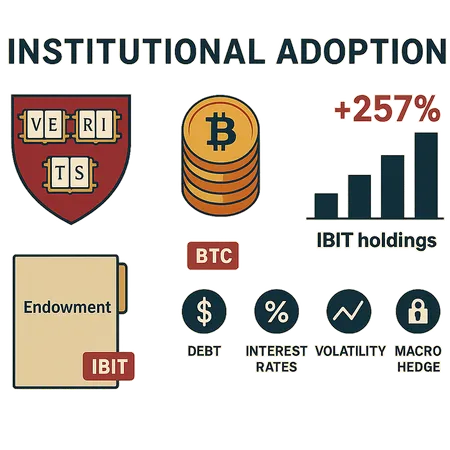

What Harvard’s 257% IBIT Buy Says About Institutional Bitcoin Adoption and Price Resilience

Summary

Harvard’s IBIT move: the facts and immediate context

This quarter Harvard’s endowment significantly expanded its position in the iShares Bitcoin Trust (IBIT), increasing its stake by 257%, lifting the holding to about $442.8 million. The original announcement and figures were reported by Coinpedia and later corroborated by Coinpaper, which both flag the magnitude and timing of the purchase: Coinpedia’s coverage and Coinpaper’s follow-up provide the transactional detail and context.

For allocators and long-term investors, the headline — a near-tripling of a single ETF stake by one of the most scrutinized endowments in the world — deserves two immediate reactions: first, this is not token retail FOMO; second, it is a deliberate portfolio decision with governance and operational implications.

Why an elite endowment buys IBIT (ETF exposure) instead of spot custody

Choosing an ETF over direct spot custody is rarely about which asset is superior; it’s about institutional constraints. Endowments live inside policy frameworks: trustee oversight, audit trails, counterparty rules, and clear liquidity governance. A spot BTC wallet creates operational vectors that many fiduciaries are uncomfortable with — private key management, custody counterparty diligence, and concentrated counterparty risk.

An ETF like IBIT offers several pragmatic advantages:

- Fiduciary simplicity and governance clarity. An ETF fits standard investment policy language and reporting lines. Committees can view a daily NAV rather than wrestling with cold‑storage procedures.

- Operational and custody outsourcing. Custodians engaged by ETFs are specialized and regulated, and the vehicle abstracts custody complexity away from the endowment staff.

- Liquidity and tradability. ETFs provide intraday liquidity and familiar execution mechanics for portfolio managers and risk officers, simplifying rebalancing.

- Auditability and transparency. ETFs have established audit, regulatory disclosure, and compliance frameworks that reduce board-level friction.

These are not trivial points. For institutions managing intergenerational capital, operational risk trumps theoretical return maximization in many decisions. In other words, some allocators will accept a small fee premium for the convenience and risk control that an ETF grants.

What this implies for other endowments and public pensions

Harvard’s move is a classic peer-effect signal. When a marquee institution revises its crypto posture, it lowers the perceived reputational and governance barriers for similar allocators. Expect three cascades:

- Governance committees revisit policy language. Other endowments and pensions will ask whether ETFs solve their custody worries; many will prefer the ETF wrapper as the low-friction route to exposure.

- Increased demand for ETF-style products. Asset managers and exchanges will respond by refining custody disclosures and product documentation to court large allocators.

- A ratcheting effect on allocations. Smaller or more conservative institutions may start with token exposures to an ETF and scale up as reporting and performance data accumulates.

That said, not every institution will move in lockstep. Pensions with long-dated liabilities and strict actuarial rules are more conservative; sovereign wealth funds may prefer direct custody if they have sovereign-grade custody capabilities. But the Harvard example lowers the hurdle for large allocators who previously cited custody as the main blocker.

ETF product design: what allocators will demand next

The Harvard episode highlights product features allocators now care about beyond headline fees. Managers building ETF-like exposures should prioritize:

- Institutional-grade custody transparency. Clear third-party attestations, proof of reserve methodologies, and disaster recovery plans.

- Regulatory clarity and legal comfort. Contractual language that satisfies trustees, auditors, and ERISA-like frameworks where relevant.

- Capital efficiency and tax considerations. Structures that minimize unintended tax consequences or operational frictions when moving in/out of positions.

