dashboards to measure real user engagement — not just raw transaction counts. And when evaluating projects or treasuries, weigh the compound returns of genuine product-market fit against the short-term uplift that purchased metrics can produce.

Sources

- Solana Foundation Kora announcement: AltcoinBuzz — Solana Foundation introduces Kora for fee-free transactions

- Upexi filing and market reaction: CryptoNews — Upexi shares slide after $1B filing to expand Solana treasury

- Exchange listing and liquidity context: Cryptonomist — Binance listings and USDC/spot context