The Rise of Crypto ETFs: Transforming Investment Strategies with Solana, Ripple, and Litecoin in 2025

The year 2025 marks a significant shift in the cryptocurrency investment landscape with the rapid rise of Crypto Exchange-Traded Funds (ETFs) featuring popular coins like Solana, Ripple, and Litecoin. These ETFs provide investors with a more accessible and regulated way to gain exposure to crypto assets without the complexities of direct coin ownership.

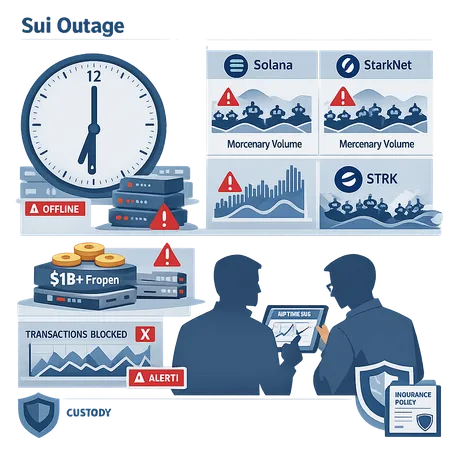

Solana, known for its high-speed transactions, Ripple with its focus on cross-border payments, and Litecoin, often considered the silver to Bitcoin's gold, have each launched ETFs that are gaining traction among both retail and institutional investors. This trend is changing investment strategies by offering diversified portfolios, reduced volatility risks, and easier market entry.

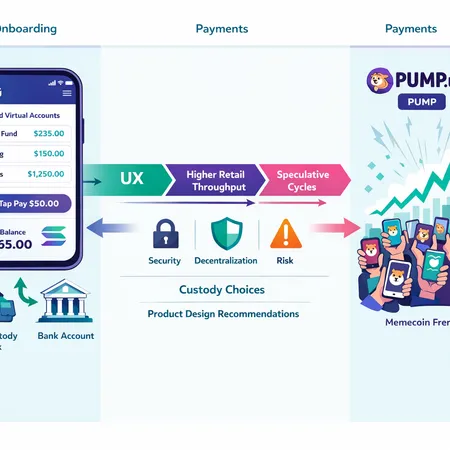

Additionally, innovative platforms like Bitlet.app are enhancing the crypto investing experience by offering a unique Crypto Installment service. This service allows investors to buy their favorite cryptocurrencies through monthly payments rather than paying the full amount upfront, making it more convenient and affordable to invest in crypto ETFs and coins alike.

With these advancements, investors in 2025 can enjoy a flexible, transparent, and diversified approach to cryptocurrency investment, making the most of the growing opportunities in the digital asset space.