- Liquidity assurances and large-block execution support. Allocators will want mechanisms to enter/exit sizeable bets without market impact.

Product teams that can offer these features and communicate them in trustee‑friendly terms will win more institutional mandates.

Macro backdrop: debt, rates, and the case for a Bitcoin macro hedge

Institutional interest in BTC doesn’t occur in a vacuum. Broader macro pressures — notably rising national debt and inflation concerns — factor heavily into the hedge narrative. Cryptoslate’s analysis of America’s debt dynamics provides a useful lens: the article frames this year’s surge in demand for BTC against a buildup in macro fiscal risk, arguing that current flows into the asset class can be contextualized as a response to long-term balance-sheet worries (Cryptoslate).

For allocators, the question is not whether BTC is a perfect hedge — it isn’t — but whether it offers a portfolio diversifier with asymmetric payoff potential if inflation or currency debasement scenarios materialize. An ETF route like IBIT permits allocators to express that macro hedge view without introducing discrete custody governance headaches.

Volatility, on‑chain signals, and the limit of ETF demand

Institutional ETF demand can provide a steady bid under price, but it does not eliminate volatility or short-term drawdowns. On‑chain analysts like Ki Young Ju outline specific triggers that could kick off a rebound in BTC — liquidity shifts, miner behavior, or exchange flows — reminding allocators that technical and on‑chain dynamics still matter alongside institutional flows (U.Today analysis of Ki Young Ju).

There are a few corollaries:

- ETF inflows improve the demand base but don’t guarantee continuous unilateral buying. Large redemptions or macro shocks can still press prices lower even with institutional ownership.

- On‑chain metrics remain useful risk tools. Allocators should monitor open interest, exchange balances, and miner selling as complements to ETF flow data.

- Narrative risk persists. Headlines, regulatory shifts, or macro surprises can override longer-term allocation decisions in the short term.

Price resilience: steadying force or illusion?

Harvard’s IBIT expansion is meaningful: it suggests allocators are embedding BTC into strategic exposures rather than treating it purely as a speculative allocation. That trend should, all else equal, increase the price elasticity of demand — more buyers with longer horizons weakens the probability of sustained, liquidity‑driven crashes.

But caveats matter. ETFs channel demand through secondary markets and authorized participant mechanisms; they are not supply-eliminating vaults. If macro turmoil forces correlated selling, ETFs will facilitate efficient price discovery rather than prevent it. In short: institutional ETF adoption strengthens the demand floor over time, but it doesn’t immunize BTC from systemic shocks.

Practical takeaways for allocators and long-term investors

- If custody risk and governance friction are the main blockers, ETFs like IBIT present a straightforward way to gain exposure while keeping audit and compliance lanes clean.

- Track both capital flow data (ETF inflows/outflows) and on‑chain indicators. They tell complementary parts of the same story: institutional flows show strategic intent; on‑chain metrics reveal tactical pressure points.

- Expect product evolution. Managers who can articulate custody, legal, and execution safeguards in trustee-friendly terms will attract larger endowments and pension mandates.

- Don’t conflate allocation announcement with a price ceiling. Institutional buying increases resilience but does not remove volatility or macro sensitivity.

Closing perspective

Harvard’s reported 257% increase in IBIT holdings is a signal: major allocators are moving from experimentation to implementation — and they’re doing so in ways that align with long‑standing institutional constraints. For allocators evaluating the import of that signal, focus on process and product design as much as headline numbers. The institutionalization of BTC via ETFs like IBIT is real, but it adds a new set of considerations for portfolio construction rather than eliminating old ones.

For practitioners, that means refining mandate language, demanding clearer custody and audit disclosures, and using both ETF flow data and on‑chain telemetry to guide timing and sizing decisions. Retail platforms such as Bitlet.app show broad interest in crypto, but Harvard’s move underscores that the allocators who shape long-term capital flows are increasingly comfortable doing so through regulated, trustee-friendly vehicles.

References and further reading: reporting on the Harvard purchase from Coinpedia, confirmation by Coinpaper, macro context from Cryptoslate, and on‑chain trigger analysis via U.Today.

For many allocators, Bitcoin is moving from the fringes toward a mainstream portfolio tool, and the mechanics of that shift — product wrappers like ETF, custody assurances, and macro hedging rationale — will determine how durable the demand becomes.